- Japan

- /

- Healthcare Services

- /

- TSE:9987

Suzuken (TSE:9987): Assessing Valuation Following Q2 Results and New Earnings Guidance

Reviewed by Simply Wall St

Suzuken (TSE:9987) grabbed attention after releasing its second quarter earnings along with fresh guidance for fiscal year 2026. The company also reaffirmed its dividend payout, giving investors plenty to consider as they assess the stock’s prospects.

See our latest analysis for Suzuken.

Following the announcement of its Q2 results and fresh full-year guidance, Suzuken’s share price has shown noticeable upward momentum this year, with a 22.3% year-to-date share price return. The company’s 19.2% total shareholder return over the past twelve months also points to sustained investor confidence. This suggests momentum is still on Suzuken’s side as the market weighs its updated outlook.

If Suzuken’s recent moves have you thinking bigger, now’s a good moment to broaden your perspective and discover See the full list for free.

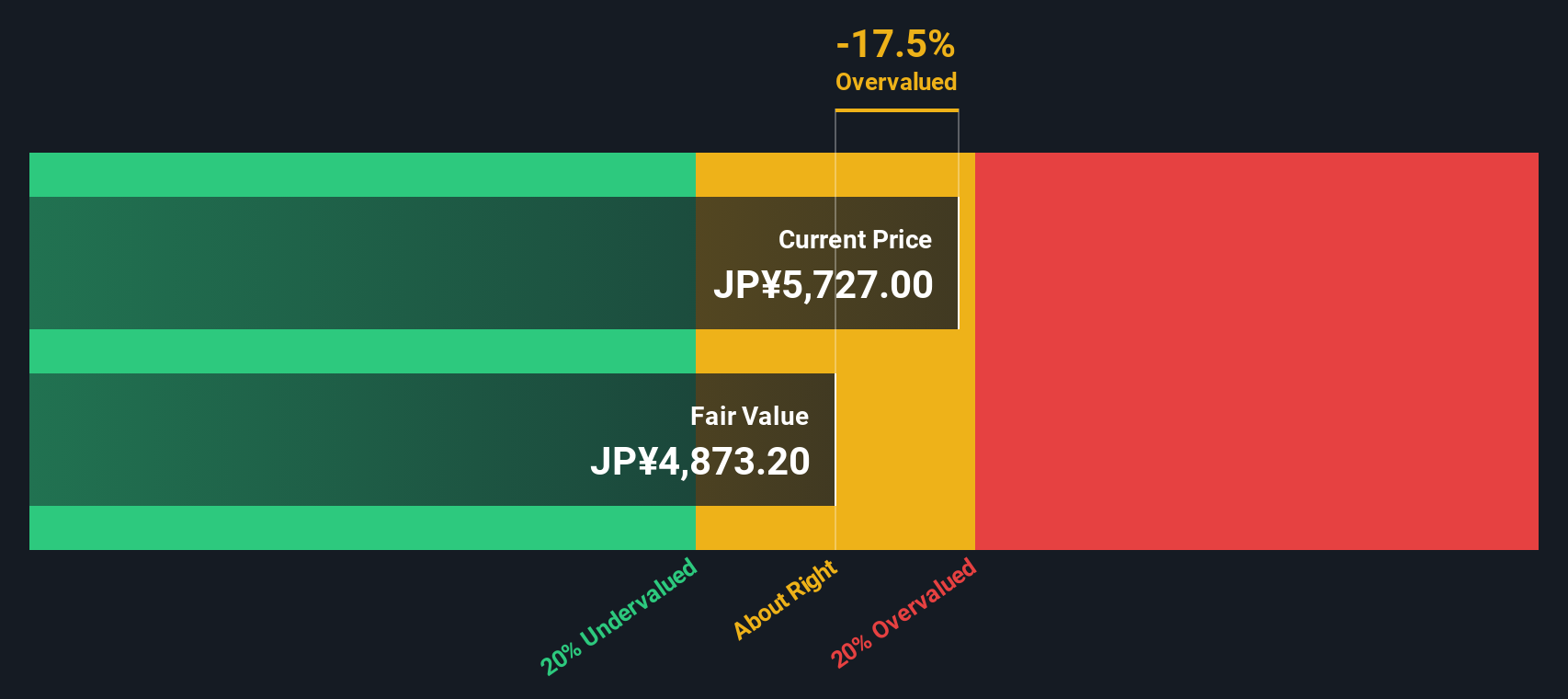

With Suzuken’s shares rallying and fresh forecasts on the table, the key question is whether the stock is still trading below its intrinsic value or if the market has already priced in the company’s growth story.

Price-to-Earnings of 13.2x: Is it justified?

Suzuken's shares are trading at a price-to-earnings (P/E) ratio of 13.2x, which is below both its peer group and industry averages. This suggests the market currently sees the stock as undervalued relative to its earnings power.

The price-to-earnings ratio is a widely used benchmark that helps investors weigh Suzuken's market valuation against its actual profits. In the healthcare sector, P/E is especially useful because it can reflect both growth prospects and earnings stability.

This relatively lower P/E means the market may be underestimating Suzuken’s future earnings potential, especially given its strong five-year profit growth record. Compared to its peers, with an average P/E of 15.2x, and the broader Japanese healthcare industry, at 15.5x, Suzuken stands out for its value. Additionally, the company’s P/E is well below its estimated fair price-to-earnings ratio of 19.4x. This indicates there is considerable room for market reassessment as fundamentals evolve.

Explore the SWS fair ratio for Suzuken

Result: Price-to-Earnings of 13.2x (UNDERVALUED)

However, slower revenue and net income growth compared to prior years could dampen sentiment if Suzuken fails to reaccelerate performance in coming quarters.

Find out about the key risks to this Suzuken narrative.

Another Angle: SWS DCF Model Sees More Upside

Looking at the situation from another perspective, the SWS DCF model indicates Suzuken may be even more attractively priced than what the multiples suggest. With shares trading more than 50% below the estimated fair value, the DCF approach highlights considerable undervaluation. Is the market overlooking important factors, or is a cautious approach justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Suzuken for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Suzuken Narrative

If you prefer hands-on analysis or want to craft your perspective, you can build your personalized Suzuken narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Suzuken.

Looking for more investment ideas?

Smart investors never stop searching for fresh opportunities. Take action now and unlock hidden gems with these tailored stock lists to skip the waiting and seize your next smart move.

- Secure consistent returns by checking out these 15 dividend stocks with yields > 3%, which features companies with robust yields and strong fundamentals for long-term income growth.

- Capitalize on the AI wave by reviewing these 26 AI penny stocks, highlighting companies that are transforming industries and presenting exciting prospects for high-growth exposure.

- Get ahead of the curve by evaluating these 917 undervalued stocks based on cash flows, where the market may be missing opportunities with promising businesses trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9987

Suzuken

Primarily engages in the distribution of pharmaceuticals in Japan and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives