- Japan

- /

- Medical Equipment

- /

- TSE:7807

Kowa Co.,Ltd. (TSE:7807) Stock's 37% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Kowa Co.,Ltd. (TSE:7807) share price has fared very poorly over the last month, falling by a substantial 37%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 13% share price drop.

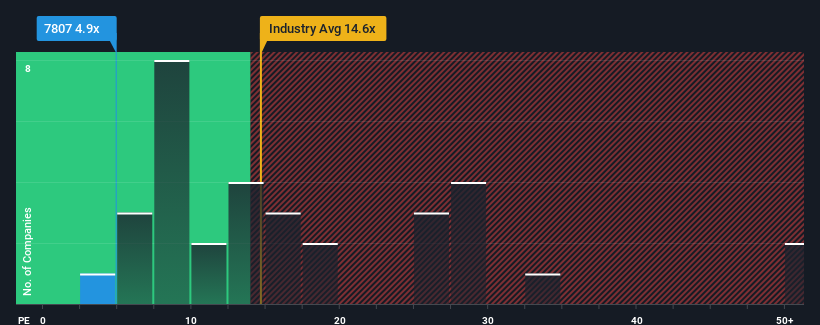

Following the heavy fall in price, KowaLtd's price-to-earnings (or "P/E") ratio of 4.9x might make it look like a strong buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 21x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for KowaLtd as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for KowaLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like KowaLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 57%. The strong recent performance means it was also able to grow EPS by 46% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that KowaLtd's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From KowaLtd's P/E?

Having almost fallen off a cliff, KowaLtd's share price has pulled its P/E way down as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that KowaLtd currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for KowaLtd you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if KowaLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7807

KowaLtd

Manufactures and sells nursing care products and welfare equipment under the Tacaof, AURULA, and GENTIL MARRONE brands in Japan.

Flawless balance sheet and good value.

Market Insights

Community Narratives