Does Dai-ichi Life Holdings' (TSE:8750) Buyback Pause Hint at a New Capital Allocation Philosophy?

Reviewed by Sasha Jovanovic

- In November 2025, Dai-ichi Life Holdings reported that it did not repurchase any of its shares in October, despite possessing a board-approved authorization to buy back up to 200 million shares by May 2026.

- This lack of buyback activity may reflect a cautious approach or shifting priorities by the company, which could alter how investors view its capital management strategy.

- We'll explore how this pause in share repurchases could influence Dai-ichi Life Holdings' investment narrative and shareholder expectations going forward.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dai-ichi Life Holdings Investment Narrative Recap

At its core, being a shareholder in Dai-ichi Life Holdings means believing in its ability to balance domestic headwinds, like a shrinking Japanese insurance market and rising expenses, with international expansion and resourceful capital management. The recent pause in its share buyback program is unlikely to significantly change the key catalysts or risks in the near term, as overseas business growth and operational efficiency initiatives remain the biggest influences on outlook. One recent announcement that connects to these themes is Dai-ichi Life’s completion of a major share buyback tranche at the end of September 2025, purchasing over 43 million shares. While the lack of buybacks in October may catch investors’ eyes, the broader context of earlier buyback activity and capital preservation goals still aligns with longer-term efficiency and earnings growth catalysts. Yet, in contrast to the narrative of steady international diversification and operational focus, investors should also be aware of...

Read the full narrative on Dai-ichi Life Holdings (it's free!)

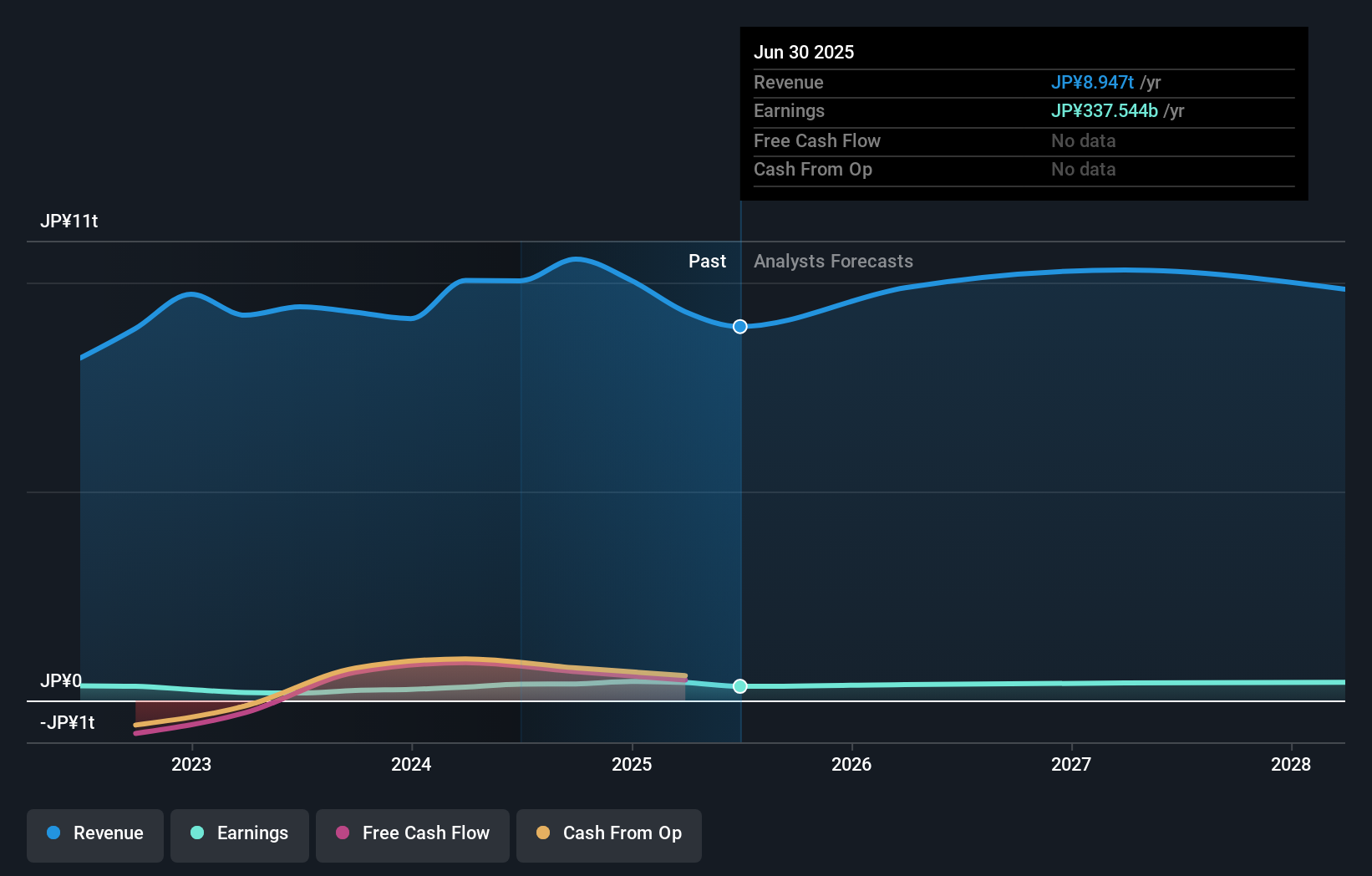

Dai-ichi Life Holdings is expected to reach revenues of ¥10,954.9 billion and earnings of ¥447.5 billion by 2028. This outlook is based on analysts forecasting a 7.0% annual revenue growth rate and an increase in earnings of ¥110.0 billion from the current ¥337.5 billion.

Uncover how Dai-ichi Life Holdings' forecasts yield a ¥1361 fair value, a 24% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted 1 independent fair value estimate for Dai-ichi Life Holdings, all at ¥2,425.45 per share, pointing to widespread agreement on undervaluation. Consider this alongside ongoing cost pressures and market expectations for efficiency gains as you explore multiple points of view on the company’s future.

Explore another fair value estimate on Dai-ichi Life Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Dai-ichi Life Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dai-ichi Life Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Dai-ichi Life Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dai-ichi Life Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8750

Dai-ichi Life Holdings

Through its subsidiaries, provides insurance products in Japan, the United States, and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives