- Japan

- /

- Medical Equipment

- /

- TSE:4543

Is Terumo Corporation's (TSE:4543) Recent Stock Performance Influenced By Its Financials In Any Way?

Terumo's (TSE:4543) stock is up by 4.4% over the past week. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to investigate if the company's decent financials had a hand to play in the recent price move. Particularly, we will be paying attention to Terumo's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Terumo

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Terumo is:

8.3% = JP¥118b ÷ JP¥1.4t (Based on the trailing twelve months to June 2024).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every ¥1 worth of equity, the company was able to earn ¥0.08 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Terumo's Earnings Growth And 8.3% ROE

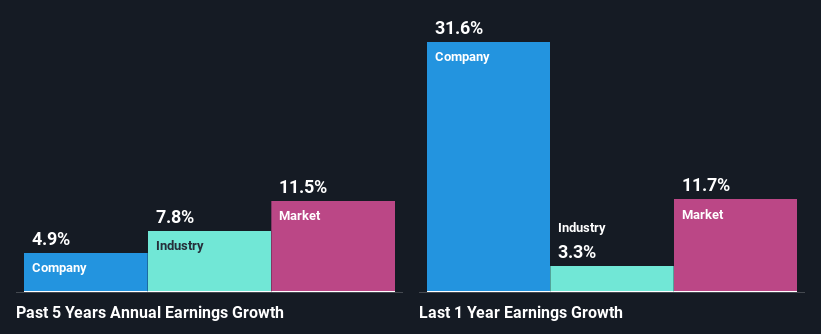

At first glance, Terumo seems to have a decent ROE. Further, the company's ROE is similar to the industry average of 8.3%. Terumo's decent returns aren't reflected in Terumo'smediocre five year net income growth average of 4.9%. So, there could be some other factors at play that could be impacting the company's growth. For instance, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

As a next step, we compared Terumo's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 7.8% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for 4543? You can find out in our latest intrinsic value infographic research report.

Is Terumo Efficiently Re-investing Its Profits?

Despite having a normal three-year median payout ratio of 31% (or a retention ratio of 69% over the past three years, Terumo has seen very little growth in earnings as we saw above. So there could be some other explanation in that regard. For instance, the company's business may be deteriorating.

Moreover, Terumo has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

In total, it does look like Terumo has some positive aspects to its business. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return and is reinvesting ma huge portion of its profits. By the looks of it, there could be some other factors, not necessarily in control of the business, that's preventing growth. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if Terumo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4543

Terumo

Engages in the manufacture and sale of medical products and equipment in Japan, Europe, China, the United States, Asia, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success