Nippon Soda (TSE:4041) Dividend Hike: Assessing the Stock’s Valuation After Management Signals Confidence

Reviewed by Simply Wall St

Nippon Soda (TSE:4041) has announced it will raise its second quarter dividend to ¥70 per share, up from ¥60 last year. Payments are scheduled to begin December 4, 2025. This move signals management’s positive outlook for the company’s earnings and financial health.

See our latest analysis for Nippon Soda.

Nippon Soda’s upbeat dividend announcement comes after an impressive run for shareholders, with a 33.9% total return over the past year and a remarkable 203.6% over five years. That long-term outperformance suggests both steady business momentum and increased investor confidence, as the company’s recent moves are being met with optimism in the market.

If this kind of sustained growth sparks your curiosity, now is an ideal moment to explore fast growing stocks with high insider ownership.

With the stock boasting a robust long-term performance and management signaling optimism, investors may wonder if Nippon Soda still trades at a bargain or if future growth is already reflected in the current price.

Price-to-Earnings of 11.9x: Is it justified?

Nippon Soda is trading at a price-to-earnings ratio of 11.9x, which suggests attractive value when compared to both peers and the sector. At the last close price of ¥3,400, investors are paying less per unit of earnings than what is typical in the market.

The price-to-earnings (P/E) ratio shows how much the market is willing to pay for each yen of company earnings. In the chemicals industry, where profitability can change with commodity cycles and demand, a lower P/E can indicate that a stock is undervalued or that the market expects slower growth ahead.

In this case, Nippon Soda’s ratio appears favorable. It is trading below the Japanese chemicals industry average of 12.2x and well below the peer average of 20.5x. In addition, the stock is priced beneath its estimated fair P/E ratio of 13.5x, which could signal potential for market rerating if business momentum continues.

Explore the SWS fair ratio for Nippon Soda

Result: Price-to-Earnings of 11.9x (UNDERVALUED)

However, headwinds such as slowing revenue growth or volatility in industry demand could still challenge Nippon Soda’s valuation outlook in the future.

Find out about the key risks to this Nippon Soda narrative.

Another View: What Does Our DCF Model Say?

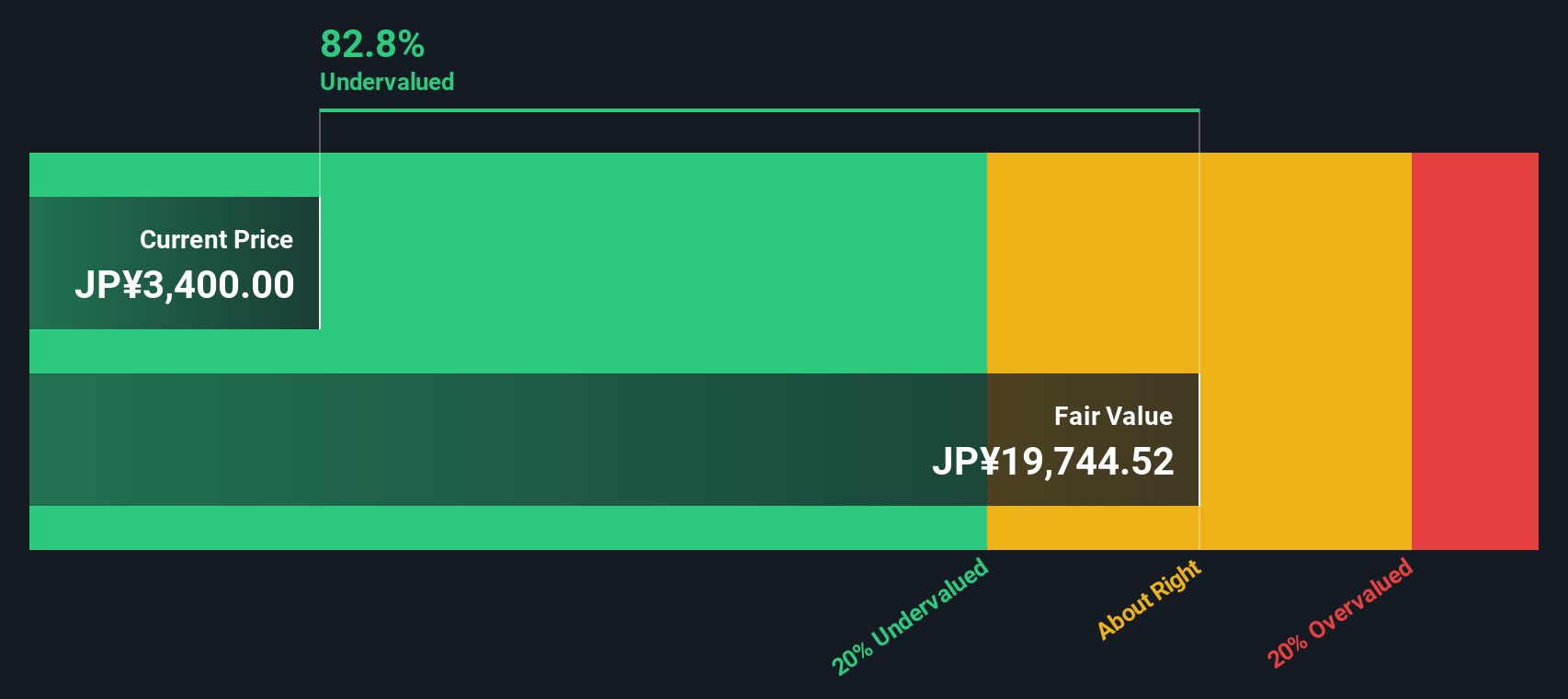

While the price-to-earnings ratio points to value, the SWS DCF model shows Nippon Soda trading at a significant discount to its estimated fair value. With the current share price of ¥3,400 well below our DCF estimate of ¥19,744.52, this approach suggests the stock could be even more undervalued than multiples imply. However, it raises the question of whether the market sees hidden risks or if this is an opportunity waiting to be realized.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Soda for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Soda Narrative

If you want to dive deeper or believe a different perspective is possible, you can independently analyze the numbers and develop your own view in just a few minutes. Do it your way

A great starting point for your Nippon Soda research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Find Your Next Smart Investment?

Every smart investor keeps an edge by tracking new opportunities. Use the Simply Wall Street Screener and act while others hesitate, so you never miss out.

- Uncover the strongest passive income ideas by checking out these 16 dividend stocks with yields > 3%, which features consistently attractive yields and robust fundamentals.

- Accelerate your portfolio’s growth by seeking out innovation leaders through these 25 AI penny stocks, as they transform industries with the latest in artificial intelligence.

- Tap into tomorrow’s financial disruptors and get ahead of the market by exploring these 81 cryptocurrency and blockchain stocks in blockchain and digital currency sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Soda might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4041

Nippon Soda

Provides agri-business, pharmaceuticals, specialty chemicals, eco chemicals, and chlor-alkali products in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives