Stock Analysis

- Japan

- /

- Professional Services

- /

- TSE:2146

Insider-Owned Growth Giants On The Japanese Exchange May 2024

Reviewed by Simply Wall St

Despite recent economic contractions and a challenging backdrop, Japanese equities have shown resilience, with indices like the Nikkei 225 and TOPIX registering gains. This environment underscores the potential stability offered by growth companies with high insider ownership, which may be particularly appealing given current market conditions where informed leadership could navigate through economic uncertainties more effectively.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 27.2% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 35.4% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 80.2% |

| Money Forward (TSE:3994) | 21.4% | 63.5% |

| Medley (TSE:4480) | 34% | 24.8% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 59.1% |

| freee K.K (TSE:4478) | 24% | 82.7% |

Let's review some notable picks from our screened stocks.

UT GroupLtd (TSE:2146)

Simply Wall St Growth Rating: ★★★★★☆

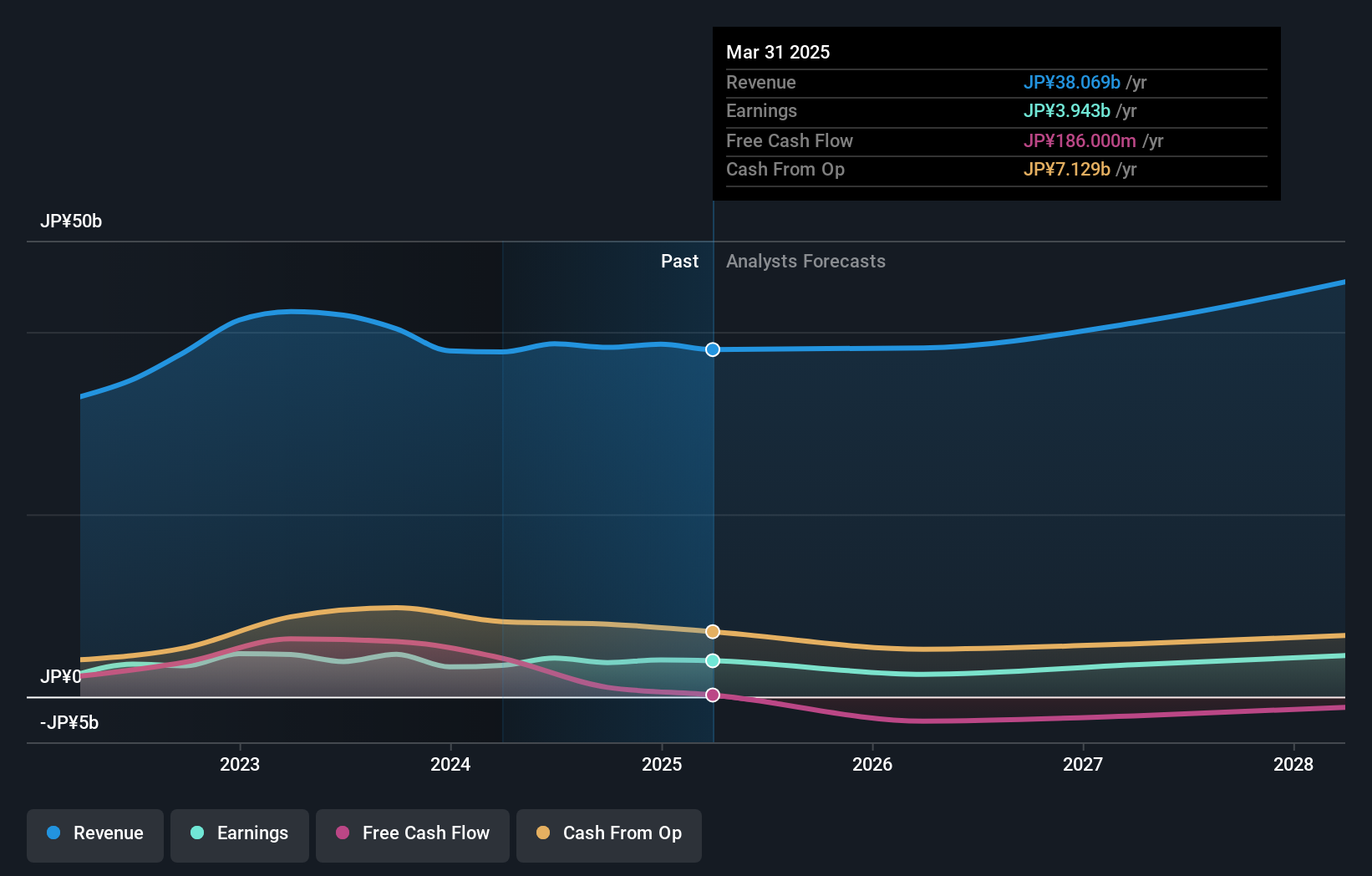

Overview: UT Group Co., Ltd. operates in Japan, focusing on the dispatch and outsourcing of permanent employees across various sectors including manufacturing and construction, with a market capitalization of approximately ¥125.65 billion.

