Shikoku Kasei Holdings (TSE:4099) Maintains 11.7% Net Margins, Reinforcing Stable Growth Narrative

Reviewed by Simply Wall St

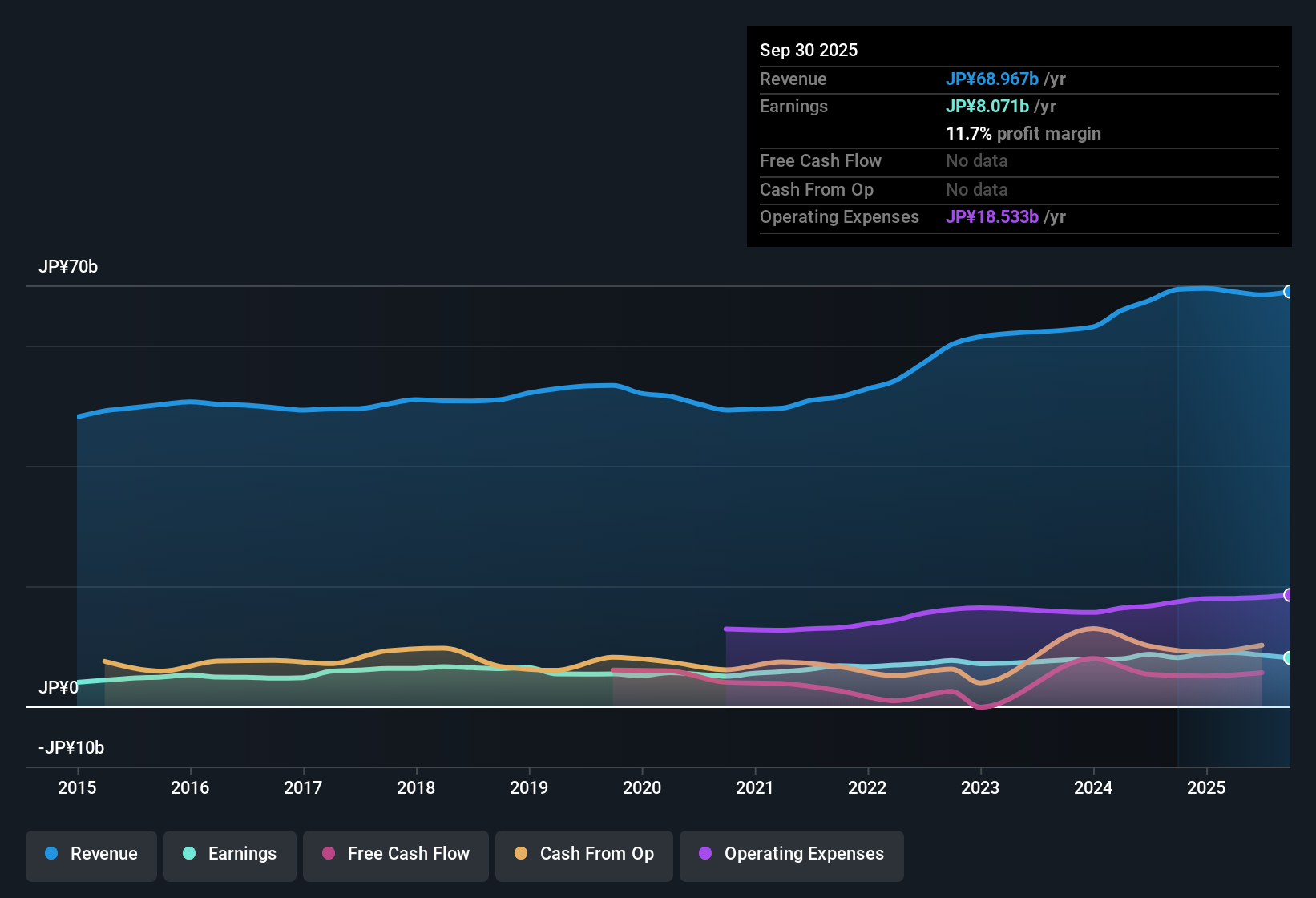

Shikoku Kasei Holdings (TSE:4099) posted net profit margins of 11.7% for the latest period, matching last year’s level, while delivering five-year annual earnings growth averaging 9%. Revenue is forecast to rise 6.5% per year, outpacing the Japanese market’s 4.5%. Earnings are projected to climb 10.4% annually versus the broader market’s 7.9%. With stable profitability, above-market growth prospects, and an attractive dividend, the results set the stage for further investor focus on the company’s growth and valuation, even as recent share price volatility lingers.

See our full analysis for Shikoku Kasei Holdings.Next up, we’ll see how these headline numbers compare with the consensus narratives. Here we look at where the market’s stories align and where they may need a refresh.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Match Last Year’s Highs

- Net profit margins held steady at 11.7%, sustaining last year’s elevated level and indicating ongoing operational strength rather than a one-off bump.

- What’s notable based on the latest analysis is that consistent margins strongly support the view that stability and quality underpin future growth aspirations.

- High profit margins are unusual for the chemicals sector, which often struggles with commodity swings. The ability to sustain 11.7% is a sign that management’s strategies are working.

- Attractive dividends, highlighted alongside these margins, signal that the company is striking a balance between sharing cashflows and reinvesting for growth.

Valuation Sits Above Fair Value, But Below Peer Average

- Shikoku Kasei trades at a price-to-earnings multiple of 14.8x, which is lower than direct peers at 15.9x but above the Japanese chemicals industry average of 13.2x, while the share price of ¥2,765 exceeds the DCF fair value estimate of ¥2,683.74.

- Despite valuation signals being mixed, prevailing market analysis points to moderate optimism, not excess, for further re-rating.

- The modest premium to fair value is partially offset by the company’s above-market projected earnings growth rate of 10.4%, compared to the broader Japanese market’s 7.9%. This suggests the market is willing to pay more for future growth potential.

- However, remaining just below peer average multiples could indicate caution, possibly reflecting recent share price volatility as a limiting factor for immediate upside.

Share Price Stability Flags as Only Major Risk

- The only notable risk flagged is the recent lack of share price stability over the past three months, in contrast to otherwise positive financial trends.

- Prevailing market thinking emphasizes that while growth and quality drive optimism, ongoing price volatility might unsettle short-term investors.

- This volatility is more pronounced despite management delivering high-quality profits with stable margins, implying the share price does not reflect operational achievements in the short term.

- Growth forecasts and dividend quality offer a buffer, but new investors should expect possible swings as sentiment adjusts to these fundamentals.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shikoku Kasei Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Shikoku Kasei’s mixed valuation signals and ongoing price volatility mean investors could face unpredictable swings. This is despite stable profits and growth prospects.

If you’d prefer smoother performance and fewer surprises, use our stable growth stocks screener (2112 results) to discover companies with a track record of consistent results no matter the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4099

Shikoku Kasei Holdings

Engages in the research and development, manufacture, and sale of chemical products and housing materials in Japan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives