- Japan

- /

- Healthcare Services

- /

- TSE:7071

Not Many Are Piling Into Amvis Holdings, Inc. (TSE:7071) Stock Yet As It Plummets 43%

Unfortunately for some shareholders, the Amvis Holdings, Inc. (TSE:7071) share price has dived 43% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

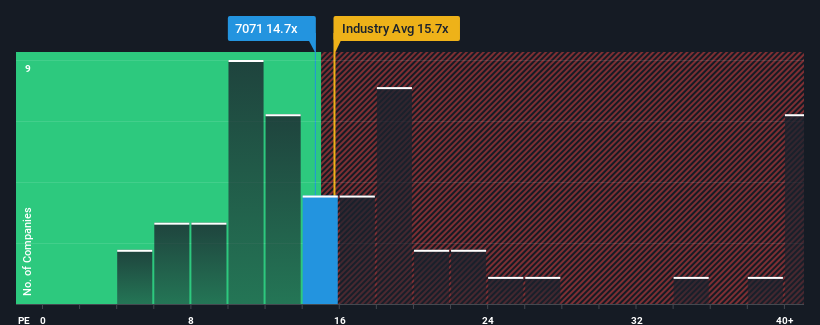

In spite of the heavy fall in price, it's still not a stretch to say that Amvis Holdings' price-to-earnings (or "P/E") ratio of 14.7x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Amvis Holdings as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Amvis Holdings

Is There Some Growth For Amvis Holdings?

In order to justify its P/E ratio, Amvis Holdings would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 18% last year. The strong recent performance means it was also able to grow EPS by 171% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 21% each year over the next three years. That's shaping up to be materially higher than the 10% per annum growth forecast for the broader market.

In light of this, it's curious that Amvis Holdings' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Amvis Holdings' P/E

With its share price falling into a hole, the P/E for Amvis Holdings looks quite average now. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Amvis Holdings currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Amvis Holdings (2 are concerning!) that you need to be mindful of.

You might be able to find a better investment than Amvis Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7071

Reasonable growth potential and fair value.

Market Insights

Community Narratives