Assessing Zeon (TSE:4205) Valuation After Latest Revenue Growth Update

Reviewed by Simply Wall St

See our latest analysis for Zeon.

After a period of steady gains, Zeon's share price sits at ¥1,702. Strong momentum earlier this year has lifted the share price return to over 15% year-to-date, while the one-year total shareholder return stands at a healthy 22%. Longer-term holders have seen the effect of steady compounding, with a 49.6% total shareholder return over five years. Recent mild movement suggests the market is awaiting clearer signs of accelerating growth or a shift in risk perception.

If you’re keeping an eye on where growth and insider confidence intersect, consider broadening your view and discover fast growing stocks with high insider ownership

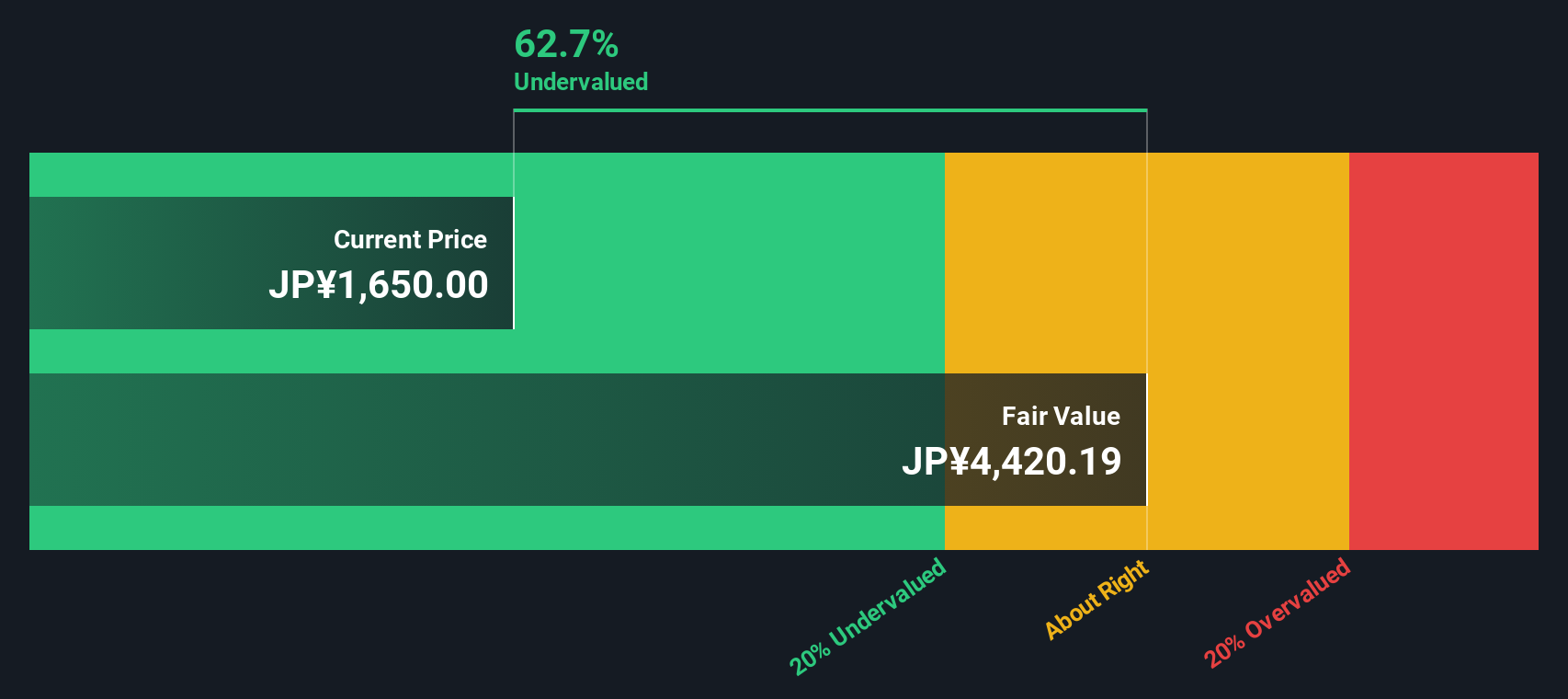

With shares trading just below analyst targets and annual growth appearing modest, the big question now is whether Zeon is quietly undervalued or if today’s price already reflects all that future growth potential.

Price-to-Earnings of 9.1x: Is it justified?

At ¥1,702, Zeon is trading at a price-to-earnings (P/E) ratio of 9.1x. This signals the market is valuing its shares below both peer and industry averages.

The P/E ratio measures what investors are willing to pay per unit of earnings. For Zeon, this low multiple could reflect skepticism about its future growth or confidence that current earnings are sustainable. In the chemicals sector, where earnings can be cyclical, a low P/E sometimes points to perceived uncertainty but can also represent opportunity if outlooks improve.

Compared to the JP Chemicals industry average P/E of 12.3x and a peer average of 25.8x, Zeon's valuation stands out as a bargain. Our estimate of Zeon's fair P/E is 12.8x. This suggests the market could re-rate the stock upward if fundamentals remain supportive.

Explore the SWS fair ratio for Zeon

Result: Price-to-Earnings of 9.1x (UNDERVALUED)

However, slowing net income growth and lingering industry uncertainty could challenge the case for a re-rating if these trends persist.

Find out about the key risks to this Zeon narrative.

Another View: What Does the SWS DCF Model Say?

Taking a different perspective, our SWS DCF model suggests Zeon is trading well below its estimated fair value. The model indicates an implied fair value of ¥4,888 per share compared to the current price of ¥1,702. This points to significant potential undervaluation in the market’s eyes. Could the DCF outlook be too optimistic, or is there an opportunity lurking beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zeon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zeon Narrative

If you’d like to dig into Zeon's story and see the data from your own perspective, you can craft your own narrative in just minutes. Do it your way

A great starting point for your Zeon research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a single stock decide your outcome. Stay ahead by searching for other compelling opportunities using the Simply Wall Street Screener.

- Accelerate your growth potential by checking out these 927 undervalued stocks based on cash flows. These may be positioned for a strong rebound based on solid fundamentals.

- Unlock powerful income possibilities and access these 16 dividend stocks with yields > 3%. These can boost your portfolio with steady, above-average yields.

- Catch the next big wave in tech by reviewing these 26 AI penny stocks. These offer the innovation and performance to shape tomorrow’s markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4205

Zeon

Engages in the elastomer materials, specialty materials, and other businesses in Japan, North America, Europe, and Asia.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives