MS&AD Insurance (TSE:8725) Valuation in Focus After Share Buyback, Dividend Boost, and Upgraded Earnings Guidance

Reviewed by Simply Wall St

MS&AD Insurance Group Holdings (TSE:8725) just unveiled a significant share repurchase program along with a higher dividend. The company also raised its earnings outlook, sending a clear message about its focus on rewarding shareholders.

See our latest analysis for MS&AD Insurance Group Holdings.

Momentum is starting to shift for MS&AD Insurance Group Holdings, supported by its sizeable share buyback, higher dividends, and a more optimistic earnings forecast. While the 1-year total shareholder return of 1.6% has been modest, the stock’s impressive 182% total return over three years highlights how rewarding its long-term journey has been for patient investors.

If you’re keen to discover what else is capturing investor attention, this could be the perfect moment to explore fast growing stocks with high insider ownership.

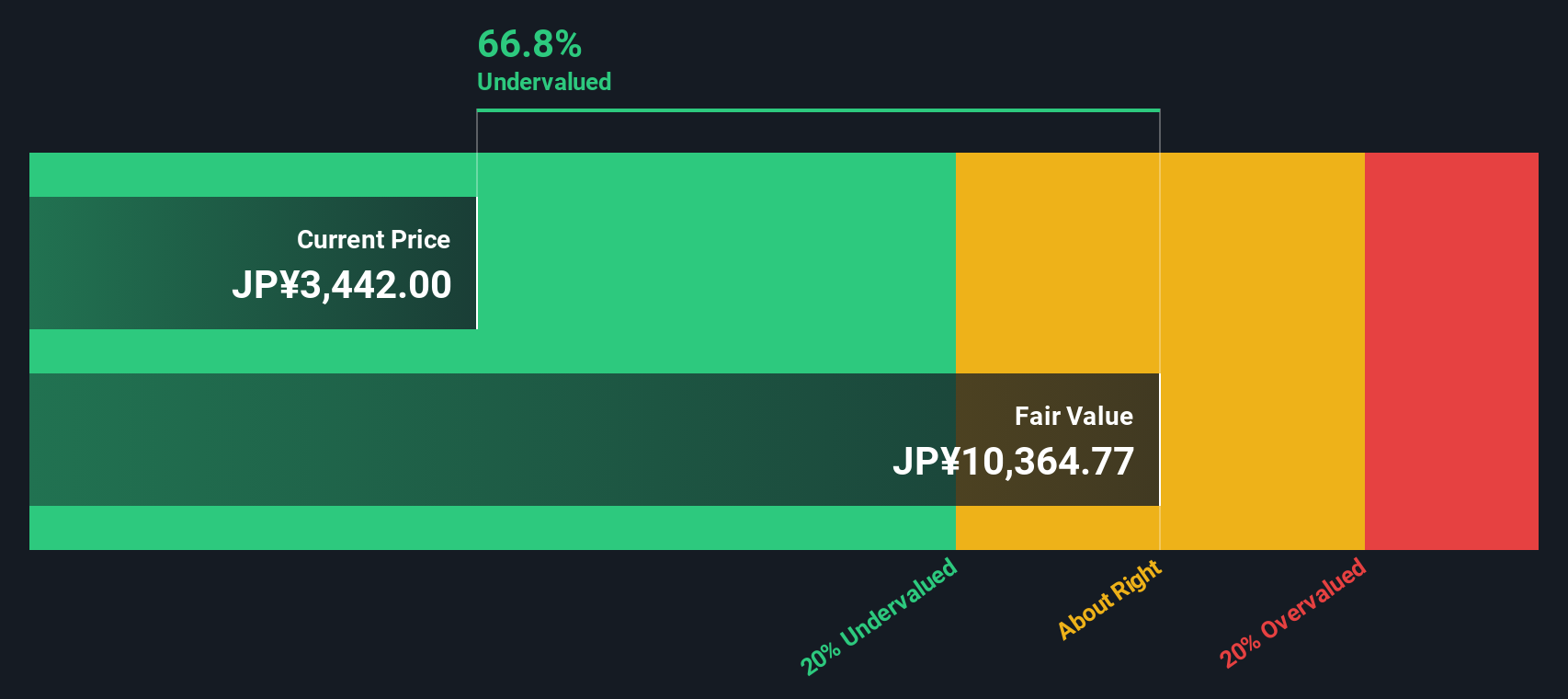

With shares still trading at a notable discount to analyst price targets despite improved earnings guidance, investors must now weigh whether MS&AD remains undervalued or if future growth is already reflected in the current price.

Price-to-Earnings of 7.1x: Is it justified?

MS&AD Insurance Group Holdings is trading at a price-to-earnings (P/E) ratio of 7.1x, noticeably below both the industry average and its own estimated fair P/E ratio. With the last close at ¥3,434, this suggests the market is discounting the company’s earnings potential compared to peers.

The P/E ratio shows how much investors are willing to pay for each yen of earnings. For an insurance company, this is a critical measure of sentiment toward its future profits and stability.

Currently, MS&AD’s P/E stands much lower than the Asian insurance industry average of 10.8x and is also well below the estimated fair value P/E of 11.2x. This disparity indicates the stock is likely undervalued, and the market might be underappreciating its earnings profile. If sentiment or expectations shift, there is meaningful room for the multiple to climb closer to its fair value benchmark.

Explore the SWS fair ratio for MS&AD Insurance Group Holdings

Result: Price-to-Earnings of 7.1x (UNDERVALUED)

However, slower net income growth and recent share price volatility could challenge the optimistic outlook and may affect how investors value the company going forward.

Find out about the key risks to this MS&AD Insurance Group Holdings narrative.

Another View: SWS DCF Model Signals Deep Undervaluation

Looking from a different angle, our SWS DCF model values MS&AD at ¥9,977 per share, which is significantly above the current price of ¥3,434. This method calculates what the company might be worth based on future cash flows rather than just earnings multiples. Could the market be overlooking long-term value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MS&AD Insurance Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MS&AD Insurance Group Holdings Narrative

If you see things differently or enjoy digging into the details yourself, it's easy to shape your own view in just a few minutes. Do it your way.

A great starting point for your MS&AD Insurance Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for yesterday’s winners alone. Use these powerful screeners to target fresh opportunities and get ahead of the crowd before the rest catch up.

- Unlock the potential for stable passive income by checking out these 16 dividend stocks with yields > 3%, which offers reliable yields above 3%.

- Spot disruptive tech trends early and jump into these 26 AI penny stocks, fueling the next wave of AI innovation.

- Capitalize on tomorrow’s breakthroughs by getting into these 26 quantum computing stocks, at the forefront of quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8725

MS&AD Insurance Group Holdings

An insurance holding company, engages in the provision of insurance and financial services worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success