European i-ED COIL™ Launch and Dividend Hike Might Change The Case For Investing In Kaneka (TSE:4118)

Reviewed by Sasha Jovanovic

- Kaneka Corporation has begun European sales of its i-ED COIL™, a brain aneurysm embolization coil, after gaining EU Medical Device Regulation certification, and announced a JPY 80.00 per share dividend for the second quarter ended September 30, 2025, up from JPY 60.00 a year ago.

- The company's expansion in advanced medical devices and a significant dividend hike reflect its focus on health care growth and shareholder returns.

- We’ll examine how Kaneka’s launch of the i-ED COIL™ in Europe highlights its push for innovation in medical technology.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Kaneka's Investment Narrative?

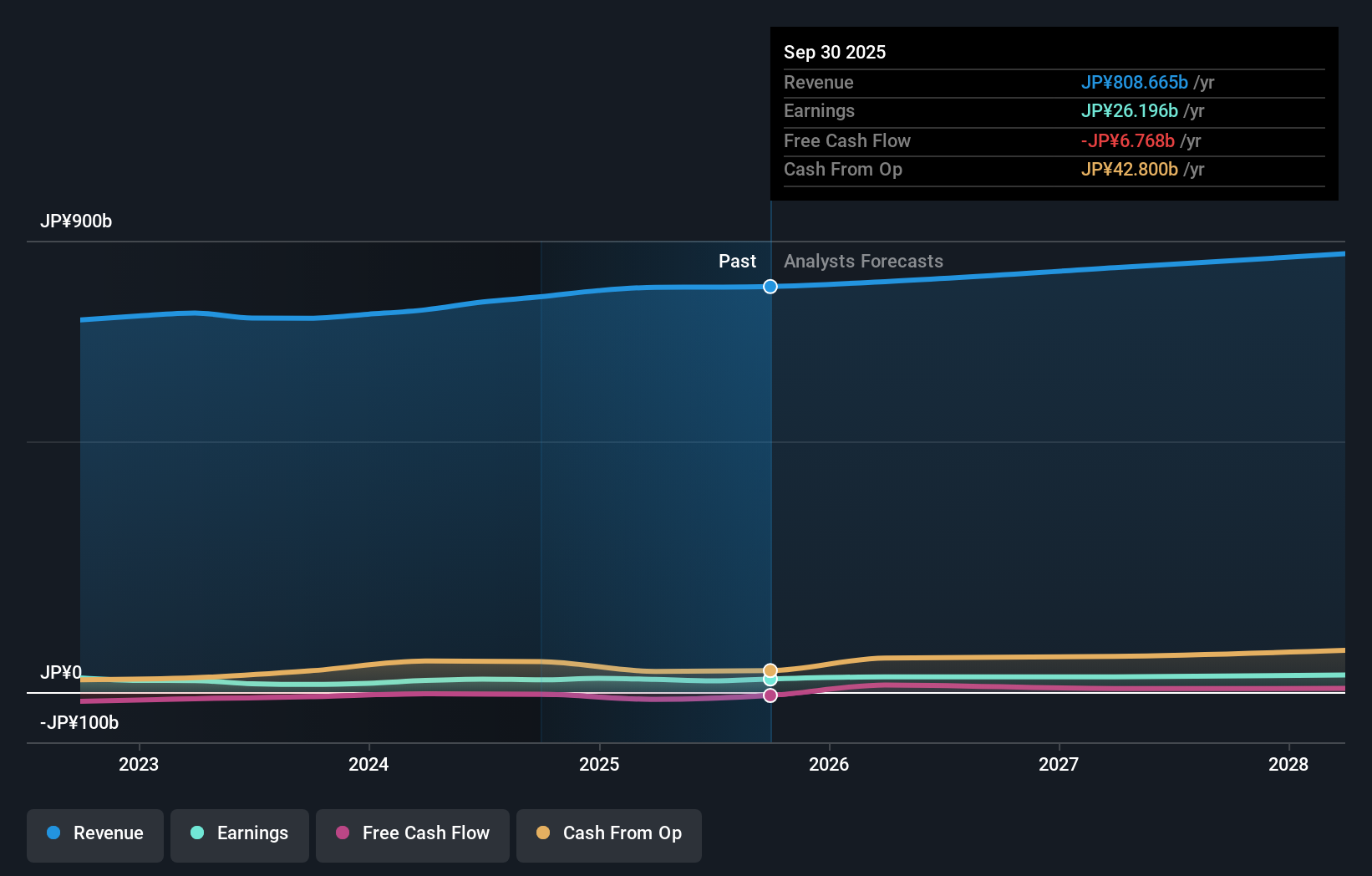

For shareholders to be optimistic about Kaneka, the real story is their ability to execute on health care innovation while maintaining strong capital returns. The recent European launch of the i-ED COIL™, coupled with a sharp dividend hike, reinforces Kaneka’s focus on expanding its presence in advanced medical devices and rewarding shareholders. However, the updated guidance reveals that while net income is steady and per-share earnings are up, both revenue and operating income forecasts have been cut, tempering near-term growth expectations. Rewarding investors through dividends and buybacks can help support the share price, but the key catalyst remains whether new medical products like i-ED COIL™ can offset slower revenue growth in the core business. The risk profile has shifted, execution on international expansion and regaining sales momentum now look even more important in the short term.

Yet rising dividends don’t erase the need to watch for slower revenue or earnings growth. Kaneka's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Kaneka - why the stock might be worth just ¥4662!

Build Your Own Kaneka Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaneka research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kaneka research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaneka's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaneka might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4118

Kaneka

Engages in the manufacture and sale of polyvinyl chloride (PVC), crosslinked PVC, PVC-PVAc polymers, paste PVC, acryl grafted-vinyl chloride copolymer, and chlorinated PVC in Japan and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives