Shin-Etsu Chemical (TSE:4063) Valuation in Focus After Record-Breaking GaN Substrate Adoption by IMEC

Reviewed by Simply Wall St

Shin-Etsu Chemical (TSE:4063) has drawn attention after announcing that its QST™ substrate was chosen by IMEC for developing new 300-mm GaN power devices. Early trials achieved a record-breaking voltage threshold, which has spurred interest from major industry players.

See our latest analysis for Shin-Etsu Chemical.

The breakthrough with IMEC has put wind back in Shin-Etsu Chemical’s sails, though the momentum has faced recent headwinds. After starting the year strong, the share price has slipped by 13.7% year-to-date, with a 1-year total shareholder return of -18.5%. However, Shin-Etsu’s three- and five-year total shareholder returns, at 34.7% and 47.8% respectively, show resilience and long-term value potential still embedded in the business as the GaN opportunity develops.

If Shin-Etsu’s leap in power devices piqued your interest, you might want to check out what’s happening across the broader tech and semiconductor landscape. See the full list for free: See the full list for free.

With shares now trading at a sizable discount to analyst targets, investors are left to wonder if the recent weakness is a rare bargain in the making or if future gains are already priced in by the market.

Price-to-Earnings of 16.9x: Is it justified?

Shin-Etsu Chemical trades at a Price-to-Earnings (P/E) ratio of 16.9x, putting it below the peer group average of 19.9x and substantially underneath the estimated “fair” P/E of 21.4x. This suggests the current share price does not fully reflect potential earnings power relative to comparable companies and the level the market could move towards.

The P/E ratio measures how much investors are willing to pay today for a unit of current earnings. It is a widely used indicator in the chemicals sector for evaluating whether a stock appears attractively priced or expensive compared to its peers, factoring in both historical results and forward-looking expectations for profit growth.

With Shin-Etsu’s P/E notably lower than average, the market may be underestimating the company’s capacity for future profit expansion or the positive impact of recent technological breakthroughs. When compared to the industry benchmark of 12.2x, Shin-Etsu does look more expensive than the sector average. This highlights the premium attributed to the quality of its earnings. However, when set against the estimated “fair” P/E of 21.4x, there is a clear case that the stock could see a rerating if its earnings trajectory meets or exceeds expectations. Potential upside lies in closing this gap.

Explore the SWS fair ratio for Shin-Etsu Chemical

Result: Price-to-Earnings of 16.9x (UNDERVALUED)

However, slowing revenue growth and recent share price declines could weigh on sentiment, especially if technological progress does not quickly translate into stronger results.

Find out about the key risks to this Shin-Etsu Chemical narrative.

Another View: What Does Our DCF Model Say?

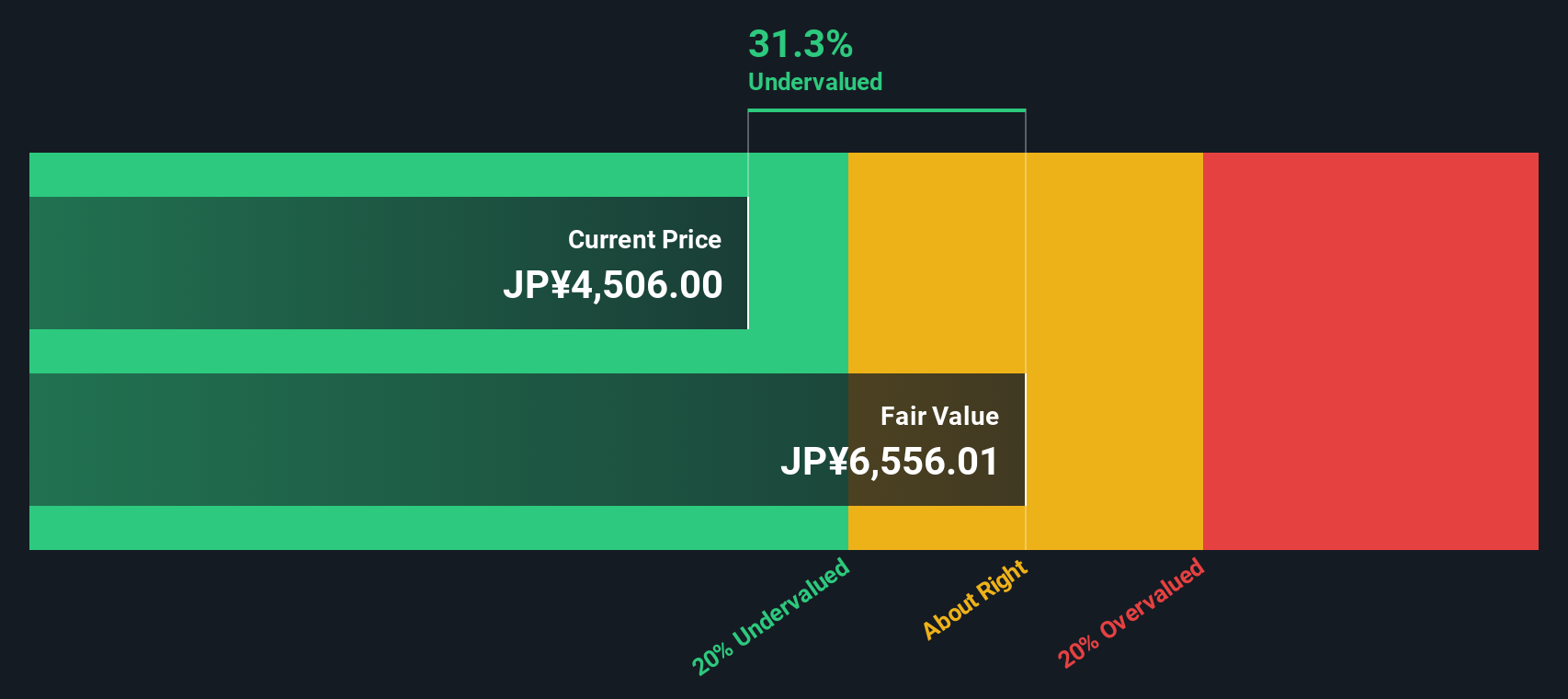

Looking at Shin-Etsu Chemical through the lens of our SWS DCF model, there is a notable disconnect with the market. The DCF analysis values the company around 31.5% above its current trading price. This points to significant undervaluation by this method. With fundamentals appearing solid, could this be the market’s blind spot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shin-Etsu Chemical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shin-Etsu Chemical Narrative

Readers who want a hands-on approach or a different perspective can dig into the data and shape their own thesis in just a few minutes. This can be done by choosing to Do it your way.

A great starting point for your Shin-Etsu Chemical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock your investing edge by searching for opportunities beyond the obvious. Use these specialized stock screens to find potential outperformers others are missing.

- Spot untapped value by reviewing these 917 undervalued stocks based on cash flows and see which stocks the market might be overlooking right now.

- Boost your portfolio's income with these 17 dividend stocks with yields > 3% featuring reliable yields above 3 percent and strong fundamentals supporting their payouts.

- Catch the breakthrough momentum in artificial intelligence with these 25 AI penny stocks driving new advances and influencing tomorrow's technological landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4063

Shin-Etsu Chemical

Provides infrastructure, electronics, and functional materials in Japan.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives