Asahi Kasei (TSE:3407) Is Up 7.1% After Announcing Share Buyback and Advances in Healthcare and Batteries

Reviewed by Sasha Jovanovic

- Asahi Kasei Corporation announced a share repurchase program of up to 45 million shares for ¥40 billion, the inclusion of its key pharmaceutical product Nefecon in the global KDIGO 2025 guidelines for IgA Nephropathy, and a licensing agreement with EAS Batteries for advanced lithium-ion battery electrolyte technology.

- These developments reinforce Asahi Kasei’s commitment to shareholder returns and showcase its leadership in both healthcare and next-generation battery solutions.

- We’ll examine how the share buyback initiative strengthens Asahi Kasei’s investment narrative by signaling confidence in long-term value creation.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Asahi Kasei's Investment Narrative?

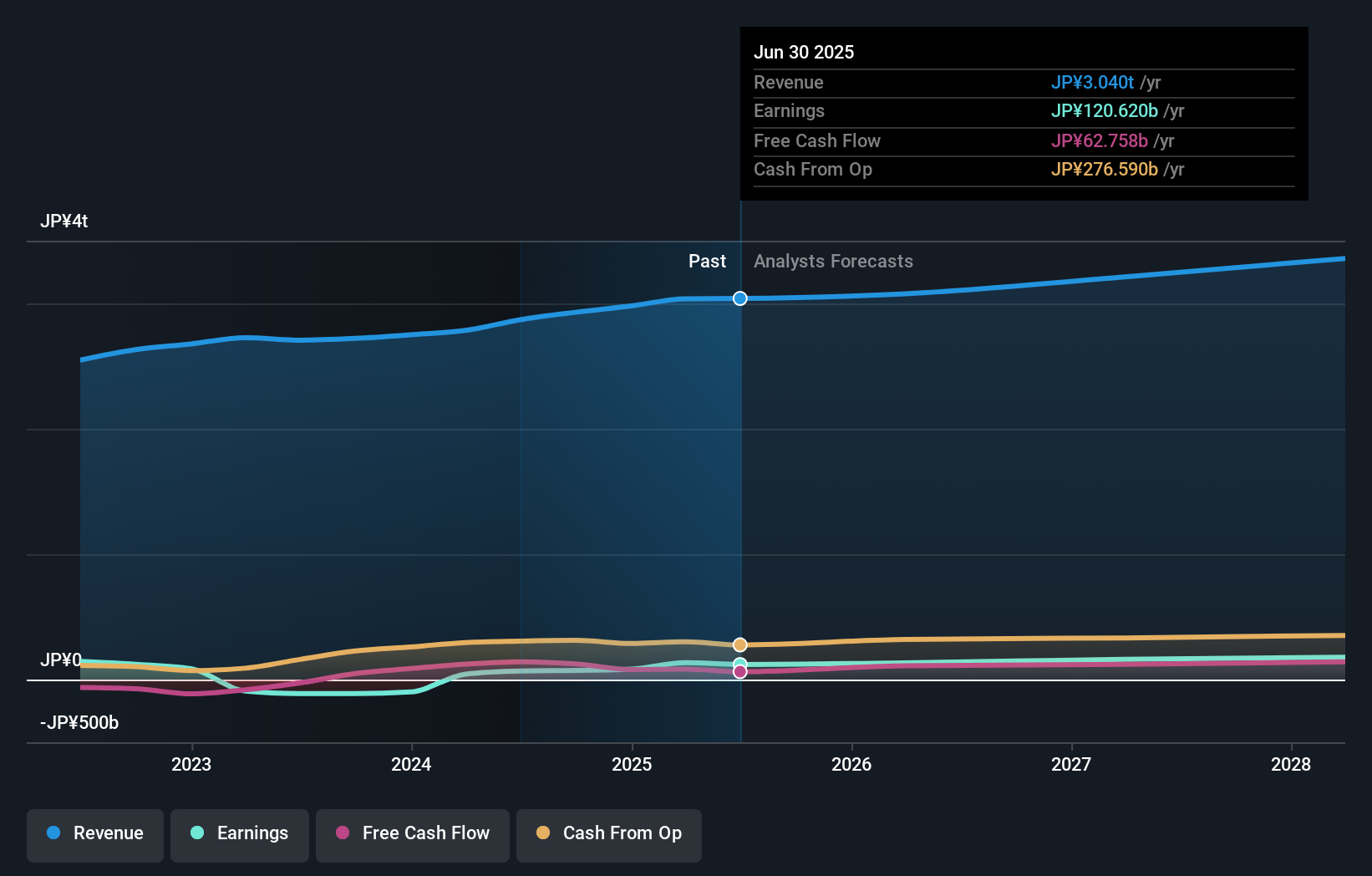

To see Asahi Kasei as an appealing investment today, it helps to believe in the company’s ability to combine steady shareholder returns with breakthroughs in healthcare and battery technology. The latest share buyback and increased dividend signal a push to enhance capital efficiency and boost investor confidence, strengthening near-term catalysts like capital allocation and returns. At the same time, the inclusion of Nefecon in global guidelines and the licensing of advanced battery electrolyte technology both highlight new drivers in Asahi Kasei’s pipeline, shifting some focus away from cyclical chemical operations toward faster-growing, higher-margin areas. While these events enhance the growth story, the current valuation already reflects much of the good news, and attention is likely to turn back to key risks, such as execution on new technology launches and slower revenue growth forecasts versus peers. Short-term upside may be capped if progress on commercialization or global market expansion stalls, and monitoring these execution risks is crucial going forward. On the other hand, execution risk around new technology commercialization is something investors need to factor in.

Asahi Kasei's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Asahi Kasei - why the stock might be worth over 2x more than the current price!

Build Your Own Asahi Kasei Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asahi Kasei research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Asahi Kasei research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asahi Kasei's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3407

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives