- Japan

- /

- Diversified Financial

- /

- TSE:7172

Top Japanese Growth Companies With High Insider Ownership On The Exchange In May 2024

Reviewed by Simply Wall St

Despite recent economic contractions, Japanese equities have shown resilience, with indices like the Nikkei 225 and TOPIX registering gains. This backdrop of modest market optimism provides a fertile ground for exploring growth companies in Japan, particularly those with high insider ownership which often signals strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.5% | 27.2% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 35.4% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 80.2% |

| Money Forward (TSE:3994) | 21.4% | 63.5% |

| Medley (TSE:4480) | 34% | 24.4% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 59.1% |

| freee K.K (TSE:4478) | 24% | 79.3% |

Here's a peek at a few of the choices from the screener.

Fujio Food Group (TSE:2752)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujio Food Group Inc. operates a chain of restaurants both in Japan and internationally, with a market capitalization of approximately ¥65.75 billion.

Operations: The company generates its revenue from operating a diverse portfolio of restaurants across domestic and international locations.

Insider Ownership: 29.6%

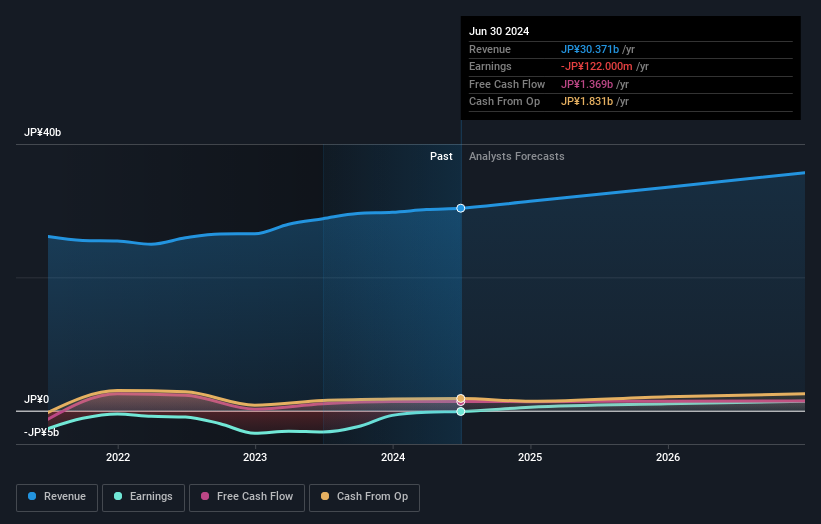

Fujio Food Group, a company with significant insider ownership, is poised for notable changes. Although its revenue growth at 5.9% per year is modestly above the Japanese market average of 4%, this pace does not reach the high-growth threshold of 20% annually. However, the firm is expected to transition into profitability within three years, with earnings potentially increasing by an impressive 84.63% per year during this period. This forecasted shift towards profitability could signal a positive trajectory for Fujio Food Group amidst a competitive landscape.

- Click to explore a detailed breakdown of our findings in Fujio Food Group's earnings growth report.

- Our valuation report here indicates Fujio Food Group may be overvalued.

Stella Chemifa (TSE:4109)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stella Chemifa Corporation, with a market capitalization of ¥47.81 billion, specializes in the manufacturing and international sale of inorganic fluorine compounds.

Operations: The company specializes in the production and global distribution of inorganic fluorine compounds.

Insider Ownership: 23.5%

Stella Chemifa, with substantial insider ownership, is trading at 34.8% below its estimated fair value, indicating potential undervaluation. The company's revenue and earnings are expected to outpace the Japanese market, with revenues growing at 8.9% annually and earnings projected to increase by 24.4% per year. However, its dividend sustainability is questionable as it is not well covered by cash flows. Recent guidance confirms a positive outlook for FY2025 with significant profit expectations of JPY 2,600 million.

- Dive into the specifics of Stella Chemifa here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Stella Chemifa is trading beyond its estimated value.

Japan Investment Adviser (TSE:7172)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Japan Investment Adviser Co., Ltd. specializes in offering diverse financial solutions across Japan, with a market capitalization of approximately ¥83.28 billion.

Operations: The firm operates primarily in the financial solutions sector across Japan.

