- Japan

- /

- Healthcare Services

- /

- TSE:2393

Nippon Care Supply (TSE:2393) Profit Growth Surges 23%, Reinforcing Bullish Margin Narratives

Reviewed by Simply Wall St

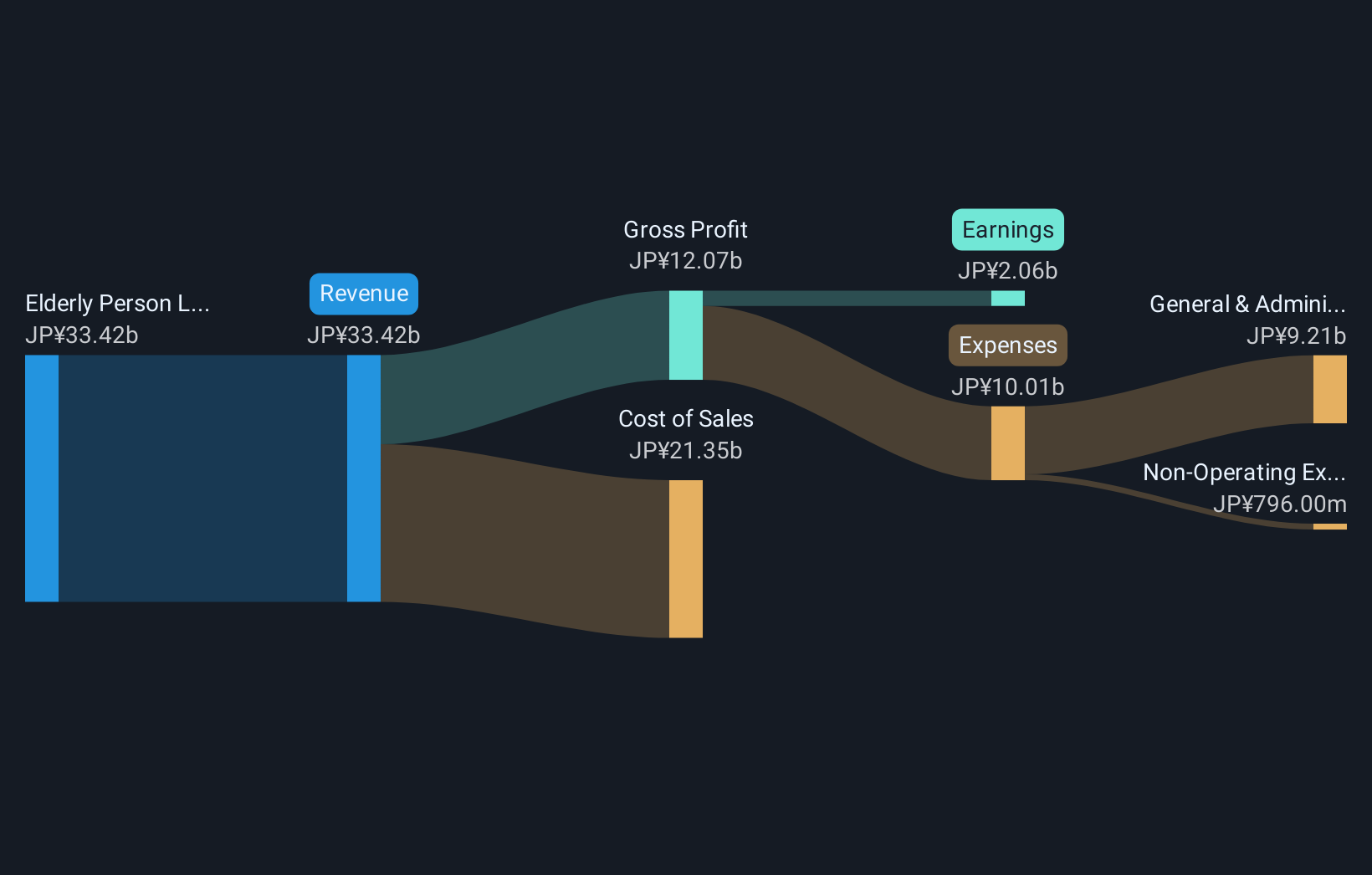

Nippon Care Supply (TSE:2393) posted earnings growth of 23.3% over the past year, a sharp acceleration compared to its 5-year average growth of just 1.7% per year. Current profit margins rose to 6.2% from 5.5% last year, and the company’s consistent profit gains over five years underscore the high-quality nature of current earnings. While investors will likely be encouraged by improved profitability, the premium price-to-earnings ratio of 18.1x versus sector and peer averages, along with concerns around dividend sustainability, may temper the enthusiasm.

See our full analysis for Nippon Care Supply.The real test is how these numbers stack up against the prevailing market narratives, which can reinforce or challenge investor sentiment.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Margin Gains Outpace Peers

- Over the past five years, Nippon Care Supply’s profit margins have increased to 6.2%, up from 5.5% just last year, which is well above the company’s longer-run average.

- Despite the sector trend toward tighter margins due to rising costs, the prevailing market view emphasizes that this margin expansion supports confidence in core operations.

- The margin boost signals improved cost control and operational resilience, which helps distinguish Nippon Care Supply within the aged-care supply sector.

- What is notable is that such margin growth comes at a time when many peers struggle to maintain profitability, reinforcing why investors are watching how sustainable these gains prove.

Profit Trend Outpaces Long-Term Average

- Annual profit growth surged 23.3% year-over-year, sharply ahead of the five-year average pace of just 1.7% per year.

- The prevailing market view notes this outsized jump stands out even against favorable industry demographics.

- Investors looking for steady compounding see these results as a validation of Nippon Care Supply’s ability to capture demand in a structurally growing market.

- However, some caution that a single strong year might not be the new normal and will look to see whether this level of profit growth can be repeated.

Premium Valuation Stretches Above Sector

- Shares trade at a price-to-earnings ratio of 18.1 times, a significant premium over the sector average of 13.9 times and above discounted cash flow (DCF) fair value of 26,730.49.

- The prevailing market view sees this high multiple as a mark of quality but underscores increasing scrutiny.

- Bulls argue that steady margin gains and consistent profitability justify paying up, as these fundamentals should be rare in the industry.

- Bears highlight that, despite the company’s strengths, its lofty valuation could limit future upside if profit momentum fades or sector risk intensifies.

See our latest analysis for Nippon Care Supply.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nippon Care Supply's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite strong recent profit growth, Nippon Care Supply’s premium valuation raises concerns. Upside could be limited if earnings momentum slows or sector risks rise.

If you want to avoid stretched valuations and seek better value opportunities, check out these 835 undervalued stocks based on cash flows to discover stocks trading at more attractive prices with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Care Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2393

Nippon Care Supply

Engages in the rental and wholesale of welfare equipment businesses in Japan.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives