How Investors Are Reacting To Nippon Sanso Holdings (TSE:4091) Boosting Its Dividend and Annual Payout Forecast

Reviewed by Sasha Jovanovic

- Nippon Sanso Holdings recently announced an increase in its interim dividend to ¥29 per share for the second quarter ended September 30, 2025, and revised its annual dividend forecast to ¥58 per share, with payments scheduled to begin on December 1, 2025.

- This dividend action reflects the company's ongoing focus on delivering stable, performance-linked shareholder returns while balancing internal reserves for business expansion and resilience.

- We'll examine how Nippon Sanso Holdings' strengthened dividend commitment shapes its investment outlook and signals management's confidence in future earnings.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nippon Sanso Holdings Investment Narrative Recap

To invest in Nippon Sanso Holdings, one must be confident in the company’s ability to balance steady shareholder returns with the ongoing challenges of global industrial gas markets and economic uncertainty. The recent dividend hike underscores management’s confidence, but does not materially change the near-term risk that persistent soft demand for packaged gases and equipment, especially in key overseas markets, could continue to weigh on revenue growth.

Among recent developments, the May 2025 upward revision in annual dividends aligns closely with the latest increase and signals a commitment to consistent returns, even as the company faces rising cost pressures. This is especially relevant considering the crucial role that stable dividends play for investors amid fluctuating sector demand and input costs.

However, despite enhanced shareholder payouts, investors should also be aware of the ongoing challenge posed by foreign exchange volatility and its impact on reported earnings...

Read the full narrative on Nippon Sanso Holdings (it's free!)

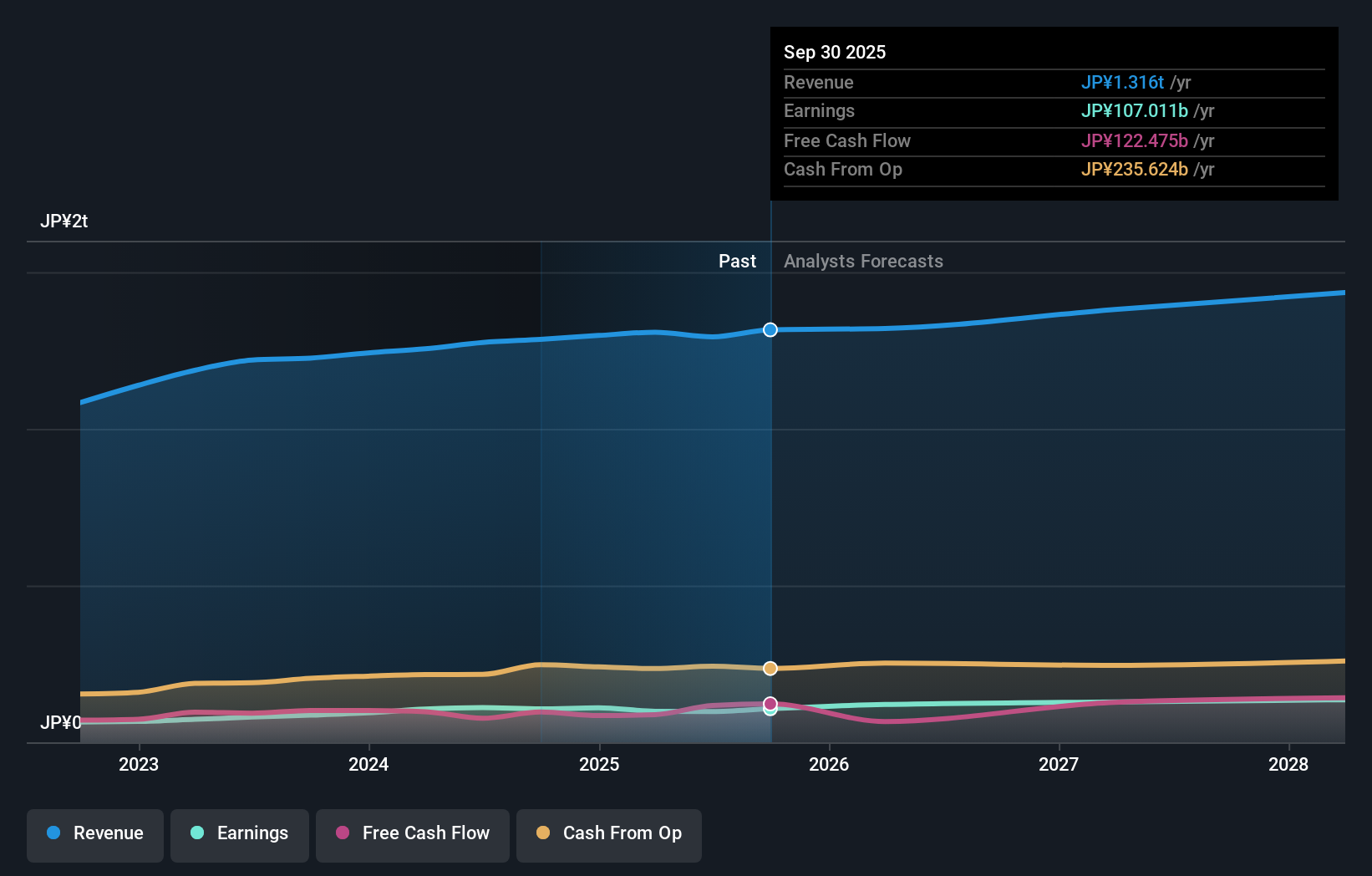

Nippon Sanso Holdings' outlook anticipates ¥1,466.2 billion in revenue and ¥139.9 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 4.3% and an earnings increase of ¥41.8 billion from the current earnings of ¥98.1 billion.

Uncover how Nippon Sanso Holdings' forecasts yield a ¥5333 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span a wide range, from ¥4,201 to ¥5,895 per share. While community participants see opportunity across different price points, keep in mind that persistent soft demand and sluggish revenue growth could temper expectations for future performance.

Explore 3 other fair value estimates on Nippon Sanso Holdings - why the stock might be worth 16% less than the current price!

Build Your Own Nippon Sanso Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nippon Sanso Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nippon Sanso Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nippon Sanso Holdings' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Sanso Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4091

Nippon Sanso Holdings

Engages in the gas business in Japan, the United States, Europe, Asia, and Oceania.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives