- Japan

- /

- Medical Equipment

- /

- TSE:8086

Should Nipro's (TSE:8086) Lower Dividend Prompt a Rethink of Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- Nipro Corporation has announced a second-quarter dividend of ¥10.00 per share for the fiscal year ending March 31, 2026, compared to ¥12.00 per share paid a year earlier, with payments scheduled to begin December 10, 2025.

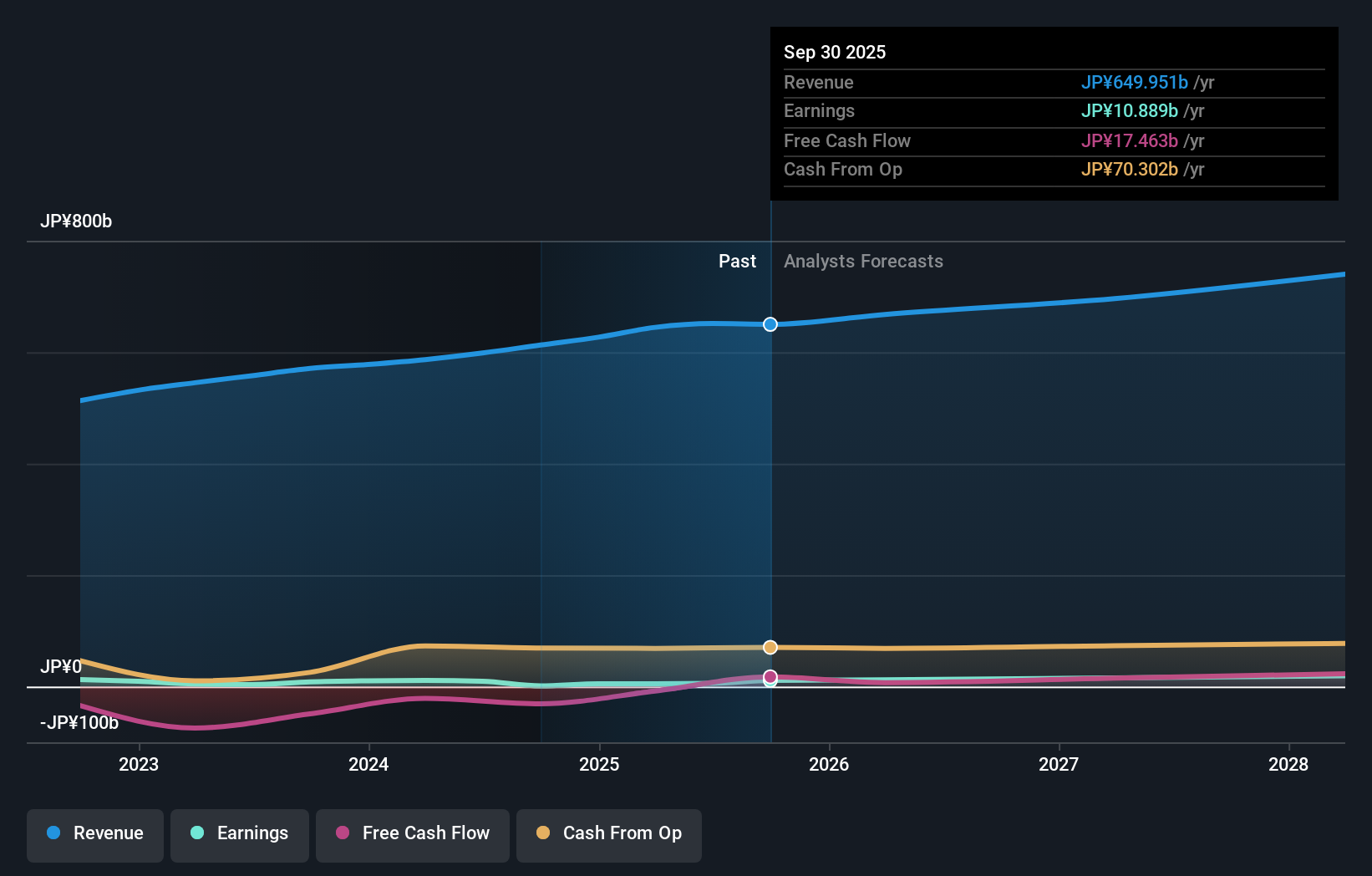

- This reduction in the interim dividend signals a shift in how management is approaching capital allocation and could reflect changing expectations for future cash flows.

- We'll explore how this dividend decrease could influence Nipro's investment narrative and perceptions of management's outlook on earnings.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Nipro's Investment Narrative?

To really believe in Nipro as a shareholder, you need confidence in the company’s ability to deliver on its growth potential in medical devices and pharmaceuticals, all while balancing profitability and capital management. The recent cut in the second-quarter dividend, trimming payouts from ¥12.00 to ¥10.00 per share, is a sign that management is shifting priorities, possibly shoring up resources for reinvestment or addressing near-term cash flow pressures. Short-term catalysts, such as promising biosimilar partnerships and significant projected earnings growth, may still drive interest, though dividend reductions have the potential to temper some enthusiasm around management’s confidence in steady cash flow generation. For now, the impact of this news does not seem to fundamentally alter the bigger drivers behind Nipro's prospects, given that share price moves have been modest and core business expectations remain unchanged. However, it does highlight a growing sensitivity to cash flow risks in the current environment. Yet, with recent dividend instability, more changes to payout policy may be on the horizon for investors to watch.

Despite retreating, Nipro's shares might still be trading 30% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Nipro - why the stock might be worth just ¥1448!

Build Your Own Nipro Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nipro research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nipro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nipro's overall financial health at a glance.

No Opportunity In Nipro?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nipro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8086

Nipro

Engages in the medical devices, pharmaceuticals, and pharma packaging businesses.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives