- Japan

- /

- Medical Equipment

- /

- TSE:7733

Olympus (TSE:7733) Undergoes Major Restructuring—A Fresh Look at Its Valuation and Growth Potential

Reviewed by Simply Wall St

Olympus (TSE:7733) has kicked off a wide-ranging restructuring, which includes laying off about 2,000 employees and implementing several leadership changes. This transformation is intended to boost innovation, streamline its structure, and improve efficiency.

See our latest analysis for Olympus.

Olympus’s sweeping restructuring and leadership shake-up arrived after a tough stretch for investors, with the stock’s share price down nearly 19% year-to-date and the total shareholder return falling almost 29% over the past year. While the recent buyback completion hints at management’s confidence, momentum has faded compared to previous years. This transformation marks a pivotal moment for the company’s long-term direction.

If you’re interested in what’s gaining traction across MedTech and healthcare, you can discover more potential opportunities through our See the full list for free.

With Olympus’s strategic overhaul and ongoing challenges reflected in its recent share price slide, investors are left to wonder: is the current valuation an attractive entry point or has the market already priced in tomorrow’s growth?

Most Popular Narrative: 4.1% Undervalued

Olympus’s most popular narrative suggests the fair value sits slightly above the current price, reflecting optimism about future efficiency gains and product expansion. The current close is ¥1,871.5, with the narrative fair value at ¥1,951.54.

The launch of OLYSENSE, a cloud-based integrated suite of endoscopic applications, along with new CAD/AI products in Europe and the U.S., is anticipated to enhance the product portfolio. This could lead to increased market share and sales, impacting revenue and earnings.

Want the full picture behind this premium? The real story is in the push for recurring revenues, expanding digital platforms, and a profit multiple higher than industry norms. See which pivotal assumptions about earnings and margins are fueling this bullish outlook. Discover what sets this valuation apart.

Result: Fair Value of ¥1,951.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in China and uncertainty in global healthcare budgets could quickly derail even the most optimistic growth story for Olympus.

Find out about the key risks to this Olympus narrative.

Another View: The SWS DCF Model

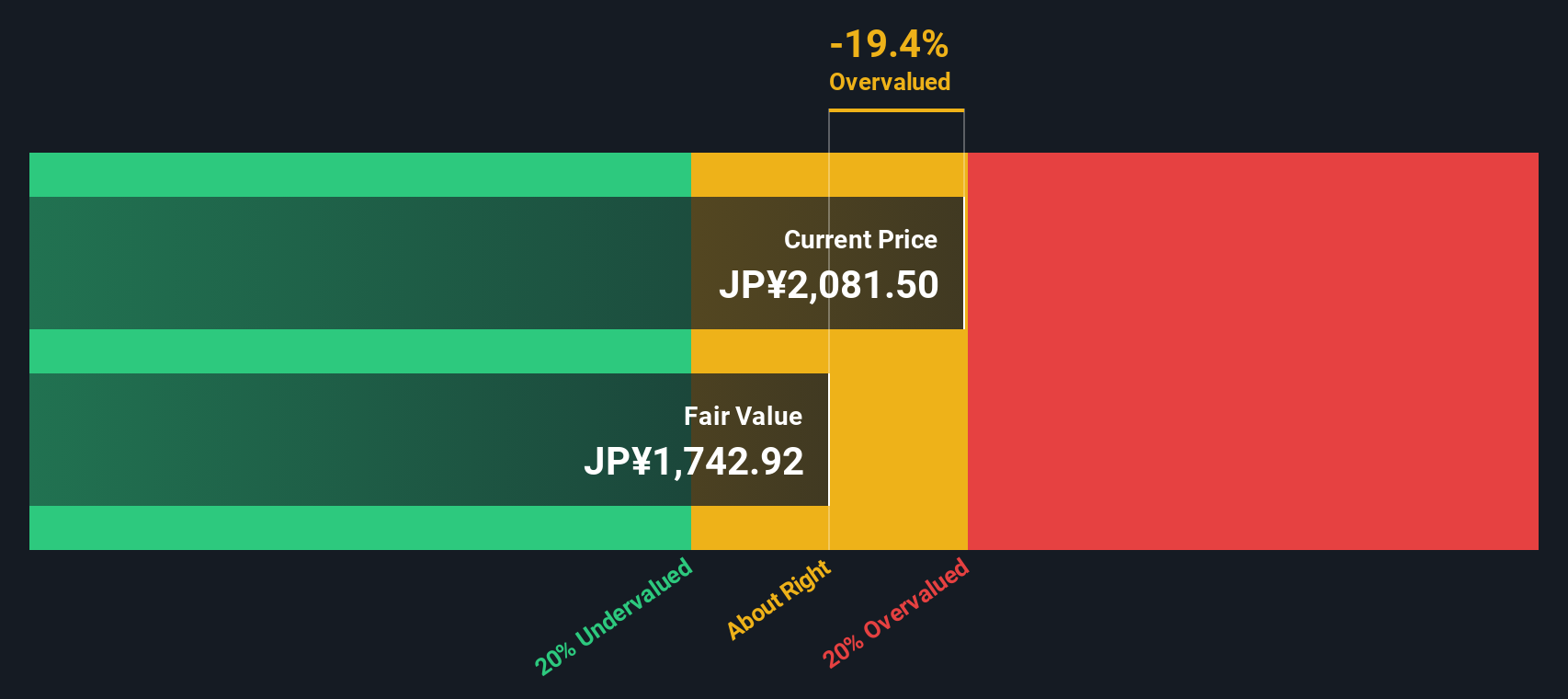

While analysts see Olympus’s fair value as modestly above today’s price, the Simply Wall St DCF model suggests a different outlook. According to this approach, Olympus appears overvalued, with the current price above the model’s estimate of fair value. Could market optimism be getting ahead of actual growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Olympus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Olympus Narrative

If the numbers or outlook here don’t match your own view, you can quickly dive in and shape the Olympus narrative your way in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Olympus.

Looking for More Investment Ideas?

Smart investors know it pays to look beyond one story. Don’t miss your chance to spot tomorrow’s winners. Uncover fresh opportunities waiting just a click away with Simply Wall St’s screeners.

- Unlock potential in tomorrow’s market leaders by starting with these 870 undervalued stocks based on cash flows. See which companies are primed for a strong rebound based on cash flow fundamentals.

- Maximize income with these 16 dividend stocks with yields > 3% for opportunities offering yields over 3 percent, so your portfolio works harder for you.

- Ride the AI momentum and stay ahead with these 24 AI penny stocks. This tool pinpoints stocks leveraging artificial intelligence for rapid growth and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7733

Olympus

Manufactures and sells medical equipment in Japan, America, the Middle East, Asia, and Oceania.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives