Market Still Lacking Some Conviction On Kuraray Co., Ltd. (TSE:3405)

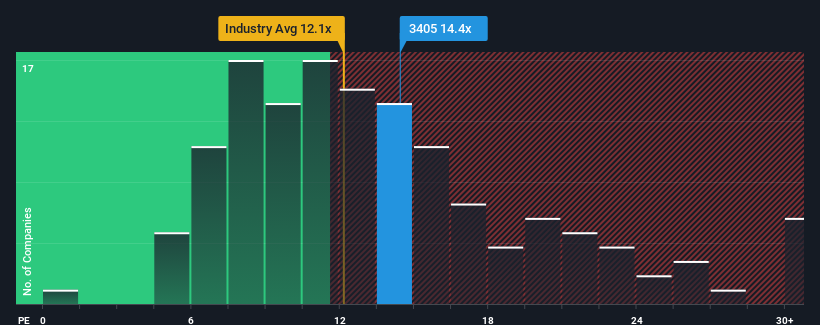

There wouldn't be many who think Kuraray Co., Ltd.'s (TSE:3405) price-to-earnings (or "P/E") ratio of 14.4x is worth a mention when the median P/E in Japan is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Kuraray as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Kuraray

Is There Some Growth For Kuraray?

There's an inherent assumption that a company should be matching the market for P/E ratios like Kuraray's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 22%. The strong recent performance means it was also able to grow EPS by 248% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 15% per year during the coming three years according to the ten analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 10% per annum, which is noticeably less attractive.

With this information, we find it interesting that Kuraray is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Kuraray's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - Kuraray has 1 warning sign we think you should be aware of.

You might be able to find a better investment than Kuraray. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kuraray might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3405

Kuraray

Engages in the production and sale of resins, chemicals, fibers, activated carbon, and high-performance membranes and systems worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success