- Japan

- /

- Medical Equipment

- /

- TSE:6869

Sysmex’s Subsidiary Merger and Lowered Forecast Might Change the Case for Investing in TSE:6869

Reviewed by Sasha Jovanovic

- Sysmex Corporation recently announced it will absorb its wholly owned subsidiary, Sysmex Medica Co., Ltd., through an absorption-type merger effective April 1, 2026, to streamline equipment production and enhance efficiency.

- This move comes as the company adjusts its full-year sales forecast downward due to ongoing currency pressures and challenging market conditions in China.

- With the absorption merger aiming to improve productivity, we'll explore how these structural changes impact Sysmex's investment narrative amid international market challenges.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Sysmex's Investment Narrative?

For those considering Sysmex, the big picture is about believing in its global leadership in diagnostic technology and potential for innovation, even as near-term profitability faces pressure. The recent move to absorb Sysmex Medica through a simplified merger is a tangible effort to cut complexity and raise efficiency, but because it's not expected to involve issuing shares or cash outflows, most immediate catalysts, like FDA product clearances or international expansion, likely remain unchanged. However, this reorganization does signal that Sysmex is responding directly to tough conditions in China and ongoing currency headwinds, both significant risks that prompted its recent guidance cuts and have weighed on the share price. If the merger accelerates cost savings or improves production flows, it could add stability, but current headwinds in key markets remain the dominant factor shaping near-term expectations for the business.

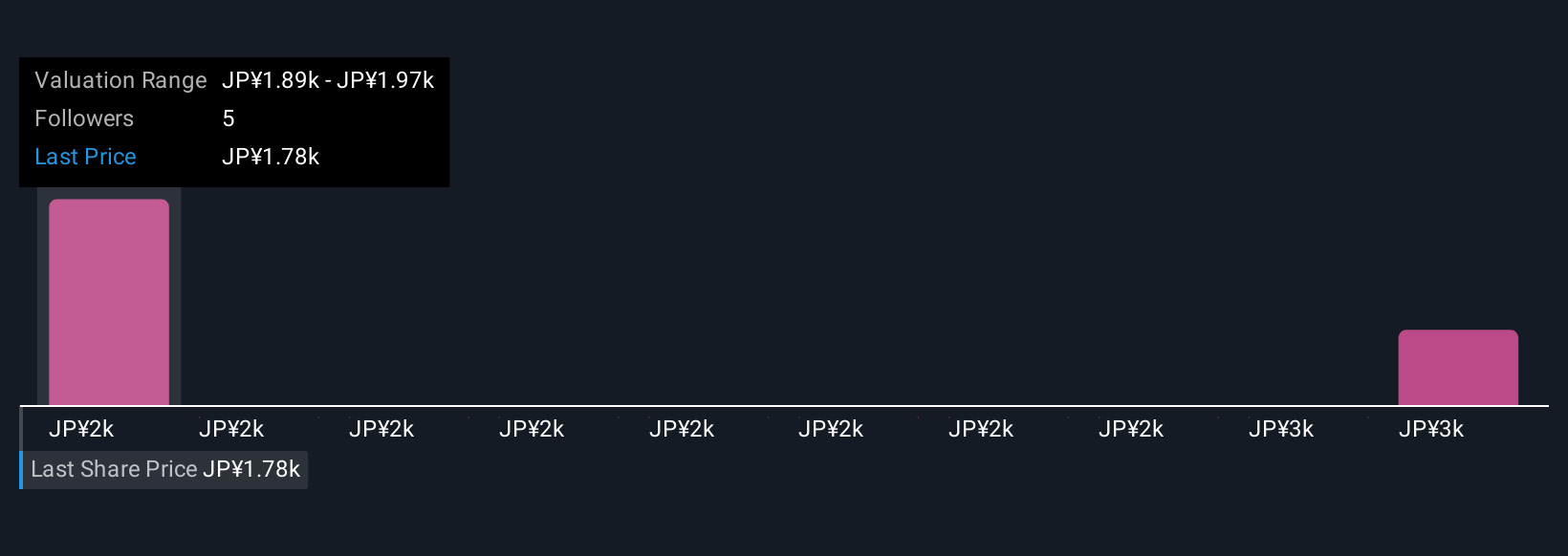

On the other hand, persistent pressure in China could continue impacting sales and margins. Despite retreating, Sysmex's shares might still be trading 11% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Sysmex - why the stock might be worth just ¥1752!

Build Your Own Sysmex Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sysmex research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sysmex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sysmex's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6869

Sysmex

Engages in the development, manufacture, and sale of diagnostic instruments, reagents, and related software.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives