- Japan

- /

- Medical Equipment

- /

- TSE:6869

Sysmex (TSE:6869) Net Profit Margin Miss Reinforces Valuation Debate Despite Strong Growth Forecasts

Reviewed by Simply Wall St

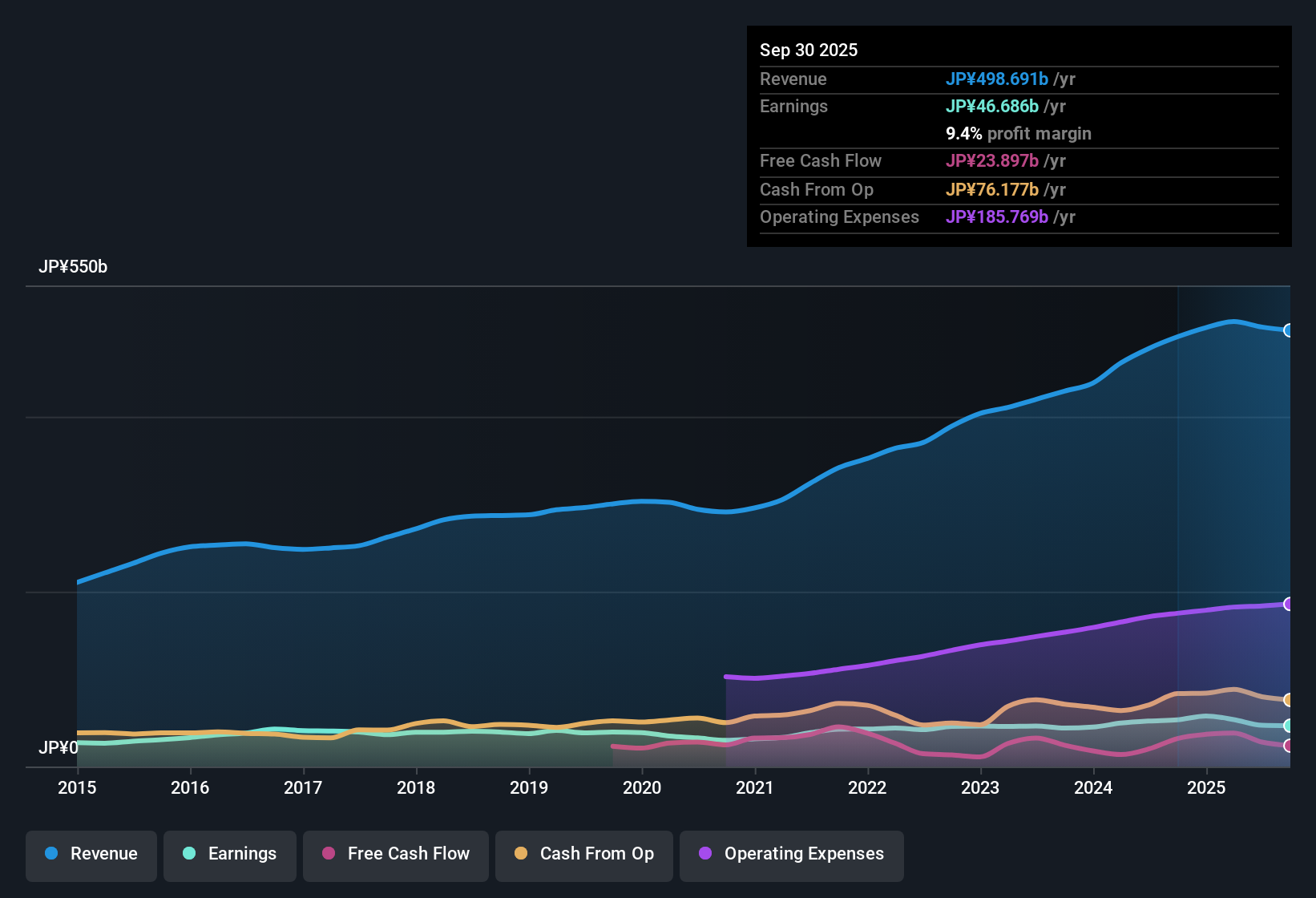

Sysmex (TSE:6869) is forecasting earnings growth of 11.2% per year, easily ahead of the broader Japanese market’s expected 7.9% pace. Revenue is projected to grow at 6.7% annually, also above the market’s 4.4% rate. The company’s current net profit margin of 9.4% is a step down from last year’s 10.9%. Over the last five years, Sysmex’s earnings have increased at an average of 9.7% per year, signaling steady underlying momentum despite the recent dip in profit margins.

See our full analysis for Sysmex.Next, we will see how these results stack up against the community’s prevailing narratives, highlighting where expectations are confirmed and where surprises may shake things up.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Valuation Signals Undervalued Opportunity

- Sysmex’s current share price is ¥1618, which is trading below its DCF fair value of ¥1816.17 by about 11%. This suggests a meaningful valuation gap not present in many sector peers.

- This heavily supports the view that robust historical earnings quality and forward growth projections (11.2% annual earnings growth forecast) justify a premium, especially with the market’s average expected pace at just 7.9%.

- Bulls highlight that the discounted share price, combined with positive revenue momentum, often attracts value-focused investors in the diagnostics sector.

- It is notable that, even with profit margins dipping to 9.4% from 10.9%, the market has not bid up the price to match its fair value, leaving upside potential tied to fundamentals.

Net Profit Margin Slips but Growth Outlook Remains Solid

- The latest net profit margin of 9.4% is a decrease from last year’s 10.9%, even as forecasts suggest a rebound in annual earnings growth.

- According to prevailing market analysis, Sysmex’s track record of 9.7% annualized earnings growth and renewed forecast momentum reinforces its positioning as a reliable, resilient player; however, margin pressure shows competitors are not standing still.

- Investors in diagnostics anticipate stability, and the slip in margins may test confidence, but long-term sector trends favor firms with steady international demand.

- Sysmex’s ability to outpace market growth even with softer margins signals underlying strengths, especially in innovation and recurring revenues.

Peer and Industry Multiples Show Strategic Value

- Sysmex carries a Price-to-Earnings ratio of 21.4x, which is lower than the peer group average (22.4x) but notably above the broader industry average (15.3x). This points to a valuation premium based on company-specific prospects rather than generic sector strength.

- Prevailing market narratives point out that while Sysmex commands a higher multiple than many industry players, this reflects confidence in its recurring growth and R&D depth, not unjustified over-optimism.

- Peers trading at a higher P/E typically have visible short-term catalysts, which means Sysmex’s premium is likely grounded in solid fundamentals and strategic positioning.

- Market watchers note that this valuation balance lets Sysmex capture both quality-seeking and long-term growth investors, tying its share performance to sustainable advances in diagnostics.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sysmex's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Sysmex’s recent slip in profit margins and ongoing competitive pressures highlight the risk that earnings quality may not remain as steady as in the past.

If you want stocks where consistent performance takes priority, use stable growth stocks screener (2074 results) to discover companies with a stronger track record of stable revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6869

Sysmex

Engages in the development, manufacture, and sale of diagnostic instruments, reagents, and related software.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives