- China

- /

- Electronic Equipment and Components

- /

- SHSE:603328

Three Promising Small Cap Stocks with Strong Fundamentals

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks, driven by optimism surrounding potential economic policies following the recent election, small-cap indices like the Russell 2000 have surged as investors anticipate favorable conditions for growth-oriented companies. Amidst this backdrop, identifying small-cap stocks with strong fundamentals becomes crucial, as these companies often possess unique attributes that can thrive in dynamic market environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Lion Capital | NA | 21.26% | 24.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Limak Dogu Anadolu Cimento Sanayi ve Ticaret Anonim Sirketi (IBSE:LMKDC)

Simply Wall St Value Rating: ★★★★★★

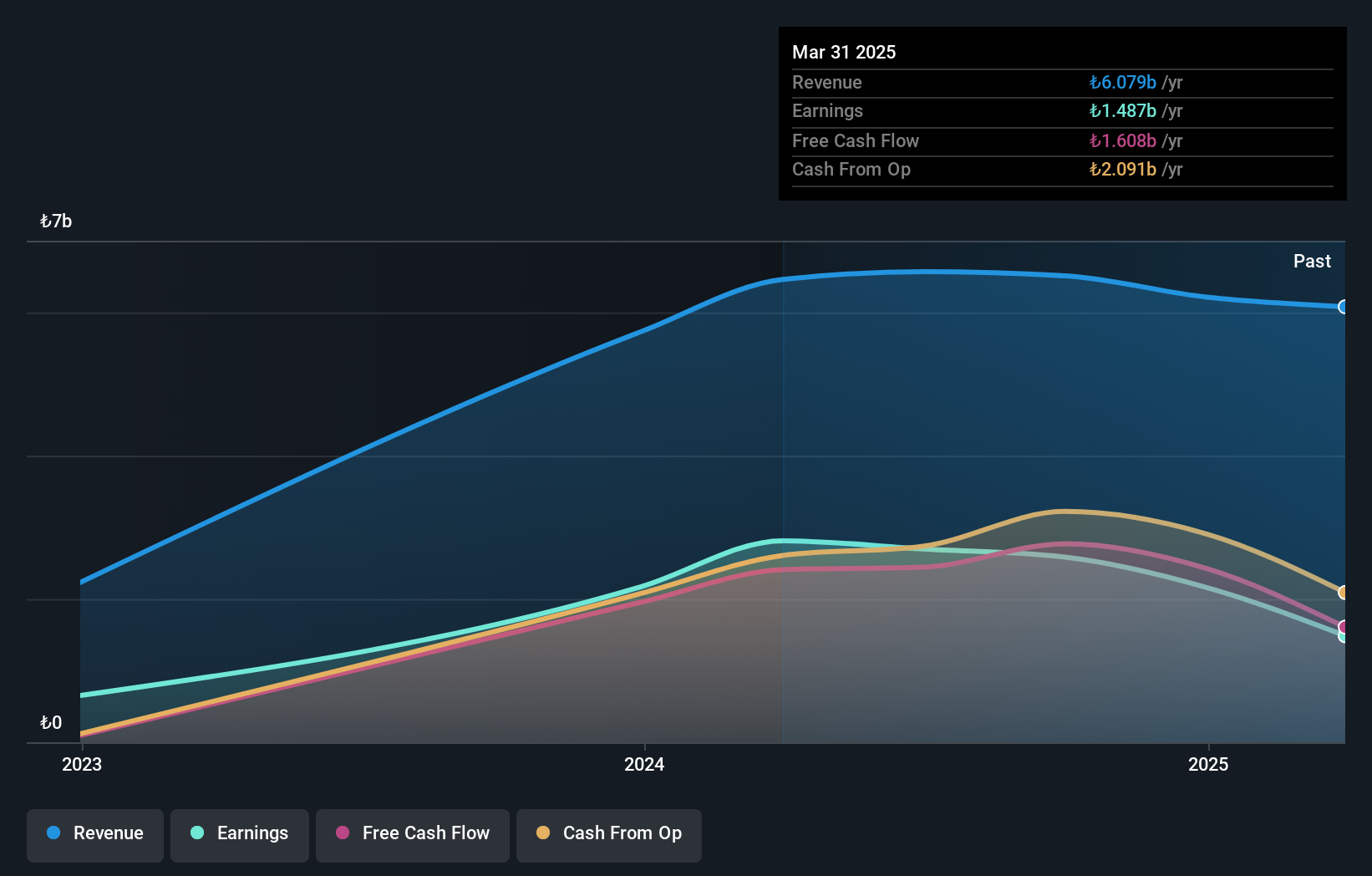

Overview: Limak Dogu Anadolu Cimento Sanayi ve Ticaret Anonim Sirketi is engaged in the production and sale of cement across Turkey, Ivory Coast, and Mozambique, with a market capitalization of TRY13.16 billion.

Operations: Limak Dogu Anadolu Cimento generates revenue primarily from its cement sales, amounting to TRY3.21 billion. The company's financial performance is reflected in its gross profit margin, which shows significant variation across different periods.

Limak Dogu Anadolu Cimento, a small player in the cement industry, has shown impressive financial health with earnings growth of 61% over the past year, surpassing the Basic Materials industry's 24.5%. Trading at 52% below its estimated fair value suggests potential for value investors. The company is debt-free for five years and boasts high-quality earnings, which likely contributes to its robust performance. Its recent addition to the S&P Global BMI Index on September 23 highlights growing recognition in broader markets. With positive free cash flow reaching US$1.18 billion by mid-2024, Limak seems well-positioned for future opportunities.

Guangdong Ellington Electronics TechnologyLtd (SHSE:603328)

Simply Wall St Value Rating: ★★★★★☆

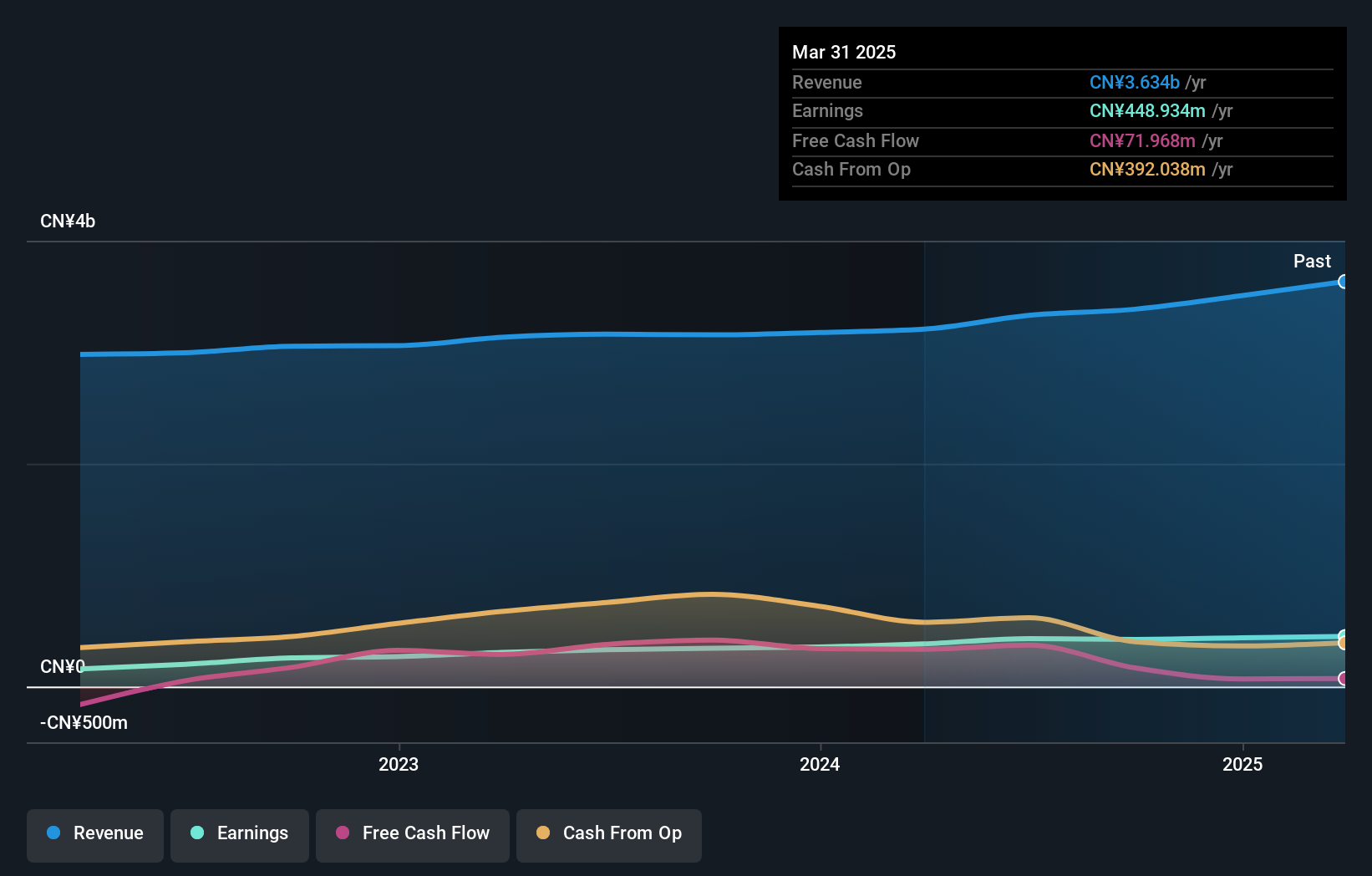

Overview: Guangdong Ellington Electronics Technology Co., Ltd specializes in the production and sale of high-precision, high-density double-layer and multi-layer printed circuit boards within China, with a market capitalization of approximately CN¥9.98 billion.

Operations: Ellington Electronics generates revenue primarily from the printed circuit board industry, totaling approximately CN¥3.39 billion. The company's financial performance can be gauged by its market capitalization of about CN¥9.98 billion.

Ellington Electronics, a player in the electronics sector, has shown promising financial performance despite its smaller market presence. Over the past year, earnings surged by 23.2%, outpacing the industry average of 1.7%. The company reported net income of CNY 366 million for the nine months ending September 2024, up from CNY 299 million in the same period last year. Its price-to-earnings ratio stands at a favorable 23.6x compared to the broader CN market's 37.3x, suggesting potential value for investors seeking growth opportunities within this niche segment of electronics manufacturing.

Lifenet Insurance (TSE:7157)

Simply Wall St Value Rating: ★★★★★☆

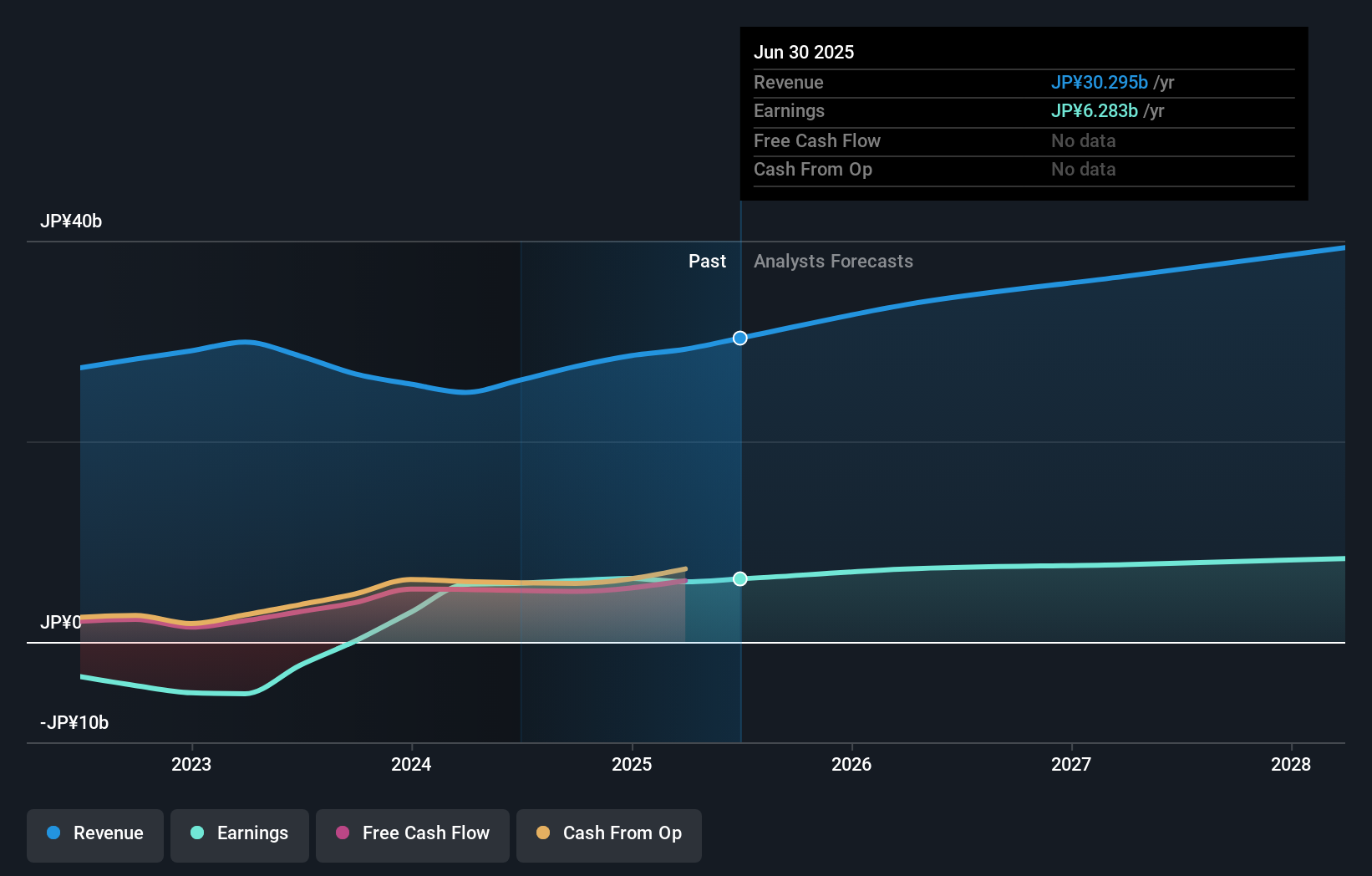

Overview: Lifenet Insurance Company offers life insurance products and services across Japan, North America, and internationally, with a market cap of ¥160.88 billion.

Operations: Lifenet Insurance generates revenue primarily through the sale of life insurance products. The company's net profit margin has shown variability, reflecting changes in its cost structure and market conditions.

Lifenet Insurance, a dynamic player in the insurance sector, recently turned profitable and is now outpacing industry growth rates. With no debt on its books for five years, it boasts high-quality earnings and strong financial health. The company has been free cash flow positive with figures reaching ¥5.28 billion as of December 2023. In September 2024, Lifenet announced new term medical products launching in October that offer flexible coverage periods and lower initial premiums than their whole-life counterparts. Earnings are forecasted to grow by 7.89% annually, indicating promising potential for future expansion in the market.

- Click here and access our complete health analysis report to understand the dynamics of Lifenet Insurance.

Understand Lifenet Insurance's track record by examining our Past report.

Key Takeaways

- Embark on your investment journey to our 4676 Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603328

Guangdong Ellington Electronics TechnologyLtd

Manufactures and sells high-precision, high-density double-layer, and multi-layer printed circuit boards in China.

Excellent balance sheet with proven track record.