Operations: The company generates its revenue primarily through the dispatch and outsourcing of permanent employees in sectors such as manufacturing, design and development, and construction.

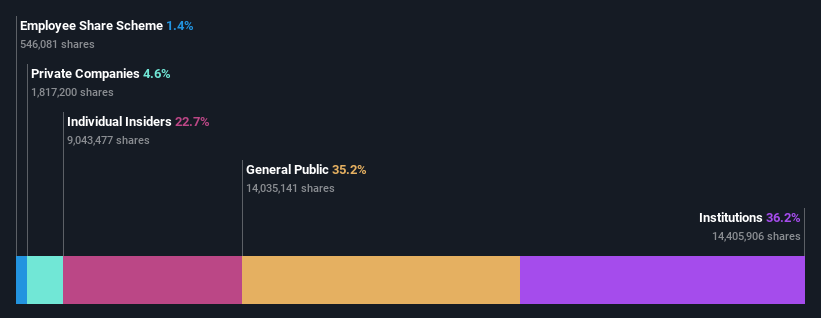

Insider Ownership: 22.8%

Earnings Growth Forecast: 33.1% p.a.

UT Group Co., Ltd. has demonstrated strong financial performance with earnings growth of 66% over the past year and is expected to continue at a rate of 33.1% annually, outpacing the Japanese market average. The company recently increased its dividend payout to JPY 3,817 million, effective June 2024, although this dividend is not well covered by cash flows. Despite trading below fair value estimates, concerns about dividend sustainability persist alongside robust revenue projections and high forecasted return on equity. Leadership changes include Manabu Sotomura's appointment as President, promising strategic continuity and focus on growth sectors within the firm.

- Delve into the full analysis future growth report here for a deeper understanding of UT GroupLtd.

- Our valuation report here indicates UT GroupLtd may be undervalued.

Enplas (TSE:6961)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Enplas Corporation, with a market capitalization of ¥62.33 billion, engages in the manufacturing and sales of semiconductor and automobile parts, optical communication devices, and life science-related products both in Japan and globally.

Operations: The company generates revenue through the sale of semiconductor and automobile parts, optical communication devices, and life science-related products across domestic and international markets.

Insider Ownership: 24.1%

Earnings Growth Forecast: 24% p.a.

Enplas is poised for substantial growth with earnings expected to increase by 24% annually, outstripping the Japanese market's 8.5% forecast. Despite trading at a significant discount of 34.7% below its estimated fair value, the company faces challenges with a highly volatile share price and a forecasted low return on equity of 10.4%. Revenue growth projections also lag behind high-growth benchmarks, growing at only 9.6% per year. No recent insider trading activity has been reported, indicating stable insider confidence amidst these financial dynamics.

- Unlock comprehensive insights into our analysis of Enplas stock in this growth report.

- In light of our recent valuation report, it seems possible that Enplas is trading behind its estimated value.

CYBERDYNE (TSE:7779)

