- Japan

- /

- Healthcare Services

- /

- TSE:8129

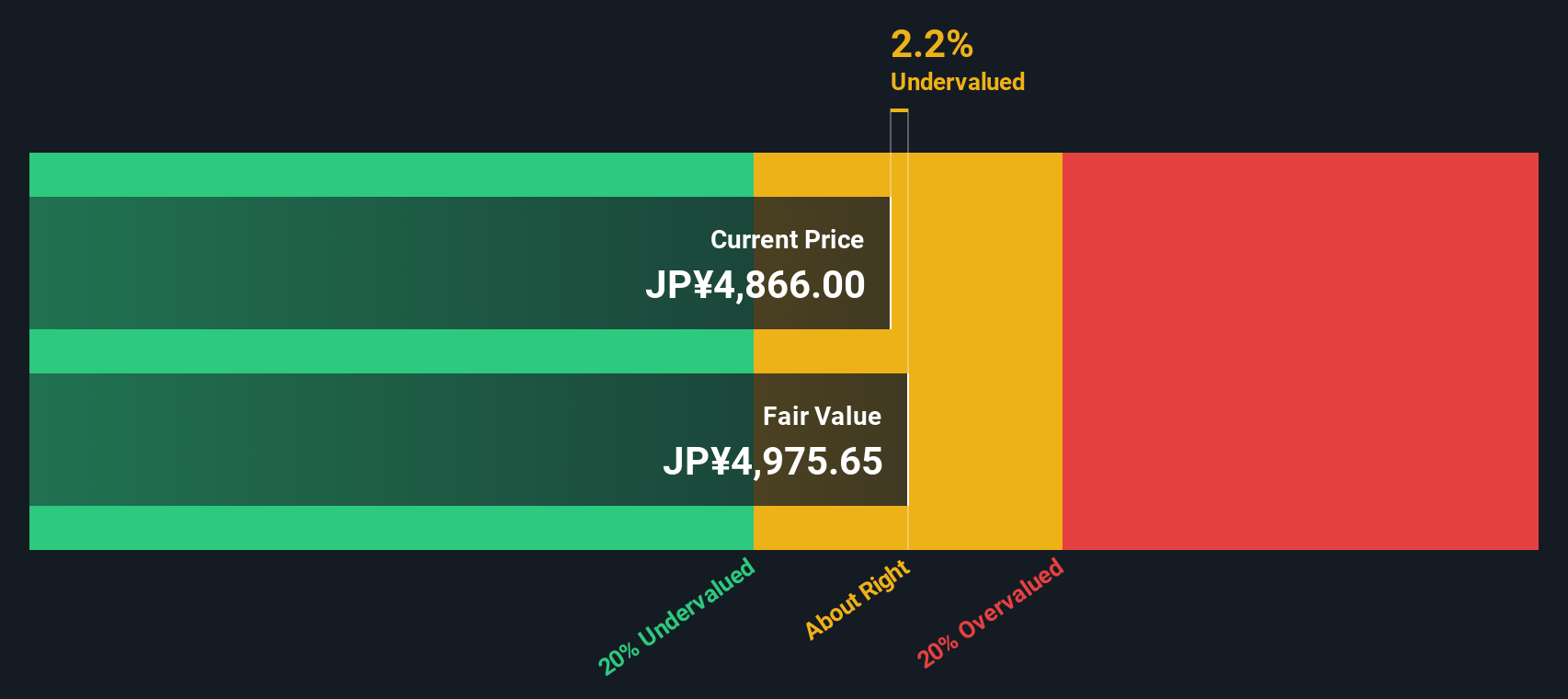

A Fresh Look at Toho Holdings (TSE:8129) Valuation Following Share Buyback and Dividend Hike

Reviewed by Simply Wall St

Toho Holdings (TSE:8129) just wrapped up a sizable share buyback and raised its interim dividend. These moves signal management’s confidence and a clear focus on rewarding shareholders. These steps likely caught the market’s attention.

See our latest analysis for Toho Holdings.

Toho Holdings’ recent string of shareholder-focused actions, including the buyback and a hefty interim dividend hike, gave its share price a clear vote of confidence and the stock ended the day up 2.22%. While the stock faced some short-term volatility, its one-year total shareholder return of 7.55% is solid. Momentum remains strong over the longer term with a 121.9% total return over three years.

If this renewed shareholder focus has you considering other opportunities, it might be the perfect time to broaden your watchlist and see what’s out there with See the full list for free.

But with so much positive news in the price already, is Toho Holdings now trading at a bargain, or have recent gains fully reflected its future growth prospects? Is there still a buying opportunity for investors?

Price-to-Earnings of 14.6x: Is it justified?

Toho Holdings currently trades on a price-to-earnings (P/E) ratio of 14.6x, which is below both peers and sector averages, as well as its estimated fair value. With a last close price of ¥4,652, this suggests the market sees relative value in the shares compared to similar healthcare companies in Japan.

The price-to-earnings ratio compares a company's share price to its per-share earnings and is a common measure for evaluating whether a stock is cheap or expensive. For healthcare distributors like Toho Holdings, the P/E can help investors gauge whether earnings growth prospects and profitability are properly reflected by the market.

In Toho Holdings' case, the P/E of 14.6x is below both the peer average of 16.5x and the healthcare industry average of 15.3x. More notably, it is also trading under our fair P/E estimate of 18.3x. This suggests price could move higher if market sentiment turns more optimistic or if earnings expectations improve further.

Explore the SWS fair ratio for Toho Holdings

Result: Price-to-Earnings of 14.6x (UNDERVALUED)

However, slower revenue and net income growth compared to sector peers could temper expectations, potentially limiting further upside despite the recent valuation discount.

Find out about the key risks to this Toho Holdings narrative.

Another View: Discounted Cash Flow Perspective

Looking at Toho Holdings from the perspective of our SWS DCF model presents a strikingly different story. The shares are trading a significant 45% below our estimate of fair value, suggesting deeper undervaluation than the multiples indicate. Does this reflect a genuine bargain, or are some risks being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toho Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toho Holdings Narrative

If you think there’s another angle or want to see the numbers firsthand, you can quickly build your own view in just a few minutes with Do it your way.

A great starting point for your Toho Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve by broadening your investment horizons with handpicked stocks built for tomorrow's markets. Your next big opportunity could be just one click away.

- Take the opportunity to profit from emerging digital economies when you analyze these 81 cryptocurrency and blockchain stocks, featuring businesses reshaping the world of decentralized finance.

- Explore sustainable income streams by reviewing these 17 dividend stocks with yields > 3% and find companies offering yields above 3% for steady returns.

- Boost your portfolio growth by tapping into these 25 AI penny stocks and get ahead with firms at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toho Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8129

Toho Holdings

Engages in the wholesale distribution of pharmaceutical products in Japan.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives