- Japan

- /

- Healthcare Services

- /

- TSE:3360

Will Ship Healthcare Holdings' (TSE:3360) Ambitious 2026 Targets Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

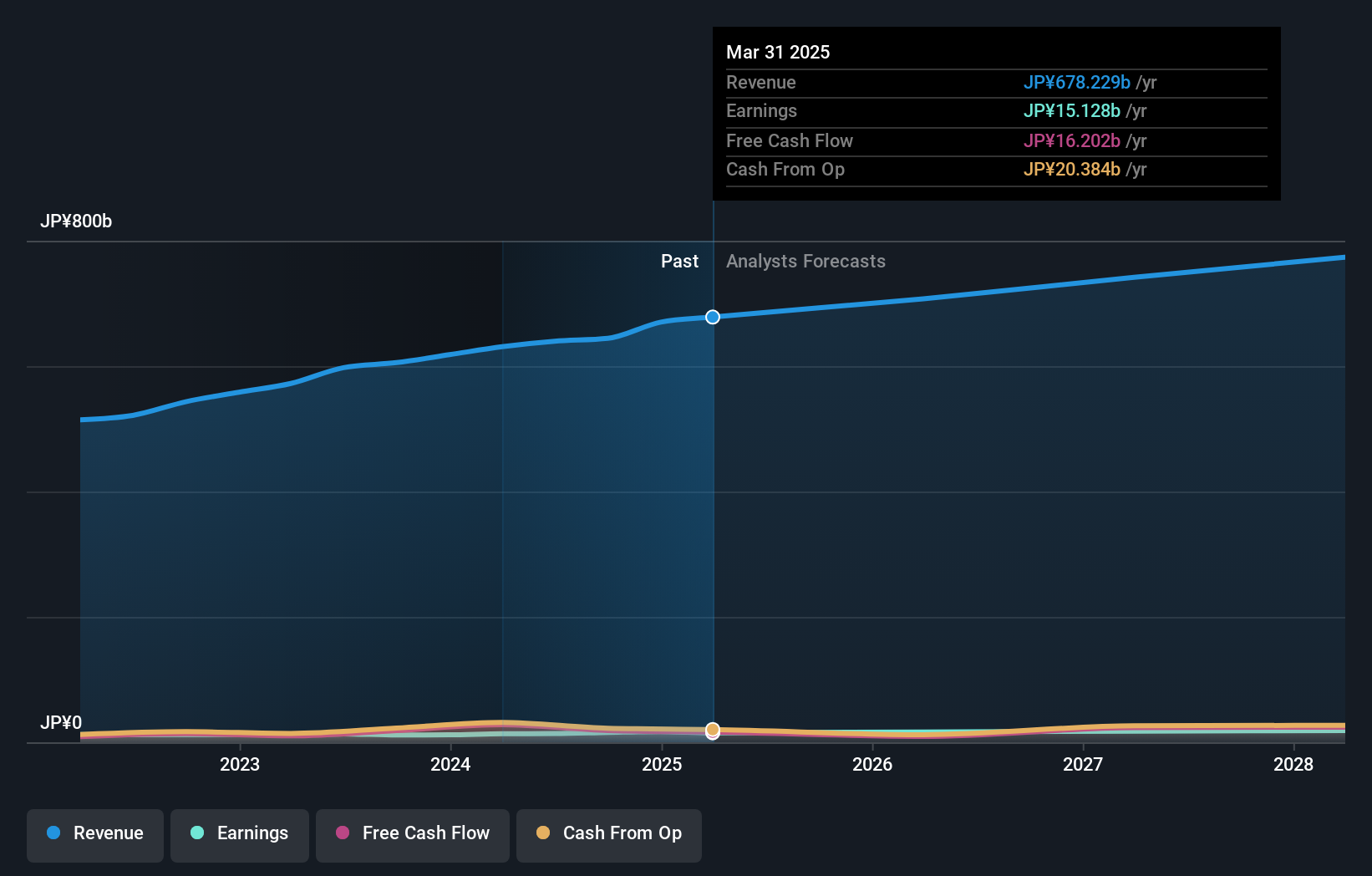

- Ship Healthcare Holdings recently released consolidated earnings guidance for the full year ending March 31, 2026, projecting net sales of ¥700 billion, operating profit of ¥26 billion, and ¥15.5 billion profit attributable to owners of the parent, with an anticipated net income per share of ¥164.85.

- This detailed outlook offers stakeholders fresh insights into the company’s financial trajectory and management’s expectations for the upcoming year.

- With management setting clear sales and profit targets, we explore how this earnings guidance update may shape Ship Healthcare Holdings’ investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Ship Healthcare Holdings' Investment Narrative?

To own shares of Ship Healthcare Holdings right now, an investor needs conviction in the company’s ability to translate steady but measured growth into shareholder value, especially as guidance for the next fiscal year remains consistent with prior forecasts. The latest guidance, released on November 11, doesn’t meaningfully shift the short-term picture: the company is still targeting moderate revenue and profit expansion, supported by ongoing dividend increases and active share buybacks. While these capital returns may bolster near-term sentiment, risks such as negative earnings growth over the past year and low return on equity still remain top of mind. Additionally, the recent drop from the FTSE All-World Index could influence institutional demand, although recent share price gains suggest investors have, so far, found reassurance in management’s steady outlook. Ultimately, the updated guidance affirms the company’s incremental progress but does not appear to fundamentally alter the biggest short-term catalysts or risks. However, not every investor may be paying close attention to Ship Healthcare’s recent FTSE index exclusion, and it’s worth understanding why.

Ship Healthcare Holdings' shares have been on the rise but are still potentially undervalued by 30%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Ship Healthcare Holdings - why the stock might be worth as much as 44% more than the current price!

Build Your Own Ship Healthcare Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ship Healthcare Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Ship Healthcare Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ship Healthcare Holdings' overall financial health at a glance.

No Opportunity In Ship Healthcare Holdings?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3360

Ship Healthcare Holdings

Engages in the medical, healthcare, welfare, and nursing care businesses in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success