Simply Wall St Growth Rating: ★★★★★☆

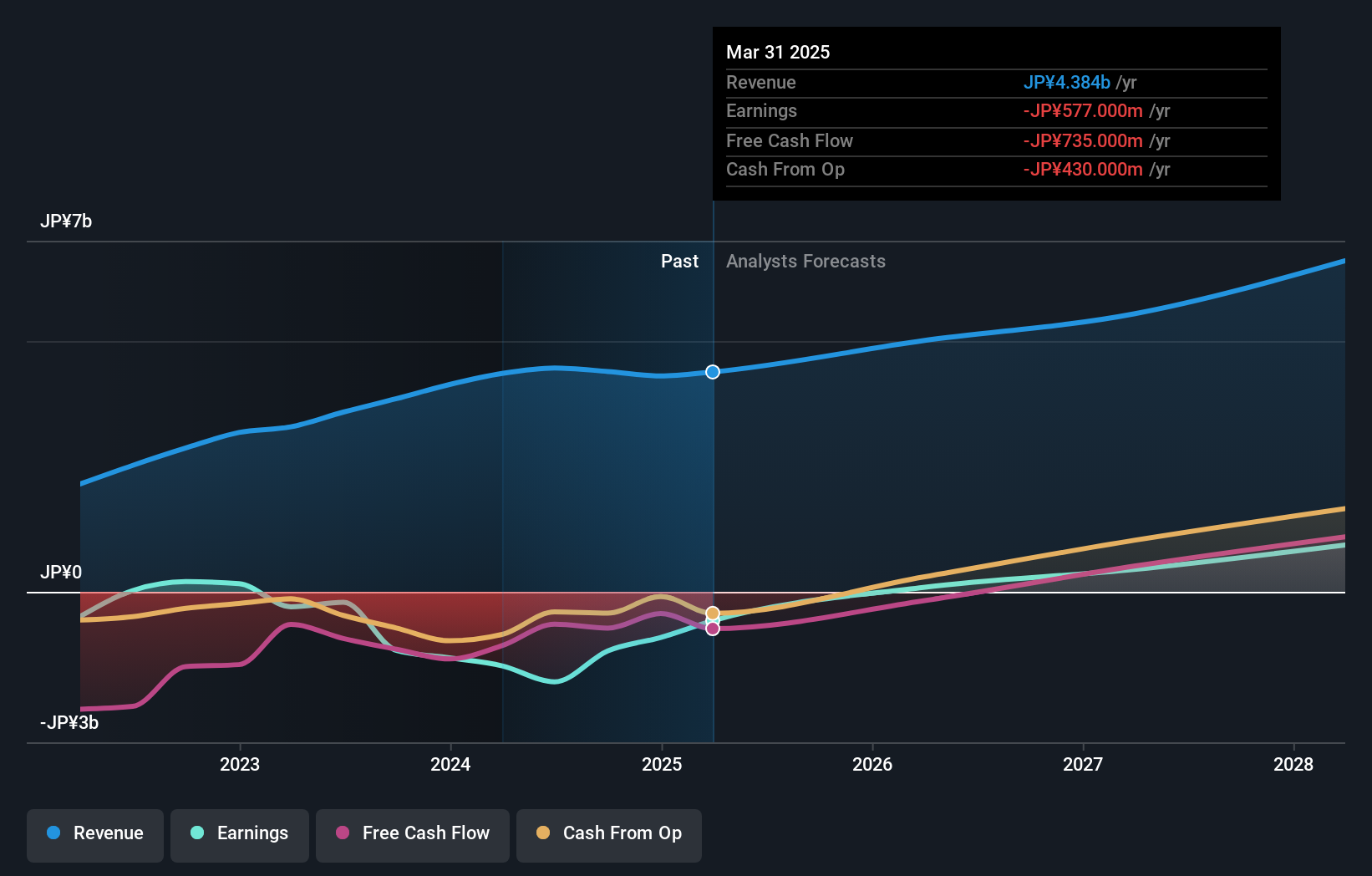

Overview: CYBERDYNE Inc. is a Japanese company engaged in the research, development, production, sale, leasing, and maintenance of medical and warfare equipment and systems, with a market capitalization of ¥40.54 billion.

Operations: The firm operates primarily in the medical and warfare equipment sectors.

Insider Ownership: 38.9%

Earnings Growth Forecast: 75.1% p.a.

CYBERDYNE Inc. is set to capitalize on recent U.S. FDA approvals, expanding the use of its Medical HAL device for additional medical conditions and smaller patient sizes, marking a significant advancement in its product offerings. With revenue expected to grow at 22.6% annually, outpacing the Japanese market's 3.9%, and profitability forecast within three years, CYBERDYNE shows promising growth potential despite trading at 57.3% below its estimated fair value and a projected low return on equity of 1.1%.

- Click to explore a detailed breakdown of our findings in CYBERDYNE's earnings growth report.

- The valuation report we've compiled suggests that CYBERDYNE's current price could be inflated.

Summing It All Up

- Dive into all 108 of the Fast Growing Japanese Companies With High Insider Ownership we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether UT GroupLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2146

UT GroupLtd

UT Group Co., Ltd. engages in the dispatch and outsourcing of permanent employees in the manufacturing, design and development, construction, and other sectors in Japan.

Flawless balance sheet with high growth potential and pays a dividend.