Assessing Kaneka (TSE:4118) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Kaneka.

Kaneka’s 17.5% share price return since the start of the year is fueling fresh optimism, as investors seem to be warming up to both its growth story and improving fundamentals. With a 22% total shareholder return over the past twelve months, momentum looks to be picking up for the stock.

If Kaneka's recent momentum has you curious about other market opportunities, now is a good time to see which fast-growing companies with high insider ownership could be worth your attention. Discover fast growing stocks with high insider ownership

But are Kaneka shares still undervalued given recent gains, or has the market already factored in expectations for future growth? The key question for investors now is whether there is more upside from here, or if the opportunity has passed.

Price-to-Earnings of 12x: Is it justified?

Kaneka's current price-to-earnings (P/E) ratio stands at 12x, which puts the stock at a discount to both the broader Japanese market and its industry peers.

The price-to-earnings ratio reflects how much investors are willing to pay for each yen of the company's earnings. For a chemicals producer like Kaneka, this metric helps gauge how future profitability and business quality are being valued in a competitive sector.

With Kaneka trading at 12x earnings, investors are paying less per unit of profit compared to the Japanese market average of 14.1x and the JP Chemicals industry average of 13x. Furthermore, according to fair value regression, a ratio of 16.2x could be justified for Kaneka given its financial profile. This indicates there could be further room for the market to re-rate the stock, especially if earnings momentum continues.

Explore the SWS fair ratio for Kaneka

Result: Price-to-Earnings of 12x (UNDERVALUED)

However, slower revenue growth or a downturn in industry demand could quickly challenge Kaneka's current upward momentum and put pressure on future returns.

Find out about the key risks to this Kaneka narrative.

Another View: SWS DCF Model Perspective

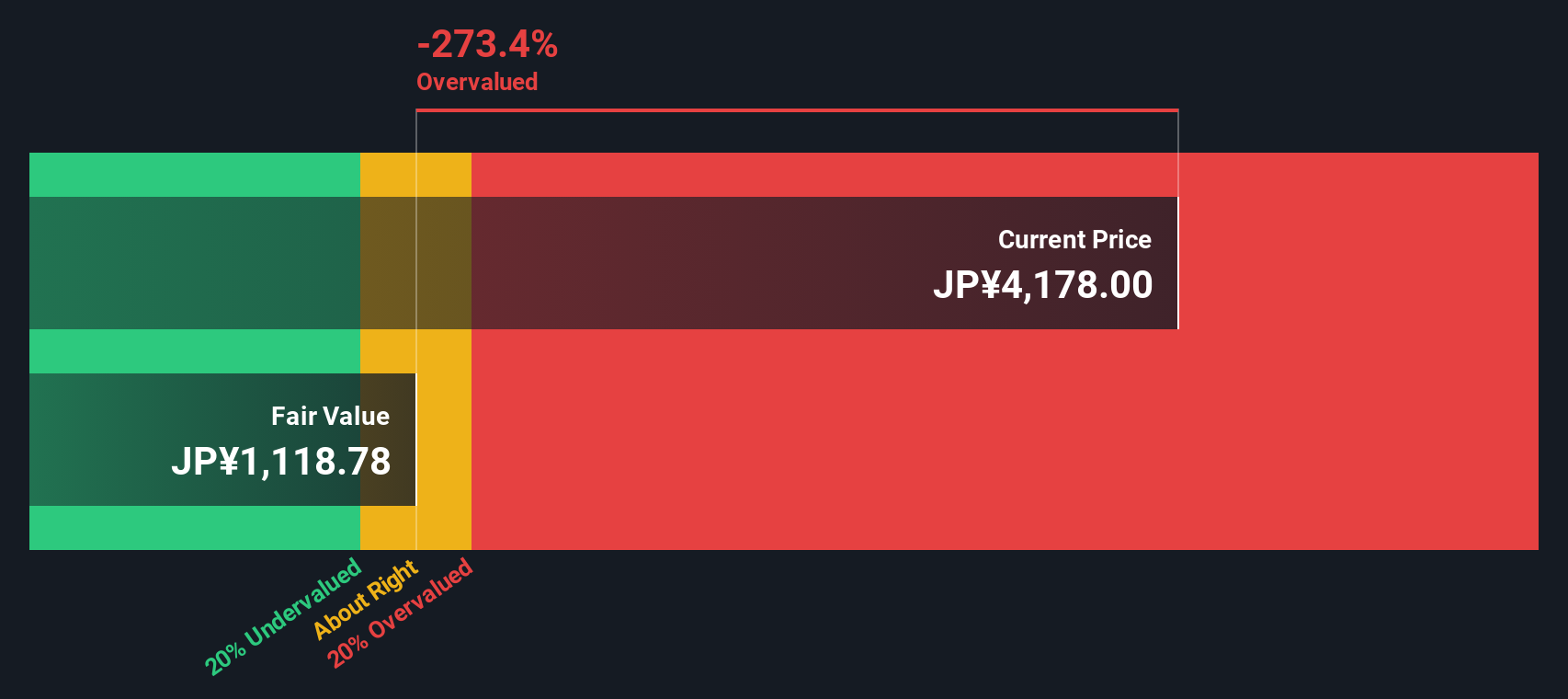

While the price-to-earnings ratio suggests Kaneka could be undervalued versus the market and industry, the SWS DCF model takes a different approach. According to our DCF estimate, Kaneka’s current share price of ¥4,384 is above its fair value, which is calculated at ¥1,159. This implies the stock might be overvalued based on cash flow projections. Is the recent optimism in Kaneka’s price already factored in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kaneka for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kaneka Narrative

If you have your own perspective or want to dig deeper into the numbers, you can easily put together your own view in just a few minutes. Do it your way

A great starting point for your Kaneka research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors move where opportunities are strongest. Expand your horizons now with unique growth stories, breakthrough industries, and high-potential stocks just a click away on Simply Wall Street.

- Tap into the future as you scan these 25 AI penny stocks making waves in artificial intelligence and transforming everyday industries.

- Lock in reliable income by uncovering these 16 dividend stocks with yields > 3% that consistently deliver dividend yields above 3% and keep your portfolio working harder.

- Catch bold early-stage opportunities by checking out these 3585 penny stocks with strong financials with strong financials before the next crowd jumps in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaneka might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4118

Kaneka

Engages in the manufacture and sale of polyvinyl chloride (PVC), crosslinked PVC, PVC-PVAc polymers, paste PVC, acryl grafted-vinyl chloride copolymer, and chlorinated PVC in Japan and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives