Rengo (TSE:3941): Analyzing Valuation After Dividend Hike and Plant Compensation News

Reviewed by Simply Wall St

Rengo (TSE:3941) caught investor attention this week by boosting both its interim and annual dividend forecasts and revealing plans to relocate operations after part of its Shonan Plant was expropriated. The company has secured compensation for the expropriated property.

See our latest analysis for Rengo.

After a few months of steady gains, Rengo’s 12.75% 3-month share price return and 13.82% total shareholder return over the past year show momentum is quietly building. With dividend hikes and relocation news in focus, investors seem to be taking a fresh look at its long-term growth strategy.

If this kind of real-world catalyst has you curious about other market moves, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

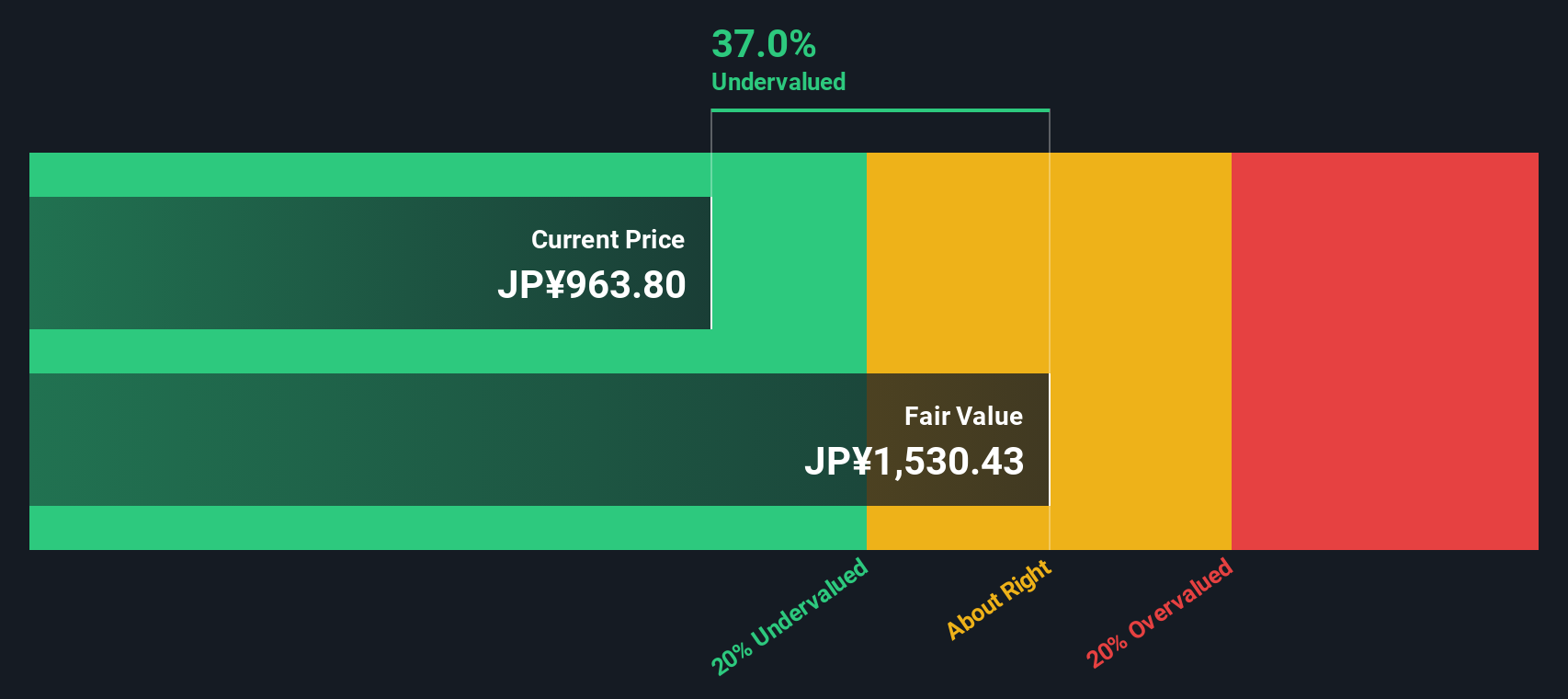

The question now is whether Rengo’s fundamentals and forecasts suggest a bargain at current levels, or if the recent dividend hikes and compensation windfall are already reflected in the share price, leaving limited upside ahead.

Price-to-Earnings of 11.8x: Is it justified?

Rengo's shares are currently trading at a price-to-earnings (P/E) ratio of 11.8x, which is higher than both the industry and peer averages. This suggests investors may be assigning a premium to the company's earnings profile, despite recent momentum.

The price-to-earnings ratio reflects how much investors are willing to pay today for each unit of earnings. For a packaging company like Rengo, this figure highlights expectations about future profitability, stability, and growth compared to similar businesses in Japan.

Rengo’s P/E ratio is above the JP Packaging industry average of 10.1x and the broader peer average of 11.1x. However, compared to the estimated fair P/E ratio of 16x, the current multiple still leaves room for potential upside if Rengo delivers on its growth ambitions. The market could eventually re-rate Rengo closer to this fair value level if performance improves.

Explore the SWS fair ratio for Rengo

Result: Price-to-Earnings of 11.8x (UNDERVALUED)

However, slower revenue growth or unexpected costs from the relocation could dampen sentiment and limit further share price appreciation this year.

Find out about the key risks to this Rengo narrative.

Another View: Discounted Cash Flow

Looking from another angle, our DCF model values Rengo shares at ¥1,579.6, which is well above the current price of ¥996. This suggests the stock could be trading at a substantial discount. However, is the market overlooking something obvious, or is the optimism overstated?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rengo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rengo Narrative

If you have your own perspective on Rengo’s outlook or prefer digging into the numbers personally, you can construct your own view in just a few minutes, or simply Do it your way.

A great starting point for your Rengo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by uncovering new opportunities beyond the obvious picks. Make sure you’re not missing out on future growth stories with these hand-picked ideas:

- Capture tomorrow’s tech leaders by investigating these 24 AI penny stocks in the fields of automation, robotics, and intelligent software.

- Build lasting income by reviewing these 16 dividend stocks with yields > 3% that consistently offer yields above 3% and reward shareholders with reliable payouts.

- Access the next wave of innovation by scanning these 27 quantum computing stocks positioned to transform industries through breakthroughs in computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3941

Rengo

Manufactures and sells paperboard and packaging-related products in Asia, Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives