- Japan

- /

- Medical Equipment

- /

- TSE:6869

Sysmex (TSE:6869): A Fresh Look at Valuation as Shares Weaken Without Clear Catalyst

Reviewed by Simply Wall St

Sysmex (TSE:6869) has been on many investors' radars lately, especially as its recent share movements have left some people scratching their heads. There hasn't been a headline-grabbing event to explain the action. The lack of a clear catalyst can sometimes catch the market off guard. For anyone considering whether to hold, buy, or move on, it's worth pausing to ask: is the market signaling a bigger shift beneath the surface?

Digging into the numbers, Sysmex’s share price has dropped nearly 29% over the past year, with negative momentum building as the stock is also down 32% since January. Even over the past three years, returns have underperformed, and the last month shows another dip of around 6%. While the headline numbers look downbeat, revenue and net income have seen annual growth. This adds a wrinkle to the picture and makes it less clear-cut than a simple price chart might suggest.

With sentiment so clearly negative, is Sysmex undervalued at these levels, or is the market already anticipating future risks and lower growth?

Price-to-Earnings of 25.3x: Is it justified?

Sysmex is currently trading at a price-to-earnings (P/E) ratio of 25.3x, which is notably higher than both its industry peers and the wider Japanese market. This indicates that investors are paying a premium for each yen of earnings compared to similar companies.

The price-to-earnings ratio is a widely used metric to gauge how much investors are willing to pay for a company’s net income. For medical equipment firms like Sysmex, where growth expectations can drive valuations, a higher P/E suggests confidence in future profitability. However, it can also signal overvaluation if growth does not materialize.

Given Sysmex's current P/E is materially above the industry average, the premium may reflect expectations of stronger growth or higher quality of earnings. However, without matching growth or profitability improvements, the market could be overpaying for future results.

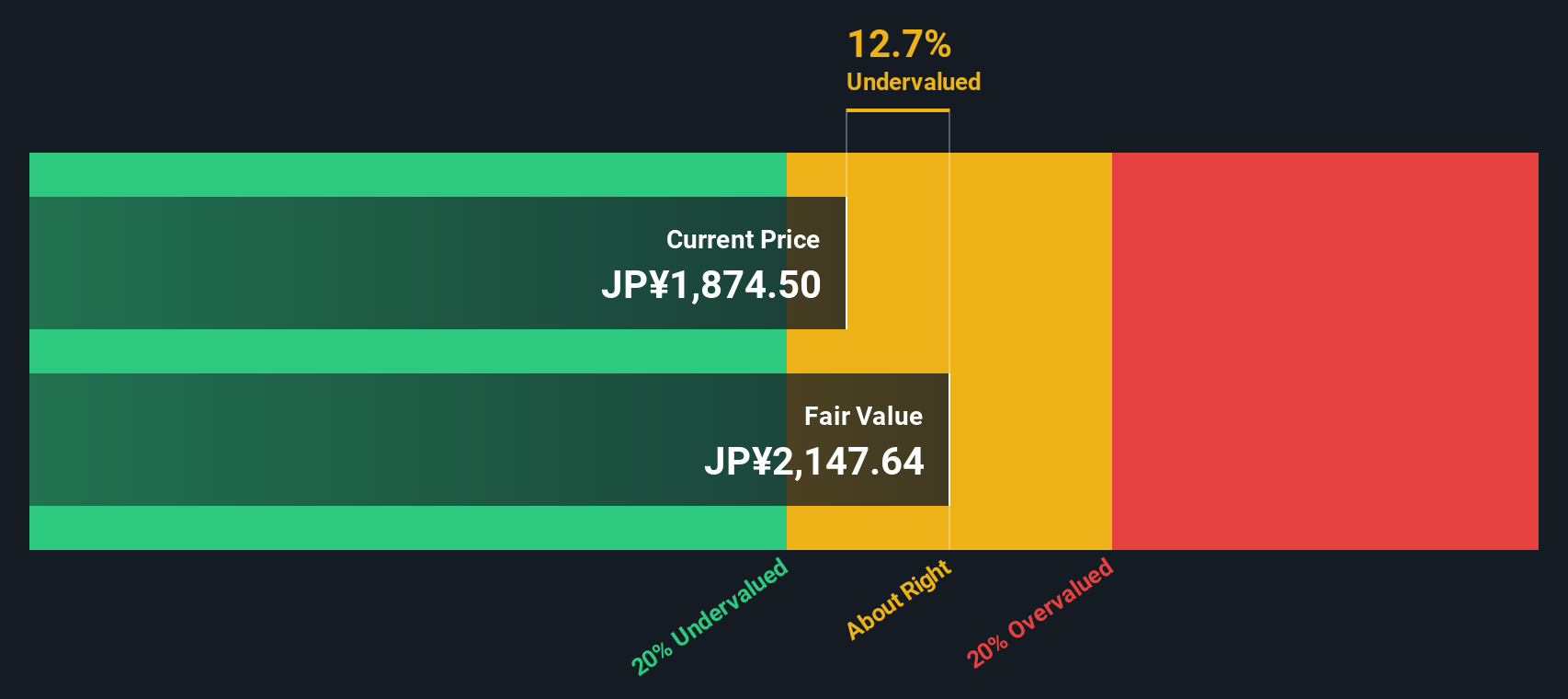

Result: Fair Value of ¥2,140.57 (UNDERVALUED)

See our latest analysis for Sysmex.However, persistent weak share performance and discounted expectations may signal challenges ahead, particularly if recent growth in revenue and net income stalls unexpectedly.

Find out about the key risks to this Sysmex narrative.Another View: What Does the SWS DCF Model Suggest?

Our SWS DCF model takes a different approach by estimating Sysmex’s intrinsic value based on future cash flows. This method also points to shares being undervalued. This could either reinforce conviction or raise new doubts.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sysmex Narrative

If you see the numbers differently or want to explore Sysmex's story on your own terms, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Sysmex research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next winning opportunity pass you by. Put the power of the Simply Wall Street Screener to work and target stocks with real upside potential today.

- Seize opportunities among undervalued companies showing strong fundamentals by leveraging undervalued stocks based on cash flows for your next smart pick.

- Capitalize on artificial intelligence trends and spot hidden gems powering tomorrow’s breakthroughs with AI penny stocks right now.

- Boost your portfolio’s income potential with attractive yields through dividend stocks with yields > 3%, which guides you to top dividend-paying stocks with financial resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6869

Sysmex

Engages in the development, manufacture, and sale of diagnostic instruments, reagents, and related software.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success