- Japan

- /

- Paper and Forestry Products

- /

- TSE:3863

Assessing Nippon Paper Industries (TSE:3863) Valuation After a Year of Quiet, Consistent Share Price Gains

Reviewed by Simply Wall St

If you have been wondering what to make of Nippon Paper Industries (TSE:3863) after its recent share movements, you are not alone. The company’s stock has quietly moved higher this month even though no single defining event has triggered investor chatter or headlines. Sometimes, these subtle price moves can say more about underlying sentiment or shifting expectations than a huge announcement, catching sharp-eyed investors just as earnings or new strategies are being digested.

Looking at the bigger picture, Nippon Paper Industries has gained 42% over the year, far outpacing its five-year rise. Its share price has built momentum in the past three months especially, suggesting some investors may see renewed potential, even as net income growth has picked up and revenue growth remains modest. While other names in the materials sector have seen fits and starts, this climb stands out for its consistency rather than sudden spikes driven by news events.

So after a year of steady gains and outperformance, are investors being too cautious, or is there still value hidden in plain sight if future growth is not already priced in?

Price-to-Earnings of 19.1x: Is it justified?

Nippon Paper Industries currently trades on a price-to-earnings (P/E) ratio of 19.1x, which is lower than the average for its industry in Asia. However, it is higher than both its peer group and its own estimated fair value multiple.

The P/E ratio measures how much investors are willing to pay for each unit of a company’s earnings. It is often used as a quick gauge of valuation and future growth expectations for companies in traditional, earnings-driven sectors such as paper and forestry.

For Nippon Paper Industries, the market is placing a relatively high value on current and expected earnings. When compared to its peers and its fair value multiple, the shares may appear pricey unless the company delivers significant growth to meet expectations.

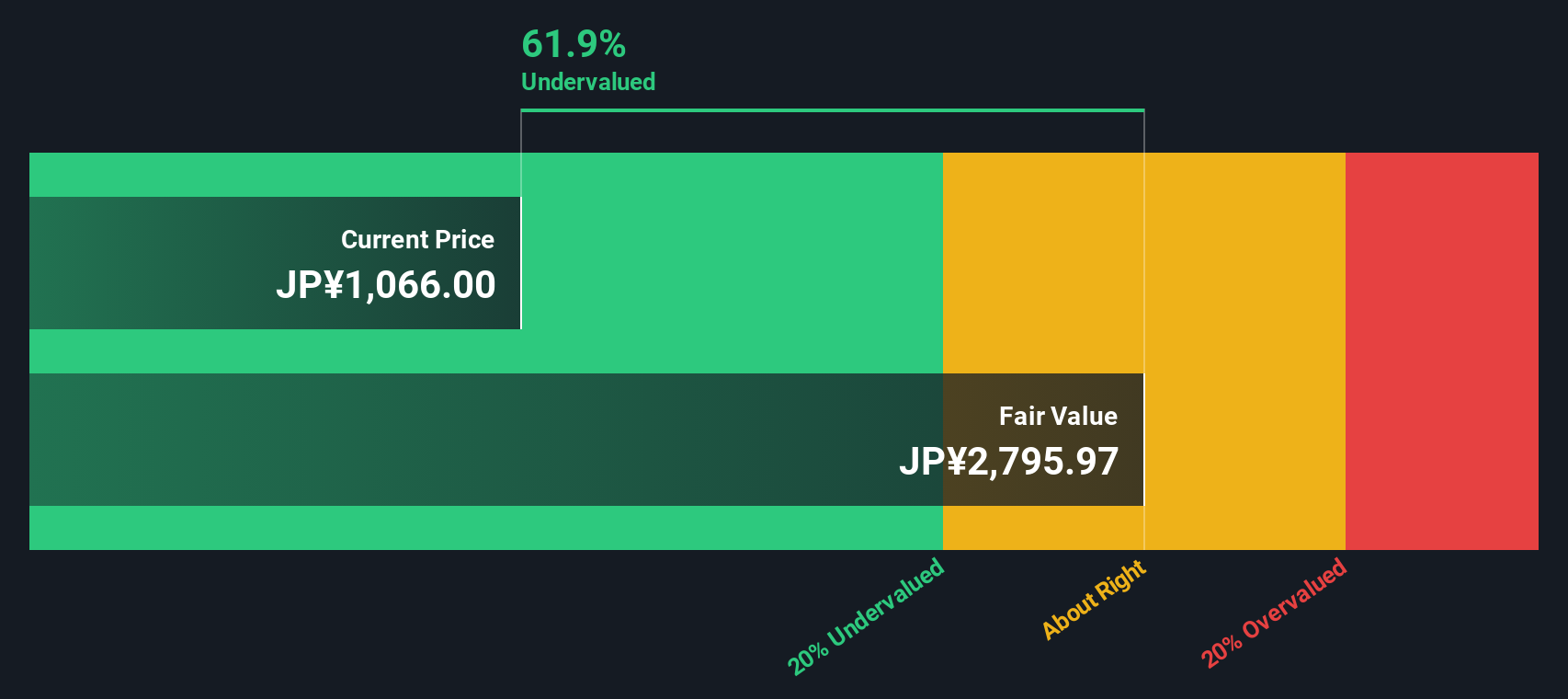

Result: Fair Value of ¥2,806.13 (UNDERVALUED)

See our latest analysis for Nippon Paper Industries.However, slower revenue growth and an above-average valuation mean that any stumble in earnings or cost inflation could quickly dampen recent investor optimism.

Find out about the key risks to this Nippon Paper Industries narrative.Another Perspective: What Does Our DCF Say?

While the market’s price-to-earnings approach points to a relatively high valuation, our DCF model takes a broader look at Nippon Paper Industries’ cash flows and suggests shares are actually trading below estimated fair value. Does this second method hint at an opportunity the market has not fully recognized?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nippon Paper Industries Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can easily build your own perspective in just a few minutes. Do it your way.

A great starting point for your Nippon Paper Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to unlock fresh opportunities, diversify beyond the obvious, and uncover companies that are gaining momentum before the crowd notices. The market tends to reward those who seek out what others overlook. Set yourself up for smarter investing with these curated tools:

- Tap into high-potential upstarts making waves in the markets with penny stocks with strong financials.

- Spot tomorrow’s breakthroughs in artificial intelligence by starting your search for leaders in the AI revolution through AI penny stocks.

- Secure reliable income streams by identifying top picks offering superior payouts using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Paper Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3863

Nippon Paper Industries

Engages in the production and sale of pulp and paper products in Japan, Oceania, Asia, North America, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives