There's Reason For Concern Over Nihon Kagaku Sangyo Co., Ltd.'s (TSE:4094) Price

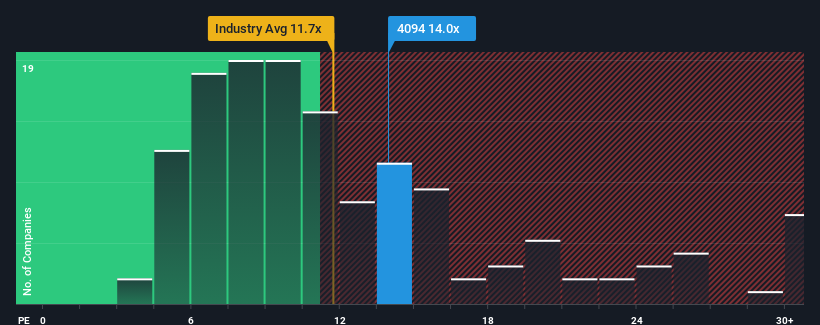

With a median price-to-earnings (or "P/E") ratio of close to 13x in Japan, you could be forgiven for feeling indifferent about Nihon Kagaku Sangyo Co., Ltd.'s (TSE:4094) P/E ratio of 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

For instance, Nihon Kagaku Sangyo's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Nihon Kagaku Sangyo

How Is Nihon Kagaku Sangyo's Growth Trending?

In order to justify its P/E ratio, Nihon Kagaku Sangyo would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. The last three years don't look nice either as the company has shrunk EPS by 2.5% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's an unpleasant look.

With this information, we find it concerning that Nihon Kagaku Sangyo is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Nihon Kagaku Sangyo revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Nihon Kagaku Sangyo with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Nihon Kagaku Sangyo. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Kagaku Sangyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4094

Nihon Kagaku Sangyo

Engages in the manufacture and sale of industrial chemicals and building materials in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives