How Investors Are Reacting To Nihon Parkerizing (TSE:4095) Processing Business Integration and New Earnings Guidance

Reviewed by Sasha Jovanovic

- Nihon Parkerizing announced it will transfer its processing business to its wholly owned subsidiary, Parker Processing Co., Ltd., effective April 1, 2026, through a simplified absorption-type company split, while also affirming its upcoming dividend and issuing new full-year earnings guidance.

- This integration aims to enhance operational efficiency and consolidate management resources, positioning the new entity as the core of the Group’s processing business.

- We'll explore how the planned processing business integration could shape Nihon Parkerizing's investment narrative amid these key developments.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Nihon Parkerizing's Investment Narrative?

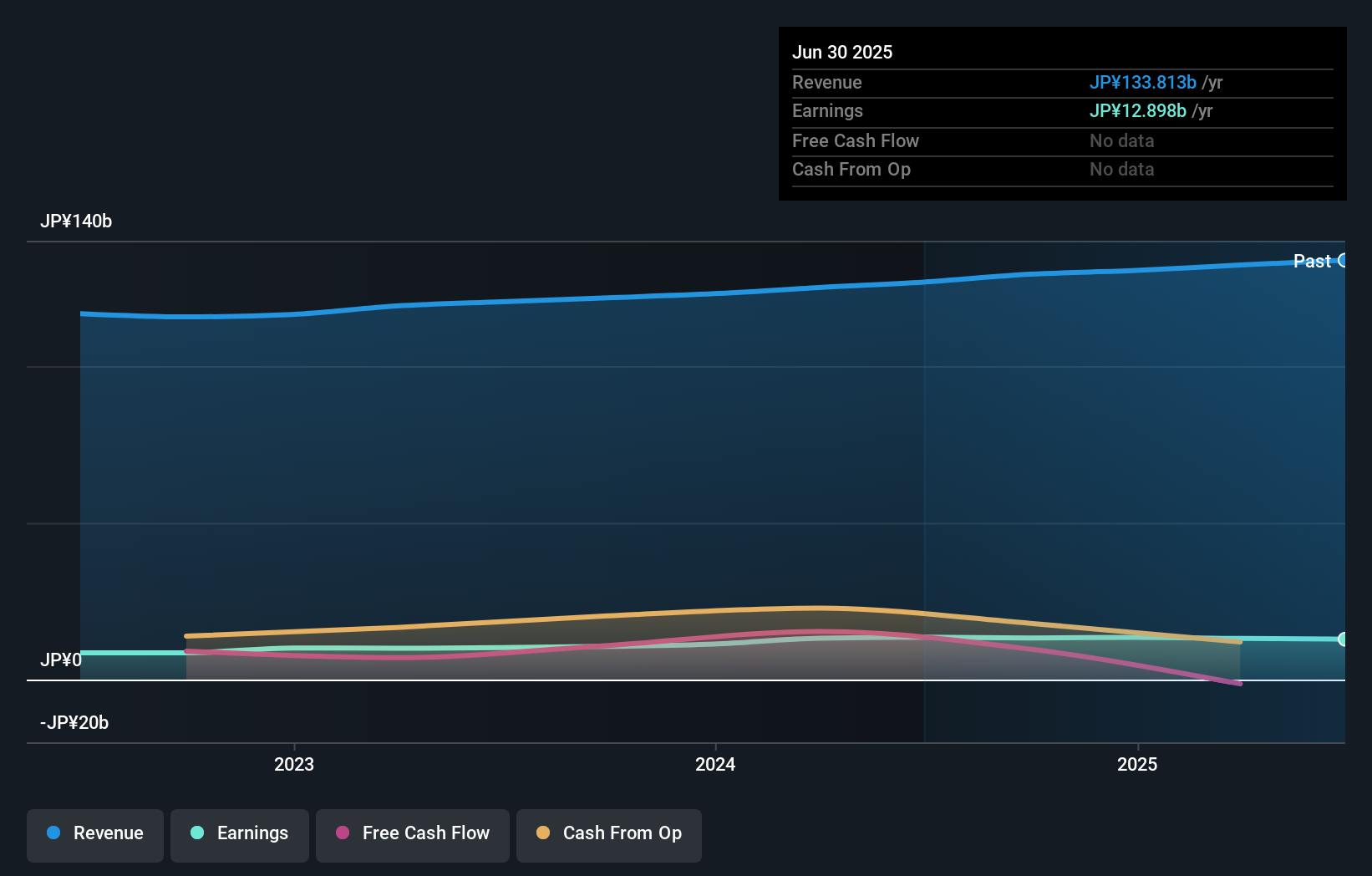

For shareholders in Nihon Parkerizing, the core belief centers on the company’s leadership in metal surface treatment and chemical processing businesses. The recent restructuring announcement, with processing operations being consolidated under Parker Processing Corporation, signals a clear effort to boost operational efficiency and focus management resources. This move could become a near-term catalyst by streamlining decision making and potentially lowering costs, though the material impact on financials may take time to be reflected as integration unfolds. For now, consistent dividend affirmations and confirmed earnings guidance provide some reassurance about business stability, even as profit margins have edged lower and earnings growth remains pressured. The main risks remain unchanged: competitive pressures, low return on equity, and questions over long-term profit acceleration, but the integration could either ease or amplify these, depending on how smoothly the transition is managed.

On the flip side, the group’s low return on equity remains a red flag that warrants closer attention.

Exploring Other Perspectives

Explore 3 other fair value estimates on Nihon Parkerizing - why the stock might be worth less than half the current price!

Build Your Own Nihon Parkerizing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nihon Parkerizing research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Nihon Parkerizing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nihon Parkerizing's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Parkerizing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4095

Nihon Parkerizing

Engages in the manufacture and supply of surface treatment chemicals in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives