Upgraded Earnings and Dividend Guidance Might Change The Case For Investing In Nissan Chemical (TSE:4021)

Reviewed by Sasha Jovanovic

- Nissan Chemical Corporation announced on November 10, 2025, that it has raised its full-year earnings and dividend guidance, with the annual dividend now expected to reach ¥180 per share, reflecting strong results in its Performance Material and Agricultural Chemicals Segments.

- This latest move underscores Nissan Chemical's ongoing commitment to its medium-term payout policy, emphasizing a targeted dividend payout ratio of at least 55% and a total payout ratio of at least 75%.

- We’ll explore how the upward revision in earnings and dividends may shape investor perceptions of Nissan Chemical’s capital allocation priorities.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Nissan Chemical's Investment Narrative?

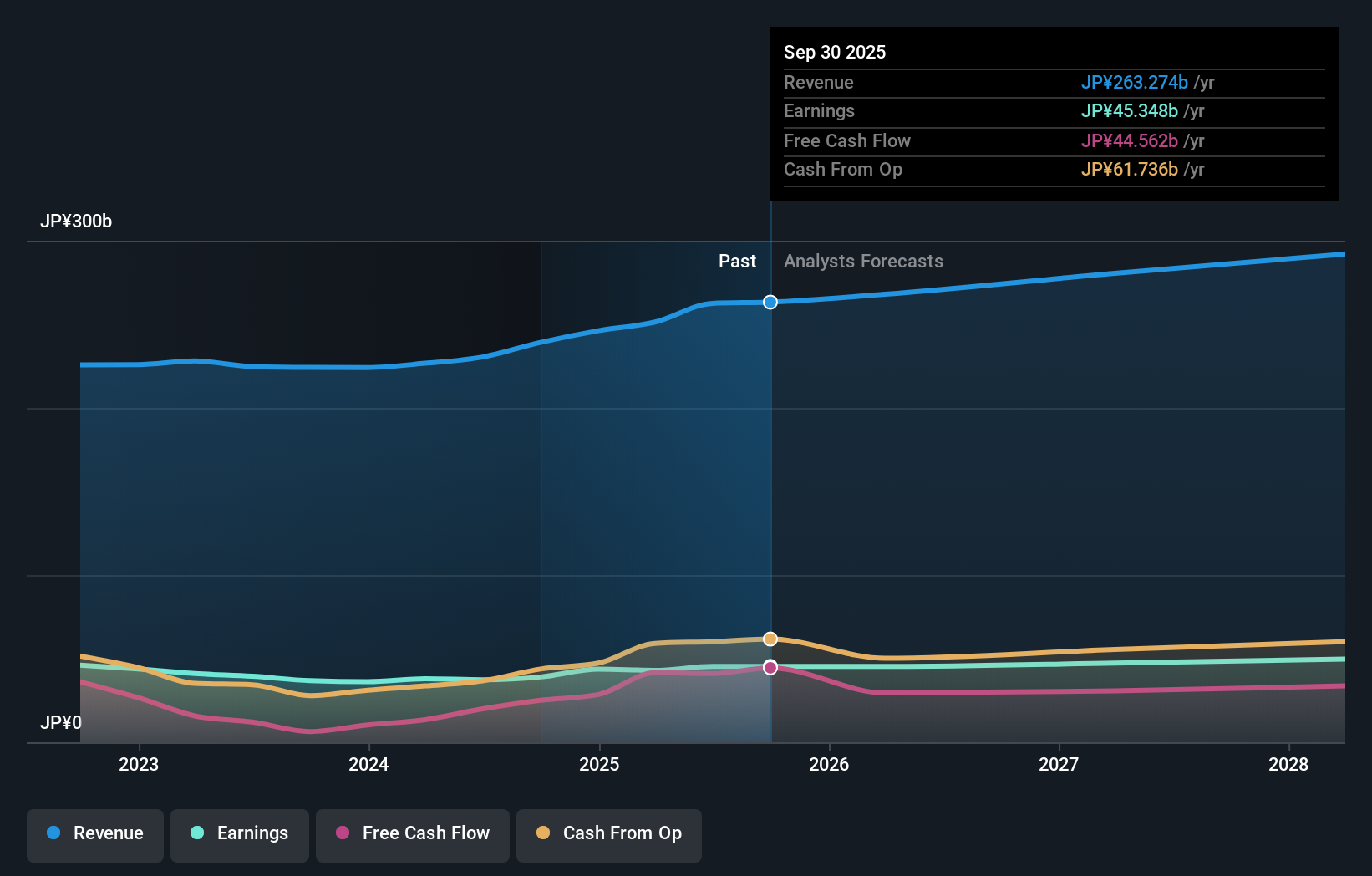

Nissan Chemical’s recent upgrade to its full-year earnings and dividend guidance signals renewed confidence from management, especially with strong gains from the Performance Material and Agricultural Chemicals segments. For shareholders, the core belief here is that Nissan Chemical’s robust cash generation and consistent capital return, underscored by an increased annual dividend forecast and ongoing share buybacks, reinforce its commitment to rewarding investors as part of a disciplined payout policy. This adjustment could shift short-term catalysts to focus more heavily on execution within these resilient segments, while investor attention may also turn to whether new product launches like Altair can sustain momentum going forward. The raised outlook appears material, potentially reducing downside risks tied to earnings underperformance, but with revenue and earnings growth projected to lag broader market expectations, debates about valuation and return potential remain especially relevant after this update.

But, unlike headline numbers, competitive pressures in core segments remain a risk investors should not ignore. Nissan Chemical's shares have been on the rise but are still potentially undervalued by 17%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Nissan Chemical - why the stock might be worth as much as 21% more than the current price!

Build Your Own Nissan Chemical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nissan Chemical research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Nissan Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nissan Chemical's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissan Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4021

Nissan Chemical

Engages in the chemicals, performance materials, agricultural chemicals, and pharmaceuticals businesses in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives