- Japan

- /

- Healthcare Services

- /

- TSE:9229

Slammed 26% Sunwels Co.,Ltd. (TSE:9229) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Sunwels Co.,Ltd. (TSE:9229) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 55% loss during that time.

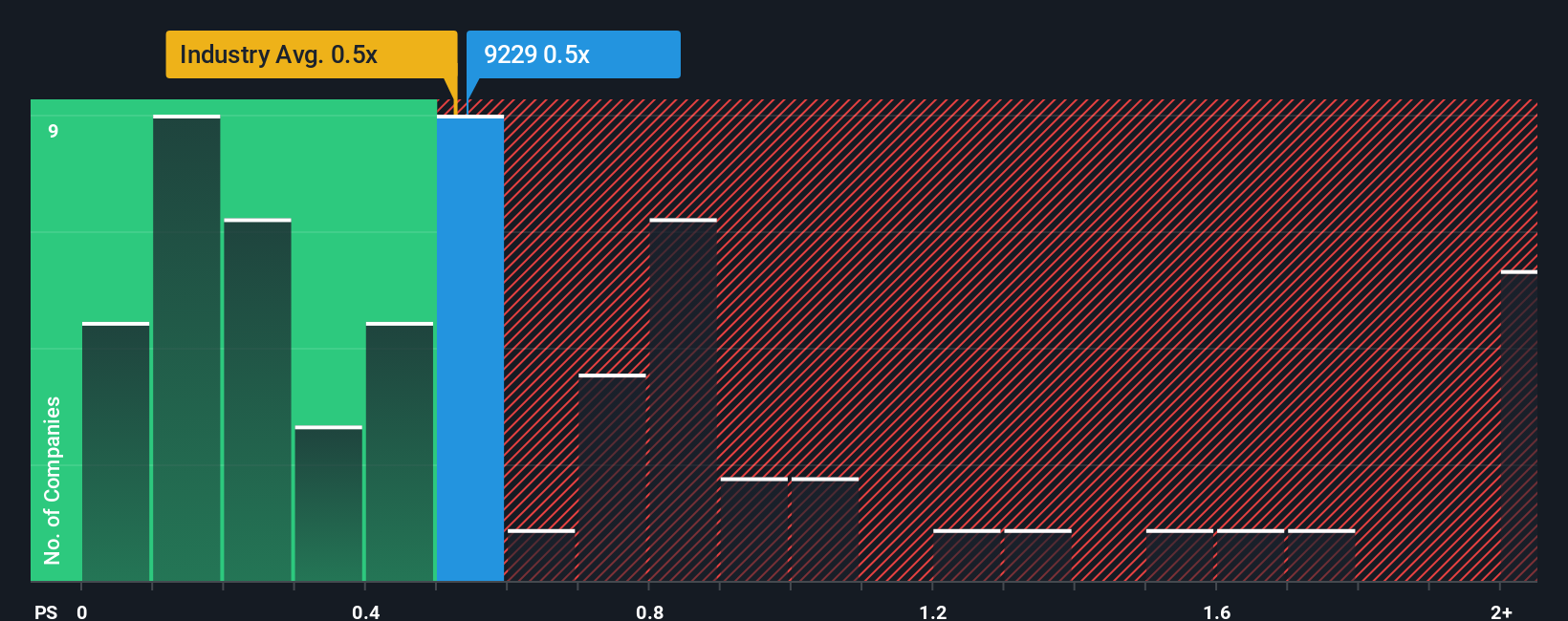

Although its price has dipped substantially, there still wouldn't be many who think SunwelsLtd's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when it essentially matches the median P/S in Japan's Healthcare industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for SunwelsLtd

What Does SunwelsLtd's P/S Mean For Shareholders?

Recent times have been advantageous for SunwelsLtd as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SunwelsLtd.What Are Revenue Growth Metrics Telling Us About The P/S?

SunwelsLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The latest three year period has also seen an excellent 131% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 18% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 4.4%, which is noticeably less attractive.

With this in consideration, we find it intriguing that SunwelsLtd's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

SunwelsLtd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at SunwelsLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware SunwelsLtd is showing 2 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9229

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives