Assessing Denka’s (TSE:4061) Valuation After Goldman Sachs Upgrade on Electronics Recovery

Reviewed by Simply Wall St

See our latest analysis for Denka.

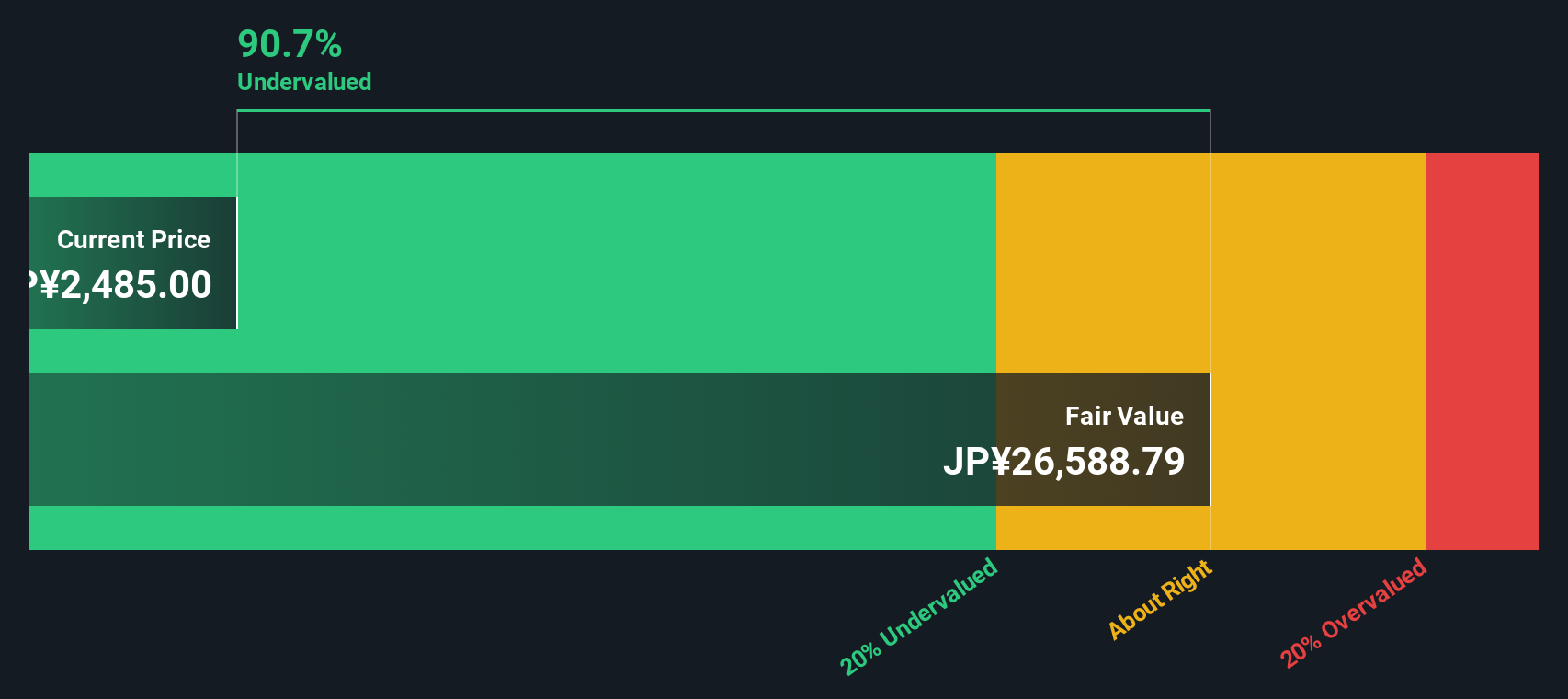

Denka’s 1-year total shareholder return of nearly 22% signals a firm rebound, with momentum clearly gathering steam over the last quarter. New product wins and stable dividends have helped put recent volatility in the rearview mirror. The stock’s current price sits at ¥2,485, up almost 12% year-to-date, and recent guidance updates suggest management is focused on steadying growth after last year’s setbacks.

If Denka’s momentum has you rethinking your watchlist, this is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With Denka’s shares rebounding and forecasts steadying, the key question now is whether the recent gains still leave room for upside or if the market has already accounted for the company’s expected recovery and future growth.

Price-to-Sales Ratio of 0.5x: Is it justified?

Denka’s shares currently trade at a price-to-sales (P/S) ratio of 0.5x, which positions the company right in line with its peer average. Despite the recent rally, the valuation indicates that the market sees Denka as fairly valued compared to similar companies.

The price-to-sales ratio measures how much investors are willing to pay for each yen of revenue earned by the company. For manufacturing and specialty chemicals firms like Denka, this metric helps investors gauge how efficiently the company is converting sales into potential future earnings, especially when profits are volatile or negative.

Denka's P/S of 0.5x matches the sector average but stands out as good value relative to both its industry average (0.6x) and an estimated “fair” P/S of 0.6x. This suggests there could be room for the market to re-rate the share price upward if operating performance continues to improve, as the current ratio slightly trails what would be justified based on fundamentals.

Explore the SWS fair ratio for Denka

Result: Price-to-Sales Ratio of 0.5x (ABOUT RIGHT)

However, Denka’s negative net income and recent years of share underperformance could challenge the sustainability of its latest turnaround story.

Find out about the key risks to this Denka narrative.

Another View: DCF Paints a Different Picture

Looking at Denka from a different angle, the SWS DCF model estimates the company is trading nearly 91% below its fair value. This suggests the market could be significantly underpricing Denka compared to its future cash flow potential. Is this a real opportunity or a caution flag for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Denka for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 921 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Denka Narrative

If you’re looking to go beyond these numbers and want to shape your own perspective, creating a custom narrative is quick and straightforward. Do it your way.

A great starting point for your Denka research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for one angle. Give yourself an edge and check out investment themes that are sparking opportunities right now using the Simply Wall Street Screener.

- Catch rising momentum by scanning for high-yield opportunities with these 17 dividend stocks with yields > 3%, which consistently deliver robust returns.

- Accelerate your portfolio’s innovation with these 25 AI penny stocks, driving breakthroughs in artificial intelligence and next-generation automation.

- Uncover tomorrow’s leaders in computing power by seeking out these 26 quantum computing stocks, positioned at the frontier of technology advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4061

Denka

Manufactures and sells organic and inorganic, electronic material, pharmaceutical, and resin-related products in Japan, rest of Asia, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives