- Japan

- /

- Medical Equipment

- /

- TSE:6849

Nihon Kohden (TSE:6849): Valuation in Focus After UBS Downgrade on Regulatory and Demand Concerns

Reviewed by Simply Wall St

Nihon Kohden (TSE:6849) shares came under fresh scrutiny after UBS downgraded the stock, highlighting a cloudier outlook for the company. Investors are now weighing how regulatory headwinds and softer hospital spending could influence performance.

See our latest analysis for Nihon Kohden.

Nihon Kohden’s share price has lost significant ground this year, with a year-to-date share price return of -25.66% and a one-year total shareholder return of -27.29%. The market’s cautious stance has increased over recent months as regulatory pressures and tighter hospital budgets weighed on sentiment. At the same time, the company’s latest earnings guidance offered a glimpse of stability looking ahead.

If you’re looking for fresh opportunities in healthcare while market sentiment is shifting, explore the landscape with our See the full list for free..

With the share price languishing near recent lows and valuation discounts apparent, the key question is whether Nihon Kohden now offers value for forward-looking investors, or if the market is accurately incorporating the company’s growth constraints into its valuation.

Price-to-Earnings of 14x: Is it justified?

Based on the latest figures, Nihon Kohden trades at a price-to-earnings (P/E) ratio of 14x, putting its valuation slightly below both peer and industry averages compared to its last close price of ¥1,561.5.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. It is a critical gauge for profitability in the medical equipment sector. A lower P/E may imply the stock is undervalued relative to anticipated earnings potential.

Nihon Kohden’s P/E ratio sits attractively beneath the JP Medical Equipment industry average of 15.6x and is well below the peer group average of 19.5x. The gap between its current P/E and the estimated fair ratio of 21.1x could indicate latent upside if market sentiment improves.

Explore the SWS fair ratio for Nihon Kohden

Result: Price-to-Earnings of 14x (UNDERVALUED)

However, regulatory changes or unexpectedly weak hospital spending could still undermine any valuation upside for Nihon Kohden in the near term.

Find out about the key risks to this Nihon Kohden narrative.

Another View: What Does the SWS DCF Model Say?

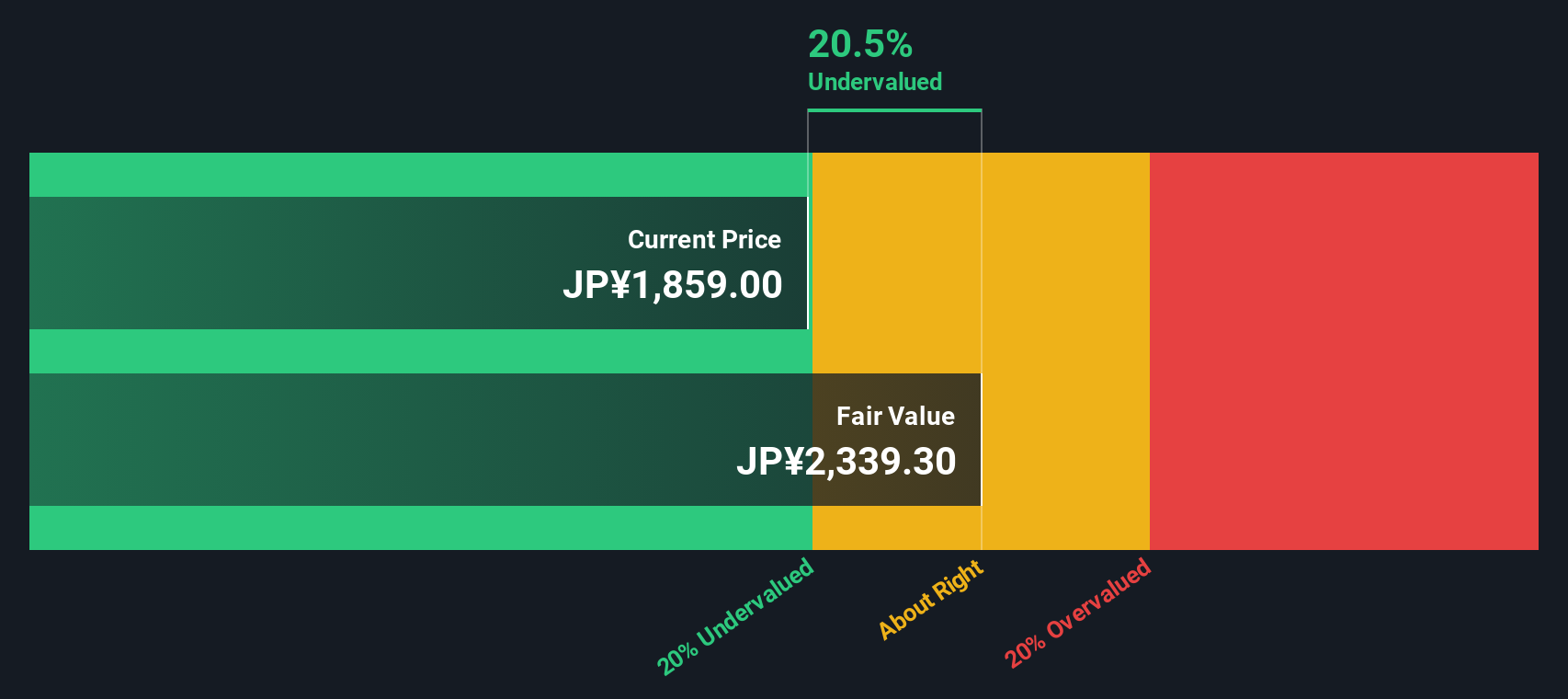

Taking a step back from earnings multiples, our SWS DCF model calculates a fair value of ¥2,254.55 for Nihon Kohden, which is about 30.7% higher than the current share price. This signals possible undervaluation based on its long-term cash flows rather than short-term earnings trends. Is the market overlooking long-term potential, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nihon Kohden for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nihon Kohden Narrative

If you see things differently or want to interpret the numbers for yourself, it’s easy to shape your own analysis using our data. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Nihon Kohden.

Looking for More Investment Ideas?

Don't wait on the sidelines while opportunities are moving. Broaden your horizons and discover unique markets, growth stories, and hidden value with these handpicked ideas:

- Capitalize on companies with robust cash flows and attractive valuations by seizing these 898 undervalued stocks based on cash flows that show potential others may be missing.

- Secure reliable income by pursuing these 15 dividend stocks with yields > 3% offering yields above 3%, ideal if stability and returns matter most to your investment approach.

- Ride the next wave of technological advancement by targeting breakthroughs and innovation with these 27 AI penny stocks capturing AI-fueled momentum in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Kohden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6849

Nihon Kohden

Engages in research and development, production, sales, and repair and maintenance of medical electronic equipment in Japan, North America, Latin America, Europe, Asia, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives