- Japan

- /

- Healthcare Services

- /

- TSE:6099

Top Growth Companies With Insider Ownership October 2024

Reviewed by Simply Wall St

In October 2024, global markets are navigating the complexities of rising U.S. Treasury yields and a cautious economic outlook, with the S&P 500 Index experiencing a slight pullback after several weeks of gains. Amid these conditions, growth stocks have shown resilience, particularly those with strong insider ownership—a factor that can indicate confidence in a company's long-term potential and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

Happiest Minds Technologies (NSEI:HAPPSTMNDS)

Simply Wall St Growth Rating: ★★★★★☆

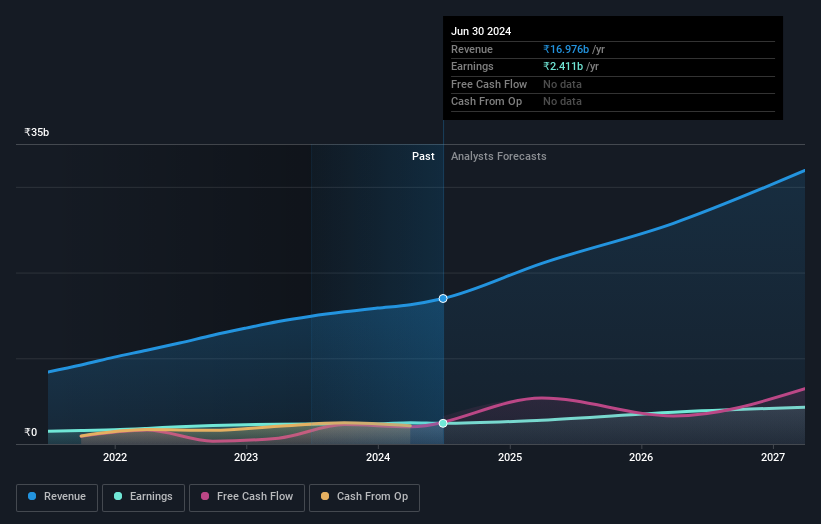

Overview: Happiest Minds Technologies Limited offers IT solutions and services across various countries including India, the United States, and the United Kingdom, with a market cap of ₹114.54 billion.

Operations: The company's revenue segments include Infrastructure Management & Security Services (IMSS) at ₹3.02 billion.

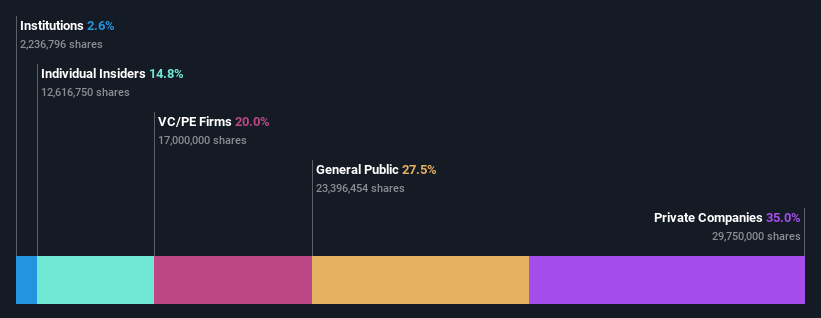

Insider Ownership: 33.7%

Happiest Minds Technologies is experiencing robust growth, with revenue expected to increase by 21.8% annually, outpacing the Indian market. Earnings are also forecasted to grow significantly at 22.2% per year. Despite a low future Return on Equity of 19.9%, the company is expanding its leadership team and launching innovative products like Secureline360, enhancing its competitive edge in cybersecurity solutions. Recent board appointments aim to bolster strategic growth and global expansion initiatives.

- Delve into the full analysis future growth report here for a deeper understanding of Happiest Minds Technologies.

- The analysis detailed in our Happiest Minds Technologies valuation report hints at an inflated share price compared to its estimated value.

Al-Dawaa Medical Services (SASE:4163)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Al-Dawaa Medical Services Company, along with its subsidiaries, operates primarily as a pharmaceutical retail company in the Kingdom of Saudi Arabia and has a market cap of SAR7.74 billion.

Operations: The company generates revenue primarily through its retail segment, which accounts for SAR5.67 billion.

Insider Ownership: 14.8%

Al-Dawaa Medical Services is positioned for growth, with earnings projected to increase at 15.2% annually, surpassing the South African market's average of 6.7%. Despite a high debt level, the company trades below its estimated fair value and analysts expect a 21.6% price rise. Revenue growth is forecasted at 5.9%, outpacing the market's 1.3%. Return on Equity is anticipated to reach a robust 32.1% in three years, indicating strong future profitability potential.

- Click here and access our complete growth analysis report to understand the dynamics of Al-Dawaa Medical Services.

- In light of our recent valuation report, it seems possible that Al-Dawaa Medical Services is trading behind its estimated value.

Elan (TSE:6099)

Simply Wall St Growth Rating: ★★★★★☆

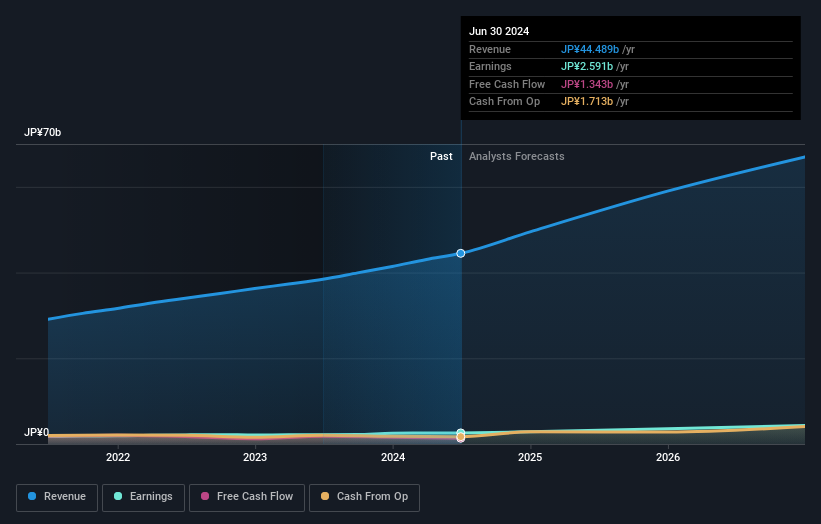

Overview: Elan Corporation operates in the nursing care business primarily in Japan, with a market cap of ¥51.99 billion.

Operations: The company generates revenue from its Nursing and Medical Care Related Business, amounting to ¥44.49 billion.

Insider Ownership: 37.3%

Elan Corporation's growth prospects are underscored by its forecasted earnings increase of 20.8% annually, outpacing the Japanese market average of 8.7%. Revenue is also expected to grow at 16.4% per year, faster than the market's 4.2%. Recently acquired by M3, Inc., Elan remains publicly listed with high insider ownership and no substantial insider trading activity reported over three months, suggesting stability in its shareholder base amid significant corporate changes.

- Dive into the specifics of Elan here with our thorough growth forecast report.

- Our expertly prepared valuation report Elan implies its share price may be too high.

Where To Now?

- Navigate through the entire inventory of 1513 Fast Growing Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Elan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6099

Flawless balance sheet with high growth potential.