Nippon Sanso Holdings (TSE:4091): Assessing Valuation Following Upgraded Dividend and Confident Outlook

Reviewed by Simply Wall St

Nippon Sanso Holdings (TSE:4091) declared a higher interim dividend and updated its year-end forecast, reaffirming its approach to stable shareholder returns and signaling confidence in ongoing financial performance. This move highlights a steady and investor-focused dividend policy.

See our latest analysis for Nippon Sanso Holdings.

Nippon Sanso Holdings has seen renewed interest from investors following the dividend announcement, but the share price momentum has faded in recent months. A 12.86% year-to-date share price return has now been moderated by a 3.85% dip over the past month. Still, long-term investors have enjoyed a remarkable 128.8% total shareholder return over three years and 205.7% over five years, which shows consistent value creation despite short-term pullbacks.

If the recent dividend hike has you looking beyond the usual suspects, now is a great time to expand your search and discover fast growing stocks with high insider ownership

With a strong track record of growth and a recent dividend boost, investors may wonder if Nippon Sanso Holdings still offers upside potential or if the market has already factored in its future prospects.

Most Popular Narrative: 7.2% Undervalued

The most widely followed narrative places Nippon Sanso Holdings’ fair value above its recent closing price, a gap that continues to spark debate regarding underlying assumptions and future drivers. Here is what is seen as the main catalyst powering this optimistic perspective.

Anticipated acceleration in demand for industrial and specialty gases linked to the global shift to clean fuels and hydrogen is likely to benefit Nippon Sanso, given its expertise and recent disciplined CapEx positioning. This could drive future revenue growth as delayed customer investment resumes, especially with policy and economic clarity.

Curious about the financial expectations behind this valuation? The projections hinge on a blend of growth ambitions, margin expansion, and confidence in sector recovery. The full narrative reveals the bold figures and reasoning analysts use to justify this upbeat target. Will the earnings and sales momentum match? Discover which numbers make all the difference.

Result: Fair Value of ¥5,332.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global uncertainty and rising costs could weaken demand. This may present challenges to the optimistic outlook for Nippon Sanso Holdings’s future growth.

Find out about the key risks to this Nippon Sanso Holdings narrative.

Another View: Market Pricing Signals Caution

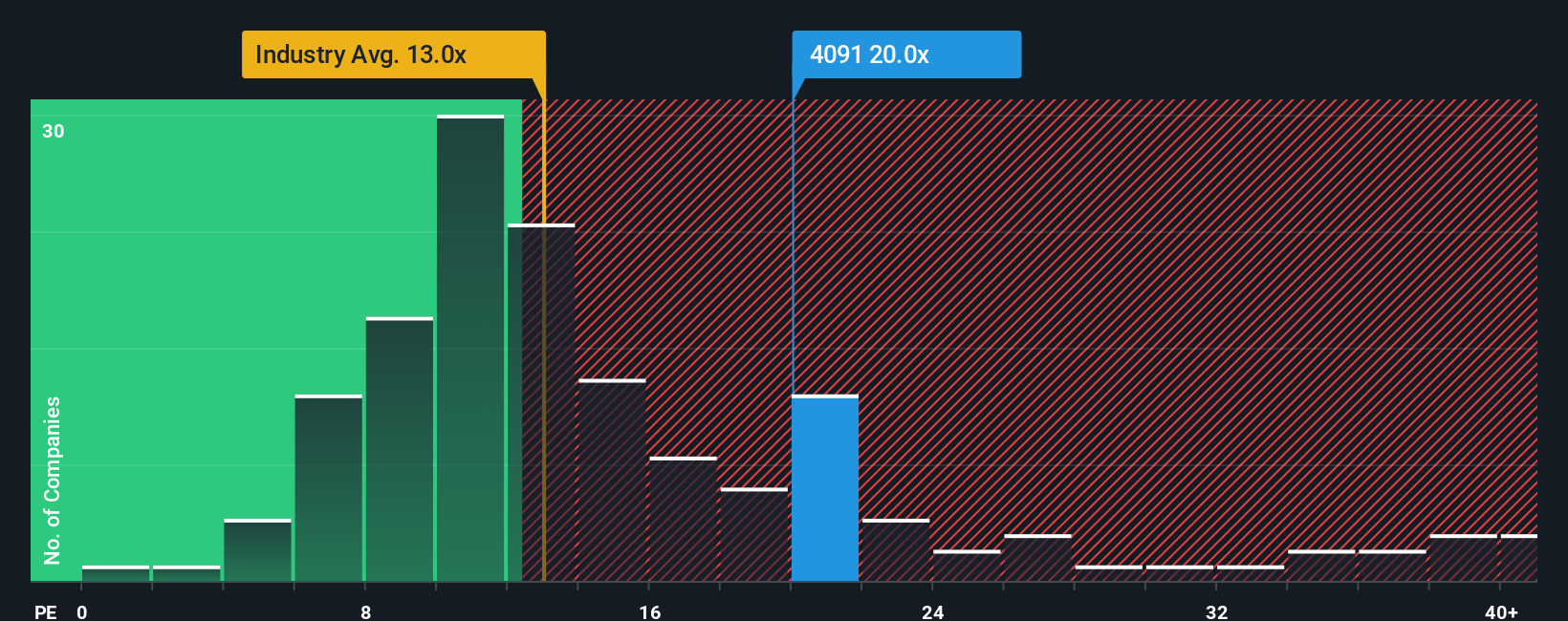

Looking at market pricing, Nippon Sanso Holdings currently trades at a price-to-earnings ratio of 20x. This is higher than the industry average of 13x and the peer average of 14.6x. The fair ratio, meanwhile, sits even lower at 18.8x, suggesting the shares might be expensive by comparison. Does the market see something others do not? Or is this a sign for value-conscious investors to pause?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nippon Sanso Holdings Narrative

Whether you have a different perspective or simply value hands-on research, you can put together your own Nippon Sanso Holdings narrative in just minutes. Start now – Do it your way

A great starting point for your Nippon Sanso Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Join savvy investors on Simply Wall Street and seize your chance to discover high-potential stocks that others might overlook. Make smart choices before the rest catch on by using these powerful tools today:

- Uncover new opportunities for growth by checking out these 24 AI penny stocks dominating artificial intelligence advancement and redefining key industries.

- Target undervalued gems by starting with these 861 undervalued stocks based on cash flows chosen for their strong fundamentals and attractive prices based on cash flows.

- Secure growing income streams by reviewing these 17 dividend stocks with yields > 3% boasting yields above 3% and robust dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Sanso Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4091

Nippon Sanso Holdings

Engages in the gas business in Japan, the United States, Europe, Asia, and Oceania.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives