Will Daicel’s (TSE:4202) Buyback Plan Mark a Shift in Its Capital Efficiency Strategy?

Reviewed by Sasha Jovanovic

- On November 6, 2025, Daicel Corporation's Board of Directors announced a share repurchase program, authorizing the buyback of up to 11,000,000 shares, equivalent to 4.14% of its issued share capital, for a maximum total of ¥15,000 million by March 31, 2026.

- This move is part of Daicel's medium-term capital policy, aiming to enhance shareholder returns and promote more efficient use of capital.

- We'll explore how Daicel's substantial buyback initiative shapes the company's investment narrative and perceived commitment to capital efficiency.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Daicel's Investment Narrative?

When I look at Daicel today, it’s clear that the investment case hinges on believing in a consistent drive for capital efficiency and shareholder returns. The company recently announced another buyback of up to 4.14% of shares, a direct response to ongoing concerns about value and operational efficiency. While ongoing dividend increases and restructuring moves have set a positive backdrop, Daicel’s share price softness and recent underperformance versus both the JP market and chemicals sector signal that investors may be waiting for a stronger evidence of turnaround in margins and profit growth. This latest share repurchase could act as a short-term catalyst, supporting the share price and highlighting management’s commitment to capital allocation. However, persistent pressure from sector headwinds and a modest return on equity mean that risks to sustained profitability remain in focus, with the buyback program only partially offsetting these concerns.

But keep in mind, Daicel’s high level of debt may complicate these plans. Despite retreating, Daicel's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

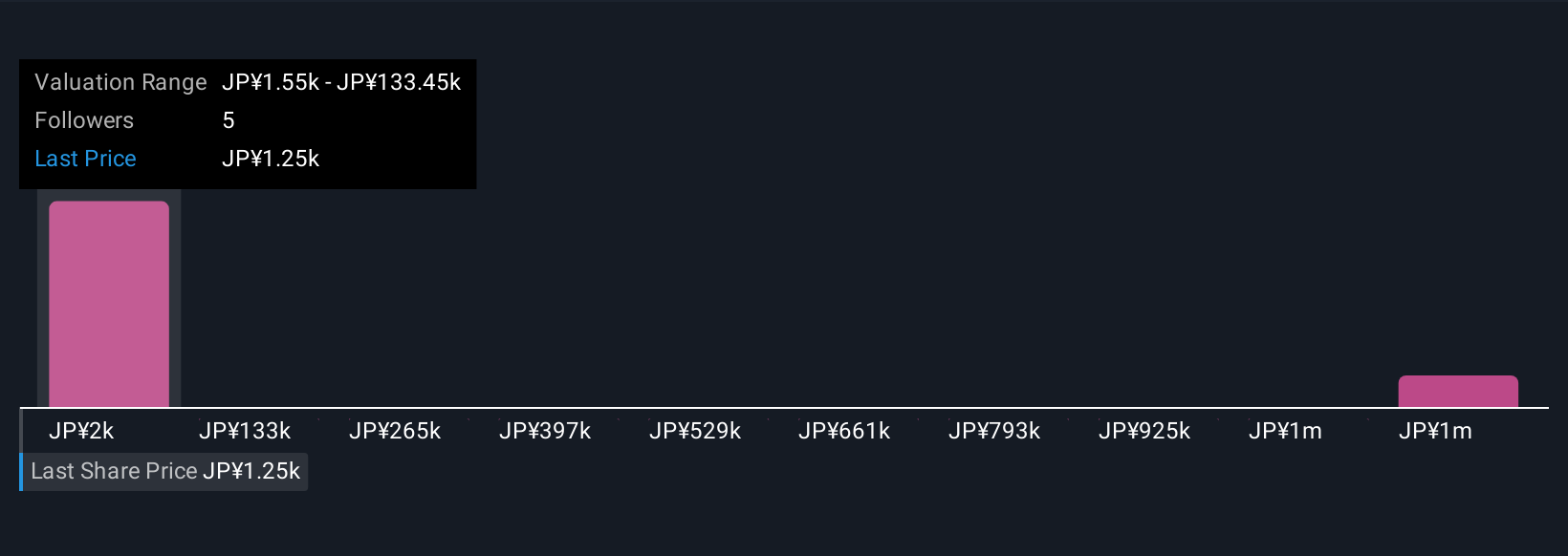

Explore 3 other fair value estimates on Daicel - why the stock might be worth just ¥1549!

Build Your Own Daicel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daicel research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Daicel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daicel's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4202

Daicel

Engages in the materials, medical/healthcare, smart, safety, and engineering plastics businesses in Japan and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives