How Investors May Respond To Mitsui Chemicals (TSE:4183) Stock Split as Earnings Outlook Weakens

Reviewed by Sasha Jovanovic

- On November 11, 2025, Mitsui Chemicals held a board meeting to discuss a potential stock split, reaffirmed its interim dividend, and revised its full-year consolidated earnings guidance downward, citing reduced selling prices and restructuring impacts.

- While the company confirmed its intention to proceed with a two-for-one stock split and maintain its dividend payout on a split-adjusted basis, the earnings revision highlights ongoing challenges from falling naphtha prices and portfolio restructuring efforts.

- We will assess how the downward revision to earnings expectations reflects broader pressures affecting Mitsui Chemicals' investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Mitsui Chemicals Investment Narrative Recap

To be a shareholder of Mitsui Chemicals, you need confidence in its ability to transition away from volatile commodity businesses toward a more resilient specialty chemicals portfolio. The recent downward revision to full-year earnings guidance, prompted by softer selling prices and restructuring impacts, does not materially shift the biggest short-term catalyst, ongoing growth in specialty segments, but it does highlight the persistent risk from prolonged weakness in naphtha-exposed Basic & Green Materials.

The company's decision to uphold the interim dividend and adjust dividends only for the upcoming stock split is most relevant in this context, as stable payouts can signal underlying cash flow strength even amid earnings revisions. This stability may help keep investor focus on the longer-term shift toward high-value-added products, rather than short-term fluctuations tied to commodity pricing cycles.

Yet, with falling naphtha prices exposing operations to ongoing margin pressure, what investors need to keep in mind is that while specialty growth offers a buffer, the underlying risk of...

Read the full narrative on Mitsui Chemicals (it's free!)

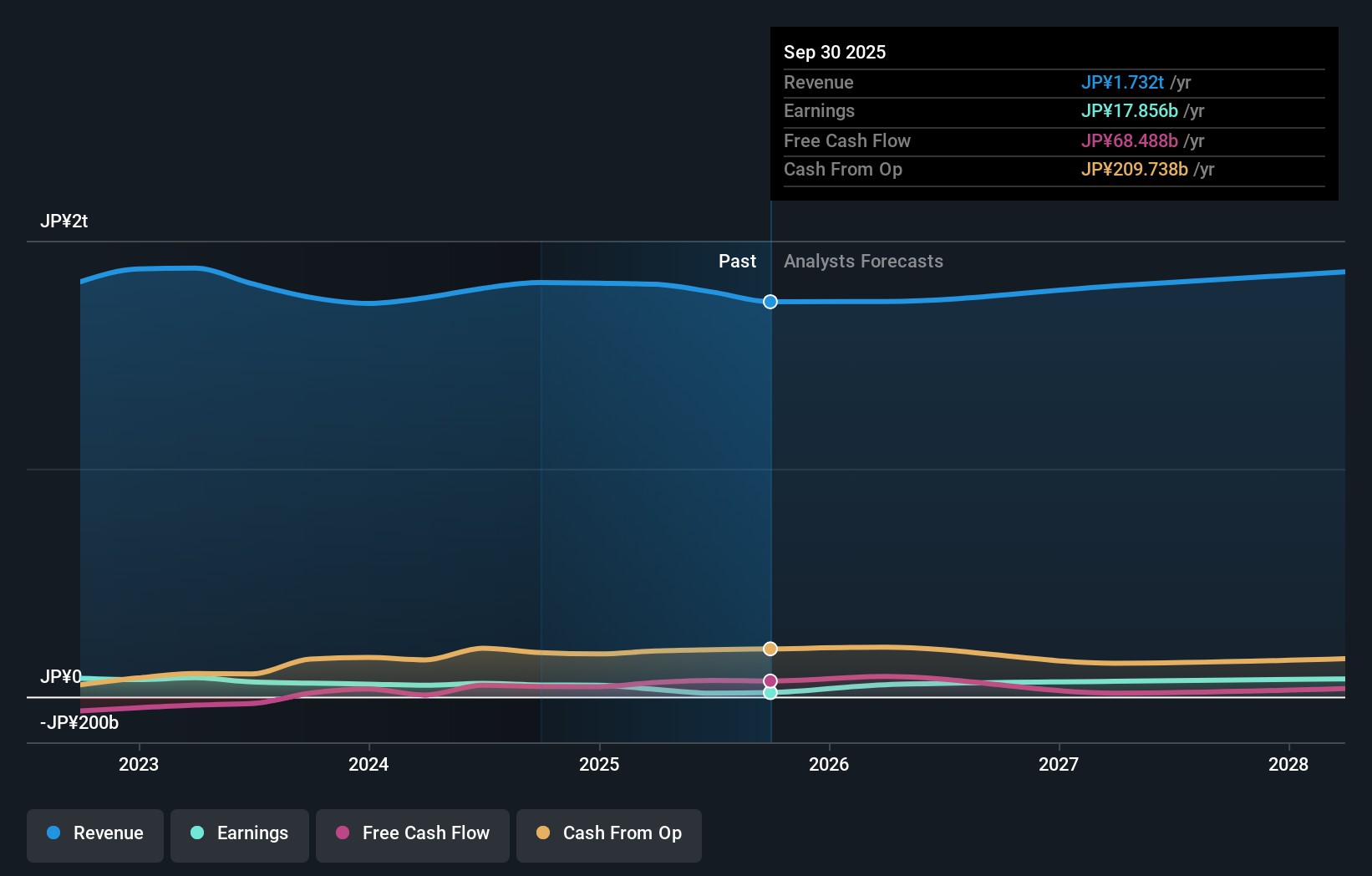

Mitsui Chemicals' outlook envisions ¥1,895.3 billion in revenue and ¥81.2 billion in earnings by 2028. This scenario relies on a 2.2% annual revenue growth rate and a ¥66.1 billion increase in earnings from the current ¥15.1 billion level.

Uncover how Mitsui Chemicals' forecasts yield a ¥4251 fair value, a 19% upside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community values Mitsui Chemicals at ¥4,801.50 per share. With the company's recent guidance cut tied to declining commodity prices, you can see just how opinions on future earnings and fair value can be far apart, and why it’s crucial to compare several viewpoints on the risks and transition away from legacy segments.

Explore another fair value estimate on Mitsui Chemicals - why the stock might be worth just ¥4801!

Build Your Own Mitsui Chemicals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsui Chemicals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mitsui Chemicals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsui Chemicals' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4183

Mitsui Chemicals

Engages in the mobility, life and health care, basic and green materials, ICT, and other businesses worldwide.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives