Investors more bullish on Mitsubishi Gas Chemical Company (TSE:4182) this week as stock rises 6.7%, despite earnings trending downwards over past five years

Mitsubishi Gas Chemical Company, Inc. (TSE:4182) shareholders might be concerned after seeing the share price drop 10% in the last quarter. While that's not great, the returns over five years have been decent. After all, the stock has performed better than the market (76%) in that time, and is up 90%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Mitsubishi Gas Chemical Company

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Mitsubishi Gas Chemical Company actually saw its EPS drop 3.9% per year.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Therefore, it's worth taking a look at other metrics to try to understand the share price movements.

In contrast revenue growth of 7.4% per year is probably viewed as evidence that Mitsubishi Gas Chemical Company is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

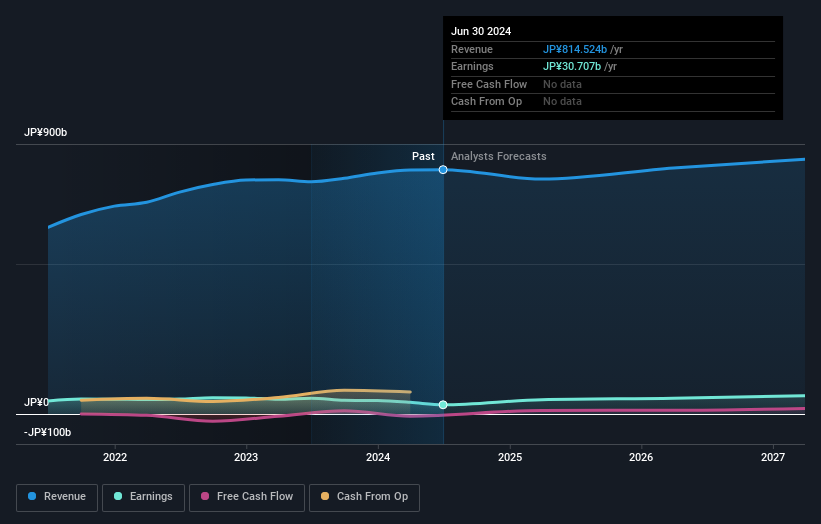

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Mitsubishi Gas Chemical Company stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Mitsubishi Gas Chemical Company's TSR for the last 5 years was 126%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Mitsubishi Gas Chemical Company shareholders have received a total shareholder return of 34% over one year. That's including the dividend. That's better than the annualised return of 18% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Mitsubishi Gas Chemical Company better, we need to consider many other factors. For instance, we've identified 2 warning signs for Mitsubishi Gas Chemical Company that you should be aware of.

Of course Mitsubishi Gas Chemical Company may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4182

Mitsubishi Gas Chemical Company

Manufactures and sells basic and fine chemicals, and functional materials in Japan.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives