Mitsubishi Chemical (TSE:4188): Margin Decline Challenges Bullish Earnings Growth Narratives

Reviewed by Simply Wall St

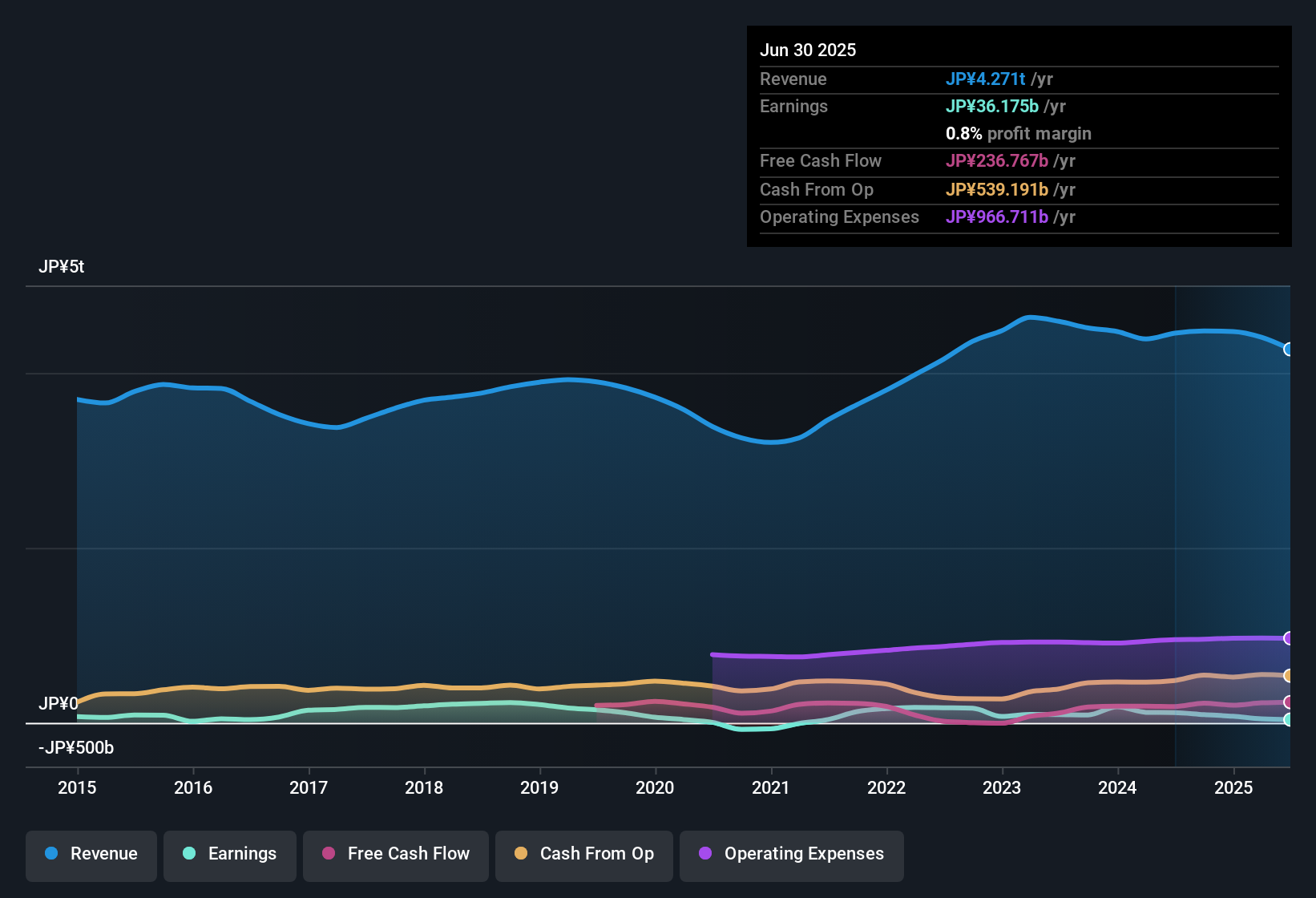

Mitsubishi Chemical Group (TSE:4188) reported a revenue growth forecast of just 0.04% per year, far lower than the broader Japanese market’s 4.5% expectation. Net profit margin has narrowed to 0.9% from last year’s 2.1%, yet over the past five years, the company has managed to return to profitability and has grown earnings at a healthy 10.7% annually. Looking ahead, earnings are projected to jump 21.9% per year, nearly triple the Japanese market average of 7.8%, with shares trading at ¥806.1, below the estimated fair value of ¥1,061.82. Despite sluggish revenue and tighter margins, investors are eyeing strong forecasted earnings growth and what it could mean for valuation sentiment.

See our full analysis for Mitsubishi Chemical Group.Next, we’ll see how these headline numbers stack up against the most widely followed narratives. This will reveal where the results support the story and where they might challenge it.

See what the community is saying about Mitsubishi Chemical Group

Profit Margins Set for Rebound

- Analysts expect Mitsubishi Chemical's net profit margin to climb from 0.8% currently to 3.2% in three years, signaling a significant projected shift in profitability.

- The analysts' consensus narrative highlights that efficiency gains from divesting non-core assets and cost-control measures are expected to stabilize and then raise margins.

- The group is focusing on specialty and sustainable materials, with operational reforms and technology investments designed to bring product mix upgrades and recurring margin expansion.

- Despite current margin pressure from oversupply and tough global competition, the consensus view leans on segment realignment and capacity investments to drive lasting improvement.

- Sense-checking these margin forecasts against operational shifts and market headwinds will be key. See where analysts converge and diverge in the full consensus narrative. 📊 Read the full Mitsubishi Chemical Group Consensus Narrative.

Asset Divestitures to Improve Balance Sheet

- Mitsubishi Chemical has been divesting non-core businesses, such as Mitsubishi Tanabe Pharma and real estate assets, funneling that capital into specialty and advanced materials projects believed to offer better returns.

- According to the consensus narrative, these divestitures should help boost returns on invested capital and strengthen the company’s balance sheet.

- Redeploying resources toward bio-based and circular economy segments aligns with expected demand surges in sustainable packaging and advanced technology components.

- Upcoming capacity expansions for barrier packaging and composites are specifically called out as growth drivers that could move the needle on long-term balance sheet resilience.

Valuation Caught Between Peers and Industry

- While Mitsubishi Chemical trades at ¥806.1 per share, well below its DCF fair value estimate of ¥1,061.82, its price-to-earnings ratio appears attractive against peer averages but expensive versus the broader Japanese chemicals sector.

- The analysts' consensus view notes this valuation gap highlights a nuanced story:

- On one hand, the stock’s discount to fair value and peer multiples suggests there is upside if expected margin and earnings growth materializes.

- On the other, risk factors like the company’s weaker financial position and tighter profit margins relative to the industry mean the current market pricing reflects a wait-and-see approach for confirmed improvements.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mitsubishi Chemical Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? You can shape your perspective and share your narrative in just a few minutes, Do it your way.

A great starting point for your Mitsubishi Chemical Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Mitsubishi Chemical’s financial health and profit margins still lag sector leaders. This reflects ongoing balance sheet pressures and operational risks compared to peers.

If you want companies with lower debt and more robust financial footing, start your search with solid balance sheet and fundamentals stocks screener (1971 results) so you can identify those built to withstand uncertainty and deliver confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4188

Mitsubishi Chemical Group

Provides performance products, industrial materials, industrial gases, and others in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives