Tomoku (TSE:3946) Profit Margin Climbs to 3.3%, Reinforcing Bullish Narrative on Earnings Quality

Reviewed by Simply Wall St

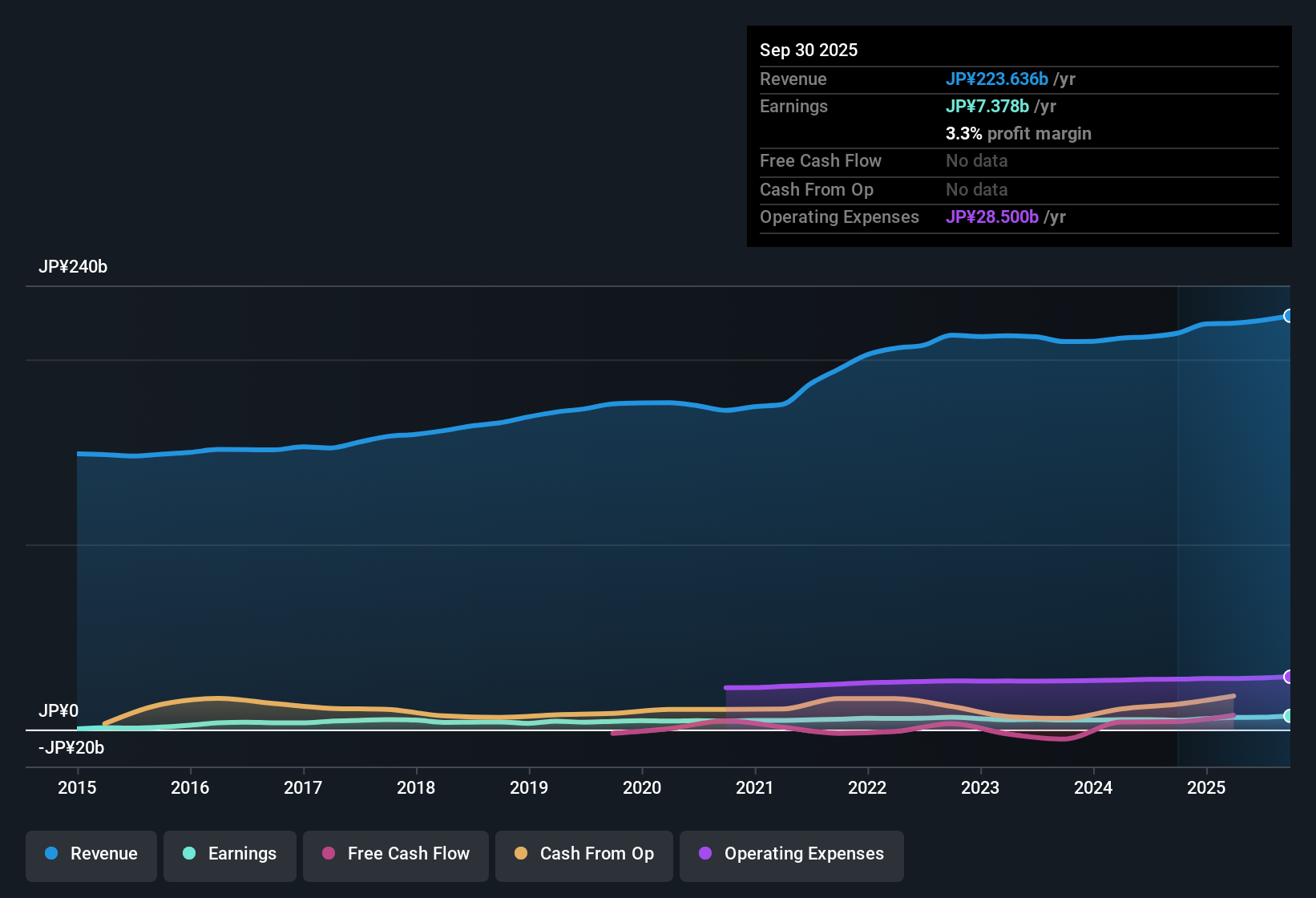

Tomoku (TSE:3946) reported a net profit margin of 3.3%, up from 2.3% a year ago, with earnings surging 47.4% over the past year. This result is well above its five-year compounded annual growth rate of 4.1%. Shares currently trade at ¥3,295, reflecting a price-to-earnings ratio of 7.4x, which is below both the Japan packaging industry average and major peer benchmarks. The price also remains well beneath the company’s estimated fair value of ¥9,743.46. With profit margins strengthening and robust annual earnings growth, investors may view Tomoku as a value-oriented play supported by solid operational performance and only minor risks flagged.

See our full analysis for Tomoku.Next, we will stack these headline numbers against the prevailing narratives to see which stories get confirmed and where expectations might be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Outpace Five-Year Trend

- Net profit margin increased to 3.3%, well above Tomoku’s five-year compounded annual growth rate of 4.1%. This highlights a significant jump in profitability relative to its long-term average.

- Strong margin improvement and high-quality earnings support the positive case, indicating that Tomoku is not only growing but also sustaining its profitability advantage.

- The 47.4% year-on-year earnings growth stands out against the steadier 4.1% CAGR, suggesting an acceleration that bullish investors see as a key upside factor.

- Bulls further note this sharp margin leap underscores durable operational performance rather than just a single-period rebound.

Minor Risks Remain on Dividends

- Despite a positive track record in profits, minor risks relating to the sustainability of dividends and broader financial position persist in the latest results.

- While Tomoku faces minor operational concerns, no major risk flags were raised, with the primary caveat being on the stability of future payouts.

- Critics highlight that these risks are minor and have not resulted in any disruption to profit generation but remain alert for any future impact on shareholder returns.

- Bears argue that despite the uptick in margins, close attention should be paid to cash flow and balance sheet resilience in case operational conditions become less favorable.

Valuation Gap Signals Deep Discount

- Tomoku’s current share price of ¥3,295 trades at a 66% discount to its DCF fair value of ¥9,743.46. The price-to-earnings ratio of 7.4x also sits below both industry and peer averages.

- The sizable valuation gap between market price and DCF fair value provides a strong case for value-oriented investors, particularly with recent profitability strength.

- The discount to industry averages could amplify positive sentiment if Tomoku’s margin growth sustains, but may also invite scrutiny if risks around dividend sustainability materialize.

- Prevailing market views suggest that robust operational performance and attractive multiples could lead to a narrowing of the valuation gap as confidence builds.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tomoku's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Tomoku’s margins and earnings are robust, concerns remain around the sustainability of its future dividends and overall financial stability.

If you want to prioritize reliable payouts, now could be a good time to check out these 1998 dividend stocks with yields > 3% offering above-average yields and dependable dividend records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tomoku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3946

Tomoku

Engages in the corrugated container and display carton, housing, transportation, and logistics businesses in Japan and internationally.

Solid track record established dividend payer.

Market Insights

Community Narratives