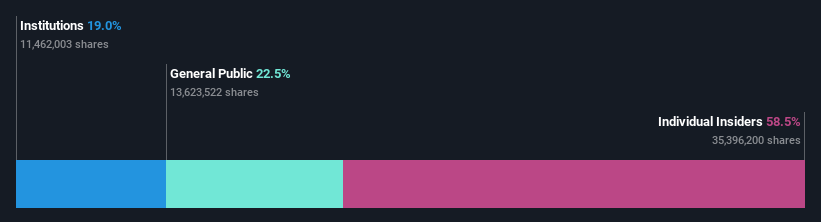

Insider Ownership: 27.6%

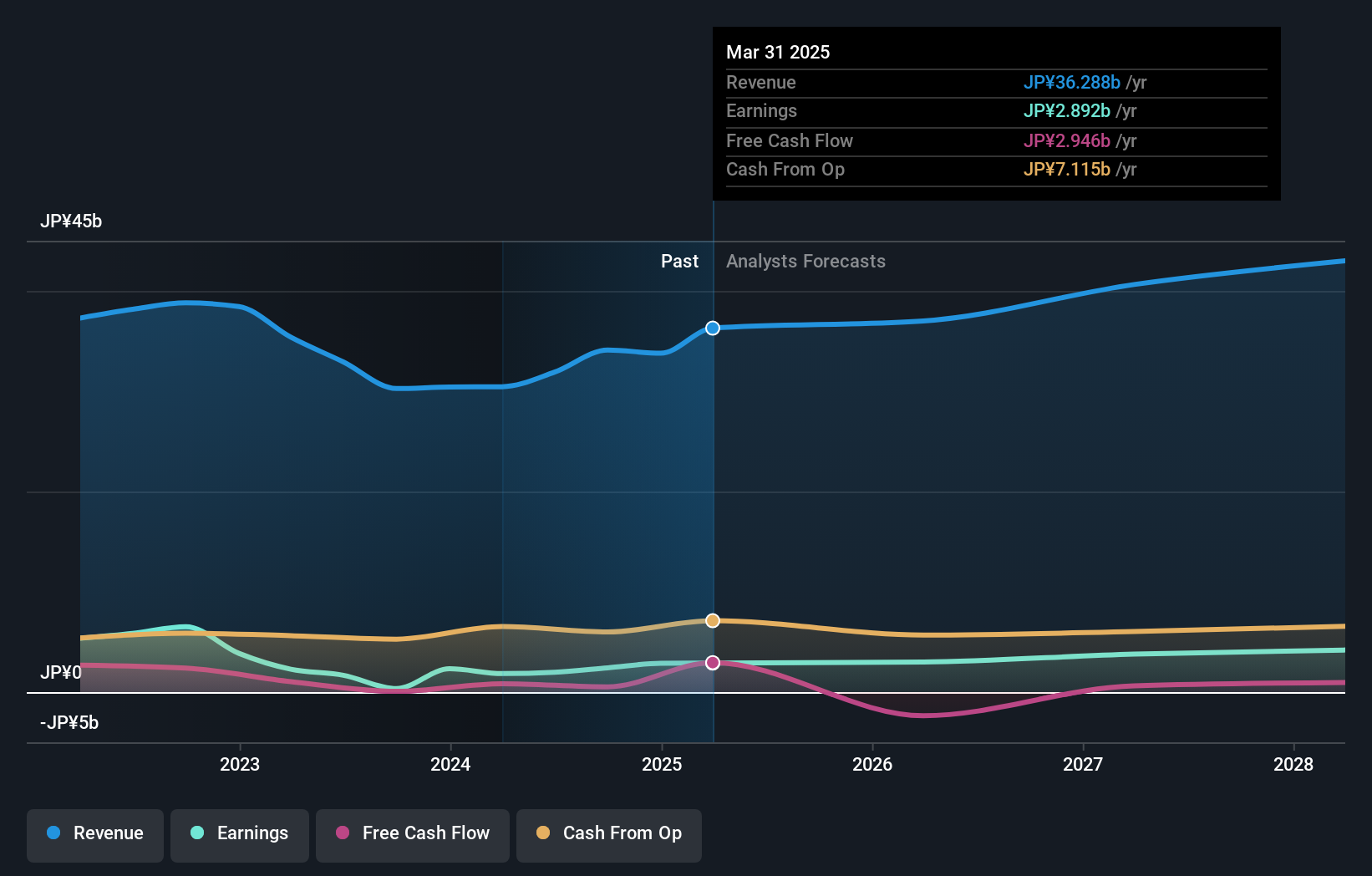

Japan Investment Adviser, despite a volatile share price, is trading at 16.2% below its estimated fair value, suggesting potential undervaluation. The company's revenue and earnings growth forecasts are robust, significantly outpacing the Japanese market with expectations of 25% and 45.9% annual growth respectively. However, concerns arise as the debt is not well covered by operating cash flow and the forecasted Return on Equity is relatively low at 16.8%. Recent executive changes might influence future strategic directions.

- Delve into the full analysis future growth report here for a deeper understanding of Japan Investment Adviser.

- The analysis detailed in our Japan Investment Adviser valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Unlock more gems! Our Fast Growing Japanese Companies With High Insider Ownership screener has unearthed 103 more companies for you to explore.Click here to unveil our expertly curated list of 106 Fast Growing Japanese Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7172

Undervalued with high growth potential.