Tosoh (TSE:4042): Assessing Valuation After Guidance Cut on Weaker Demand and Impairment Losses

Reviewed by Simply Wall St

Tosoh (TSE:4042) updated its earnings guidance after encountering softer demand and reduced sales volumes, particularly in its Chlor-alkali and Petrochemical Groups. The revised outlook also reflects negative impacts from impairment losses this quarter.

See our latest analysis for Tosoh.

Recent months have seen Tosoh’s share price ebb and flow as investors balance the impacts of softened demand and impairment charges against a resilient Engineering Group and favorable currency trends. Even with some recent volatility, the stock’s one-year total shareholder return stands at 13.7 percent. Over three and five years, it has delivered a robust 64 and 66 percent respectively, suggesting long-term outperformance despite short-term headwinds.

If you’re curious where momentum or value might be emerging next, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

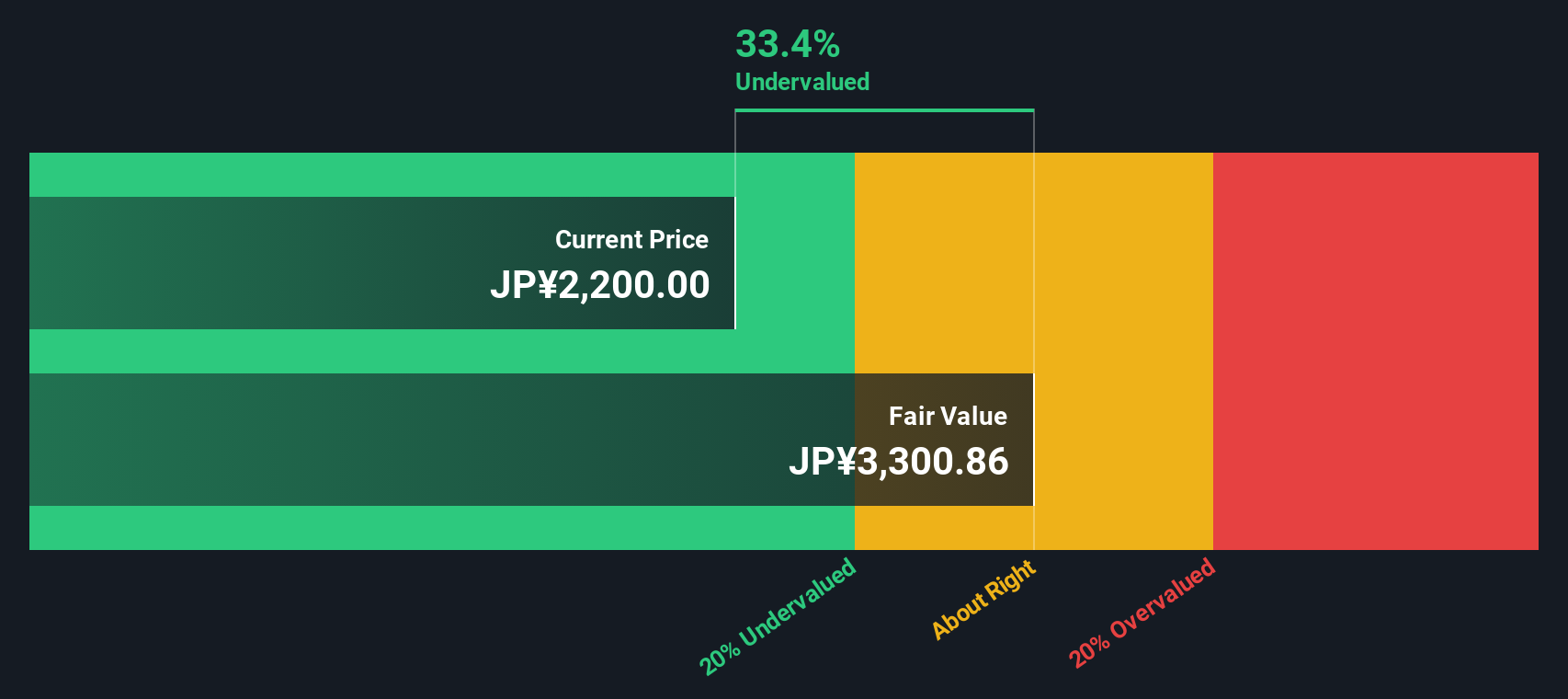

With shares trading at a notable discount to analyst targets and underlying value, the key question remains: Is Tosoh currently undervalued following the recent guidance cut, or has the market already priced in future growth prospects?

Price-to-Earnings of 17.5x: Is it justified?

Tosoh’s current price-to-earnings (P/E) ratio stands at 17.5x, positioning its valuation above the average for the Japanese Chemicals sector. With its last close at ¥2,246.5, investors are paying a stronger premium per unit of earnings than the typical peer.

The price-to-earnings ratio shows what the market is willing to pay for each yen of reported net profit. It is a well-watched metric for established chemical manufacturers like Tosoh, reflecting investor expectations for sustainable profits and sector resilience.

At 17.5x, Tosoh’s P/E is notably higher than the Chemicals industry average of 13x. This signals that the market expects faster earnings growth, stable cash flows, or unique advantages moving forward. However, the company’s multiple is well below the average for its broader peer group at 28.6x. This might signal a cautious optimism about its future. Further, its P/E also sits below the estimated fair price-to-earnings ratio of 18.9x, suggesting the market could move higher towards that level if confidence in growth improves.

Explore the SWS fair ratio for Tosoh

Result: Price-to-Earnings of 17.5x (ABOUT RIGHT)

However, softer demand in key divisions and ongoing impairment risks could weigh on future results and challenge the company’s premium valuation.

Find out about the key risks to this Tosoh narrative.

Another View: DCF Valuation Suggests More Upside

Looking from a different perspective, our SWS DCF model presents a significantly more optimistic picture for Tosoh. The model suggests shares are trading well below their estimated fair value, highlighting a potential undervaluation that may not be apparent from the earnings multiple alone. Could this gap signal an overlooked opportunity, or are there risks holding back the market?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tosoh for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tosoh Narrative

If you see the story unfolding differently or prefer your own analysis, you can craft your unique view using the available data in just a few minutes. So why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tosoh.

Looking for more investment ideas?

Expand your investment playbook by sizing up fresh opportunities using the Simply Wall Street Screener. The right idea now could boost your portfolio for years to come.

- Unlock powerful income streams and future-proof your portfolio with these 16 dividend stocks with yields > 3% offering yields above 3 percent and strong fundamentals.

- Chase the potential of game-changing innovation by targeting AI leaders, starting with these 24 AI penny stocks before others catch on.

- Ride the next wave of market opportunity with these 3589 penny stocks with strong financials showing financial strength and rapid growth momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tosoh might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4042

Tosoh

Manufactures and sells basic chemicals, petrochemicals, specialty products, and fine chemicals.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives