- Japan

- /

- Medical Equipment

- /

- TSE:4543

Terumo (TSE:4543) Valuation in Focus After Revised Earnings Outlook and Dividend Increase

Reviewed by Simply Wall St

Terumo (TSE:4543) just revised its earnings outlook for the fiscal year ending March 2026, citing impacts from the yen’s depreciation and business-related one-time costs. At the same time, the company announced a higher dividend for both the quarter and the year.

See our latest analysis for Terumo.

Terumo’s updated guidance and dividend bump come after a challenging stretch, as the stock’s year-to-date share price return sits at -18.0%. While recent announcements have sparked a short-term bounce, momentum remains subdued, which is reflected in a one-year total shareholder return of -19.08%. However, the longer-term lens shows a 25.9% gain over three years. Investors appear to be closely weighing the currency headwinds and restructuring costs against underlying business growth.

If Terumo’s evolving story has you thinking about what’s next in healthcare, it might be the perfect moment to discover See the full list for free.

With the stock down despite steady financial growth and a higher dividend, investors may be wondering if Terumo remains undervalued or if the market has already accounted for the effects of recent headwinds and future growth prospects.

Most Popular Narrative: 22.7% Undervalued

Terumo’s current share price sits well below the narrative’s fair value estimate, making this valuation a key battleground for bulls and bears. The narrative’s case relies not just on solid financial growth, but on an expectation that Terumo’s strategic moves and earnings trajectory will meaningfully boost shareholder value in coming years.

Strong volume growth and sustained demand in the U.S. and China, driven by an aging population and rising chronic disease prevalence, are resulting in record-high quarterly revenues for Terumo; these structural health trends are likely to support ongoing top-line growth.

Curious how this ambitious price target is calculated? The narrative hinges on bold future estimates for margins, earnings, and valuation multiples—estimates usually reserved for fast-growing global leaders. Do these assumptions stand up? Dive in to uncover the financial projections behind this bullish view.

Result: Fair Value of ¥3,180.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected price increases or a weaker innovation pipeline could undermine Terumo’s growth story and prompt a rethink of its current valuation.

Find out about the key risks to this Terumo narrative.

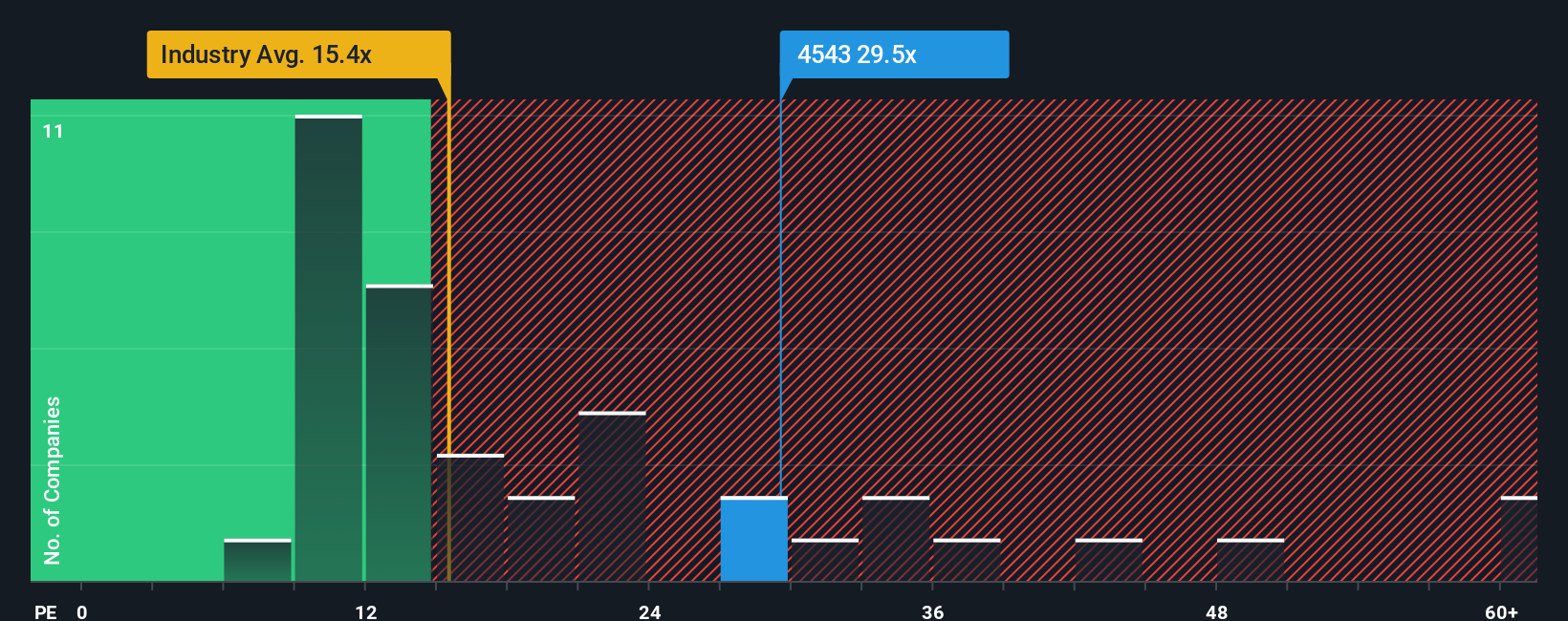

Another View: Valuation by Multiples

Looking through the lens of earnings multiples, Terumo is trading at a price-to-earnings ratio of 27.8x, significantly higher than the Medical Equipment industry average of 15.8x and its peer average of 19.9x. This suggests investors may be paying a premium, potentially increasing valuation risk if growth slows or sentiment shifts. However, the current ratio remains below the fair ratio of 32.4x, which hints that the market could reassess Terumo’s potential. Will the premium hold up, or is a correction on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Terumo Narrative

If you see things differently, or want to dig deeper on your own terms, you can craft a personalized Terumo story in just a few minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Terumo.

Looking for More Smart Investment Ideas?

Your biggest opportunity might still be ahead, so why settle? Use the Simply Wall Street Screener and spot investment breakthroughs you don’t want to miss out on.

- Uncover companies with high yields and stable payouts by checking out these 15 dividend stocks with yields > 3% for consistent dividend income opportunities.

- Tap into the innovators driving healthcare’s future by surveying these 30 healthcare AI stocks making advances in medical AI and digital therapy.

- Seize potential bargains before the crowd by tracking these 921 undervalued stocks based on cash flows with the strongest upside based on intrinsic value signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terumo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4543

Terumo

Engages in the manufacture and sale of medical products and equipment in Japan, Europe, China, the United States, Asia, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives