Creation of Innovation-Focused Departments Could Be a Game Changer for Toagosei (TSE:4045)

Reviewed by Sasha Jovanovic

- Toagosei Co., Ltd. recently announced major organizational and leadership changes that take effect January 1, 2026, including new departments focused on chemical substance management and production innovation under its Medium-Term Management Plan.

- This move reflects Toagosei's intent to accelerate new product development and strengthen chemical management, aiming to boost innovation and operational efficiency.

- We'll explore how the creation of new innovation-oriented departments may reshape Toagosei's long-term investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Toagosei's Investment Narrative?

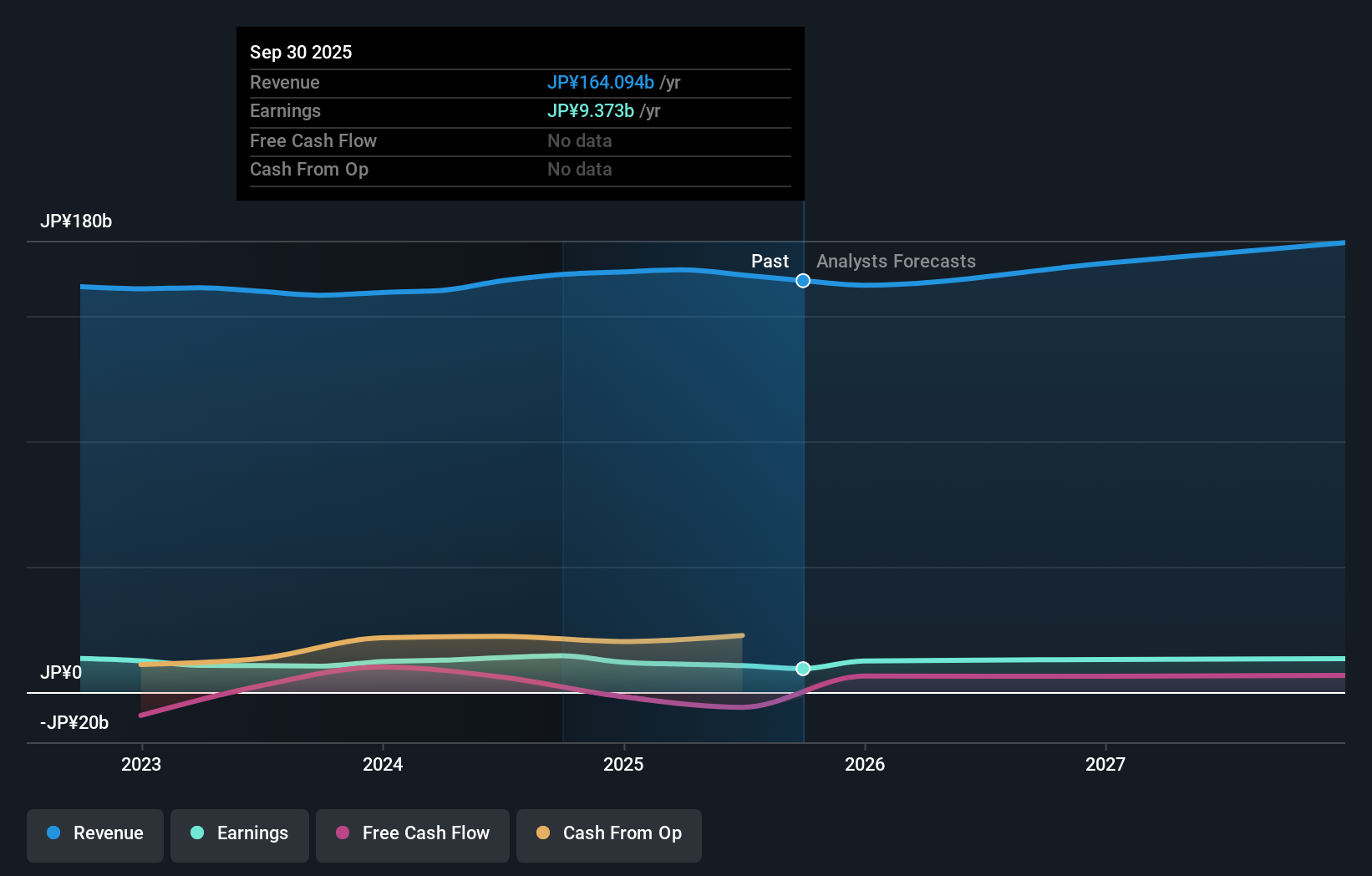

Being a Toagosei shareholder means believing in the company’s ability to upgrade and streamline its core operations by innovating in specialty chemicals and improving product development. The latest organizational overhaul, announced for January 2026, targets two of Toagosei’s persistent short-term challenges: slow earnings growth and operational efficiency. By creating departments devoted to chemical substance management and production innovation, the company is signaling that it intends to tackle regulatory complexity and speed to market, which had been risks flagged in earlier analysis. As a result, one of the biggest risks, execution capability with a relatively new management team, may evolve as leadership adapts to a sharper innovator’s mindset. For now, these changes reflect more of a long-term orientation than an immediate shift for short-term earnings catalysts, so investors watching for near-term results will need to keep an eye on how these efforts get executed.

However, the company’s recent management reshuffle carries its own set of execution risks that investors should not ignore.

Exploring Other Perspectives

Explore another fair value estimate on Toagosei - why the stock might be worth just ¥1916!

Build Your Own Toagosei Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toagosei research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Toagosei research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toagosei's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toagosei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4045

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives