Sumitomo Chemical (TSE:4005) Profitability Rebounds on ¥109.8B Gain, Raising Questions Over Earnings Quality

Reviewed by Simply Wall St

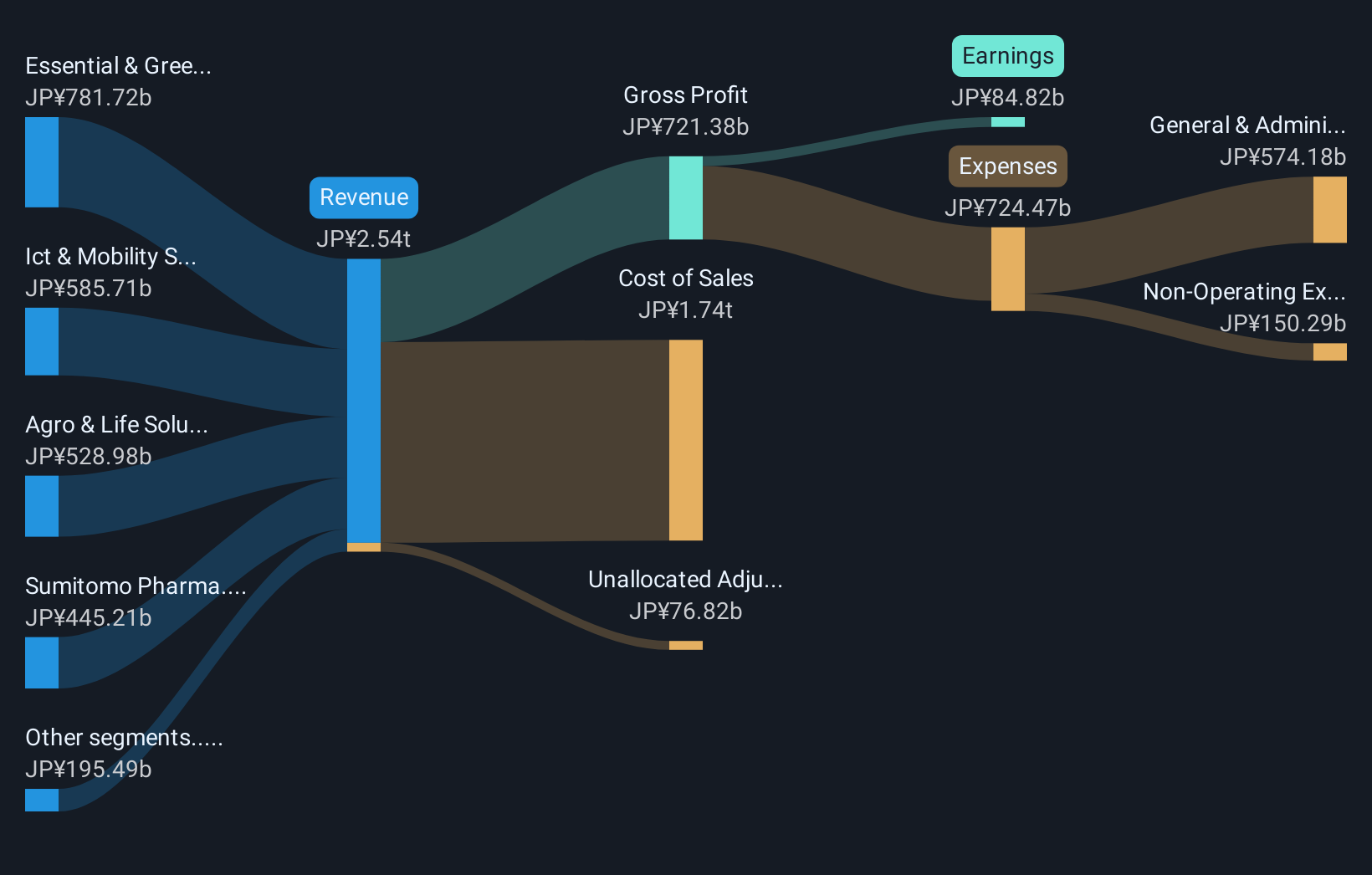

Sumitomo Chemical Company (TSE:4005) has reported a return to profitability for the twelve months to September 30, 2025, thanks in large part to a one-off gain of ¥109.8 billion. Although the turnaround boosted its net profit margin, investors will note that earnings have declined by 38.9% per year over the last five years, which complicates straightforward comparisons to previous results. Looking forward, earnings are forecast to grow at 7.1% annually, but this pace is expected to trail both the broader Japanese market and industry peers, meaning overall sentiment remains balanced between optimism and caution.

See our full analysis for Sumitomo Chemical Company.Next, we will see how these headline results measure up against the most widely discussed narratives among investors, highlighting where views align and where the numbers may surprise.

See what the community is saying about Sumitomo Chemical Company

Margin Target: 0.4% Rising to 3.4%

- Sumitomo Chemical's profit margins are forecast to climb from the current 0.4% to 3.4% by 2028, signaling expectations for improved efficiency and cost control over the medium term.

- According to the analysts' consensus view, this margin expansion is expected to be powered by:

- Operational efficiency gains and portfolio changes targeting higher-margin segments, in line with reported improvement across areas such as Agro & Life Solutions and Advanced Materials.

- International opportunities such as growing agricultural demand in India and South America, as well as cost transformation and green materials adoption that could support a more durable profit structure.

PE of 8.3x Undercuts Industry

- The company is trading at a Price-To-Earnings (PE) ratio of just 8.3x, considerably lower than the Japan chemicals industry average of 13.1x and its peer group’s 19.2x.

- Analysts' consensus view suggests this discounted multiple could offer value if margin improvements materialize as expected:

- Sumitomo Chemical’s share price sits well below the DCF fair value of 1019.44, but with headline profits propped by a ¥109.8 billion one-off gain, investors are watching for more consistent operational progress before buying into a rerating.

- The consensus analyst price target of 526.91 is only 22% above today’s 432.3 share price, highlighting muted expectations and ongoing debate about whether the current discount is justified or simply reflects underlying risks.

Revenue Down 0.1% Annually: Flat Outlook

- Despite the focus on margin gains, revenue is projected to fall at an average rate of 0.1% annually over the next three years, signaling muted demand and weak top-line momentum even as international markets present opportunities.

- Consensus narrative points to structural and near-term headwinds weighing on volume growth or price realization:

- Sluggish demand in legacy petrochemicals, yen fluctuations, and inventory buildup, particularly in Agro & Life Solutions for Latin America, are expected to restrain revenue, despite innovation and specialty chemicals showing resiliency.

- The company’s heavy reliance on non-recurring gains, such as the recent ¥109.8 billion windfall, means future growth will increasingly depend on new products and sharper execution in areas such as green materials and supply chain integration.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sumitomo Chemical Company on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? If you spot a different angle, you can craft and share your own narrative in just a few minutes. Do it your way

A great starting point for your Sumitomo Chemical Company research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Sumitomo Chemical’s weak revenue outlook and inconsistent earnings highlight challenges in sustaining dependable growth, even with anticipated margin improvements.

If you want greater consistency and less uncertainty, use our stable growth stocks screener (2078 results) to surface companies with dependable revenue and earnings momentum year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4005

Sumitomo Chemical Company

Engages in Agro & Life Solutions, ICT & Mobility Solutions, Advanced Medical Solutions, Essential & Green Materials, and Sumitomo Pharma.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives