Asahi Kasei (TSE:3407) Valuation in Focus After KDIGO Nefecon Win and High-Power Battery Deal

Reviewed by Simply Wall St

Asahi Kasei (TSE:3407) shares have seen renewed investor focus after two recent developments. Most notably, the company’s Nefecon gained inclusion in the KDIGO 2025 guidelines for IgA nephropathy, which bolsters its presence in the pharmaceutical sector.

See our latest analysis for Asahi Kasei.

Asahi Kasei’s share price momentum has picked up, climbing 9.6% over the last three months as investors reacted positively to both the KDIGO guideline inclusion for Nefecon and the company’s push into high-power battery technology. With a robust one-year total shareholder return of 10.6% and nearly 48% cumulative gains over five years, Asahi Kasei’s performance suggests steady long-term value. Recent news has clearly sparked renewed optimism.

If these breakthroughs have you thinking about what else is accelerating in the healthcare sector, explore fresh opportunities with our curated list of innovators: See the full list for free.

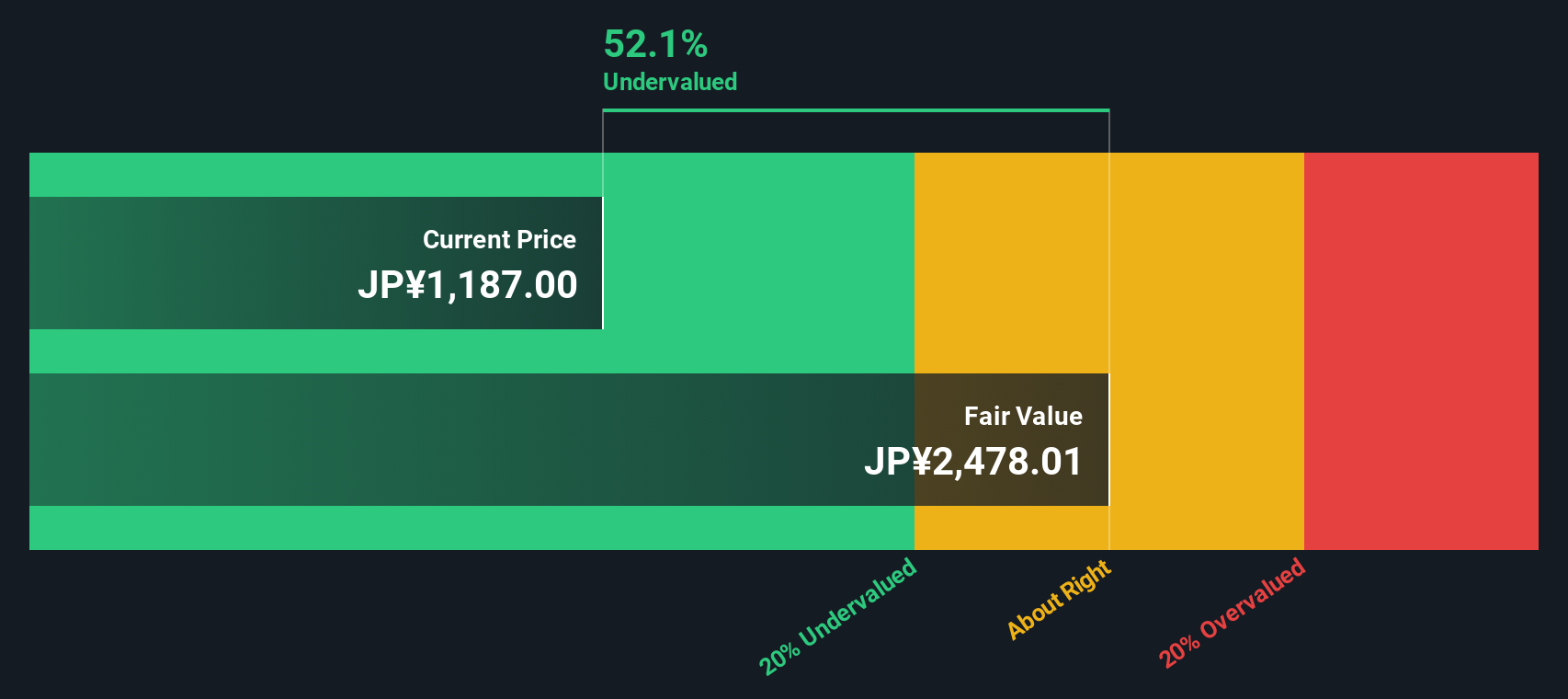

With the stock trading about 19% below analyst price targets and strong growth catalysts in play, the big question is whether Asahi Kasei remains undervalued or if the market is already factoring in its future upside.

Price-to-Earnings of 13.6x: Is it justified?

Asahi Kasei’s current price-to-earnings ratio stands at 13.6x, placing its valuation in sharp focus relative to the broader market and sector. At ¥1,208 per share, the stock trades below its peer group average and well below analyst consensus fair values, signaling a possible value opportunity for investors.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each yen of earnings. For Asahi Kasei, a P/E of 13.6x means the market is pricing the company at around 13.6 times its current annual earnings. This metric is particularly relevant for mature companies in the chemicals sector, as it encapsulates expectations for profitability and future growth.

The company’s earnings growth is impressive, up 76.6% over the past year, and it is forecast to continue outpacing the Japanese market average. While Asahi Kasei looks expensive compared to the Japanese chemicals sector mean of 13.2x, it is attractively valued next to the peer average of 28.9x. The gap between the current P/E and an estimated fair P/E ratio of 20.1x suggests the market could re-rate the stock if positive trends persist.

Explore the SWS fair ratio for Asahi Kasei

Result: Price-to-Earnings of 13.6x (UNDERVALUED)

However, slower than expected revenue growth or volatility in the chemicals market could quickly undermine the bullish outlook investors currently hold for Asahi Kasei.

Find out about the key risks to this Asahi Kasei narrative.

Another View: What Does Our DCF Model Say?

While the price-to-earnings ratio paints Asahi Kasei as undervalued, the SWS DCF model takes a broader look at projected future cash flows and suggests the stock is trading significantly beneath its fair value. However, does this difference signal a true bargain, or are there hidden risks behind the numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Asahi Kasei for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 844 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Asahi Kasei Narrative

If you’d rather investigate the figures yourself or see the story from a fresh angle, you can easily build your own perspective in just minutes. Do it your way

A great starting point for your Asahi Kasei research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Stay ahead of the curve and pinpoint unique stocks perfectly suited to your strategy. The right screener could be your edge in beating the market.

- Grab the chance to uncover solid yields by checking out these 20 dividend stocks with yields > 3%, which rewards shareholders with attractive income and long-term stability.

- Tap into the digital revolution with these 82 cryptocurrency and blockchain stocks, offering exposure to the forces shaping blockchain and the future of finance.

- Spot unique disruptors with these 3614 penny stocks with strong financials, uncovering undervalued companies with strong financials and potential for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3407

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives