Will Toyo Suisan Kaisha’s (TSE:2875) Upgraded Sales Forecast Offset Margin Pressure This Year?

Reviewed by Sasha Jovanovic

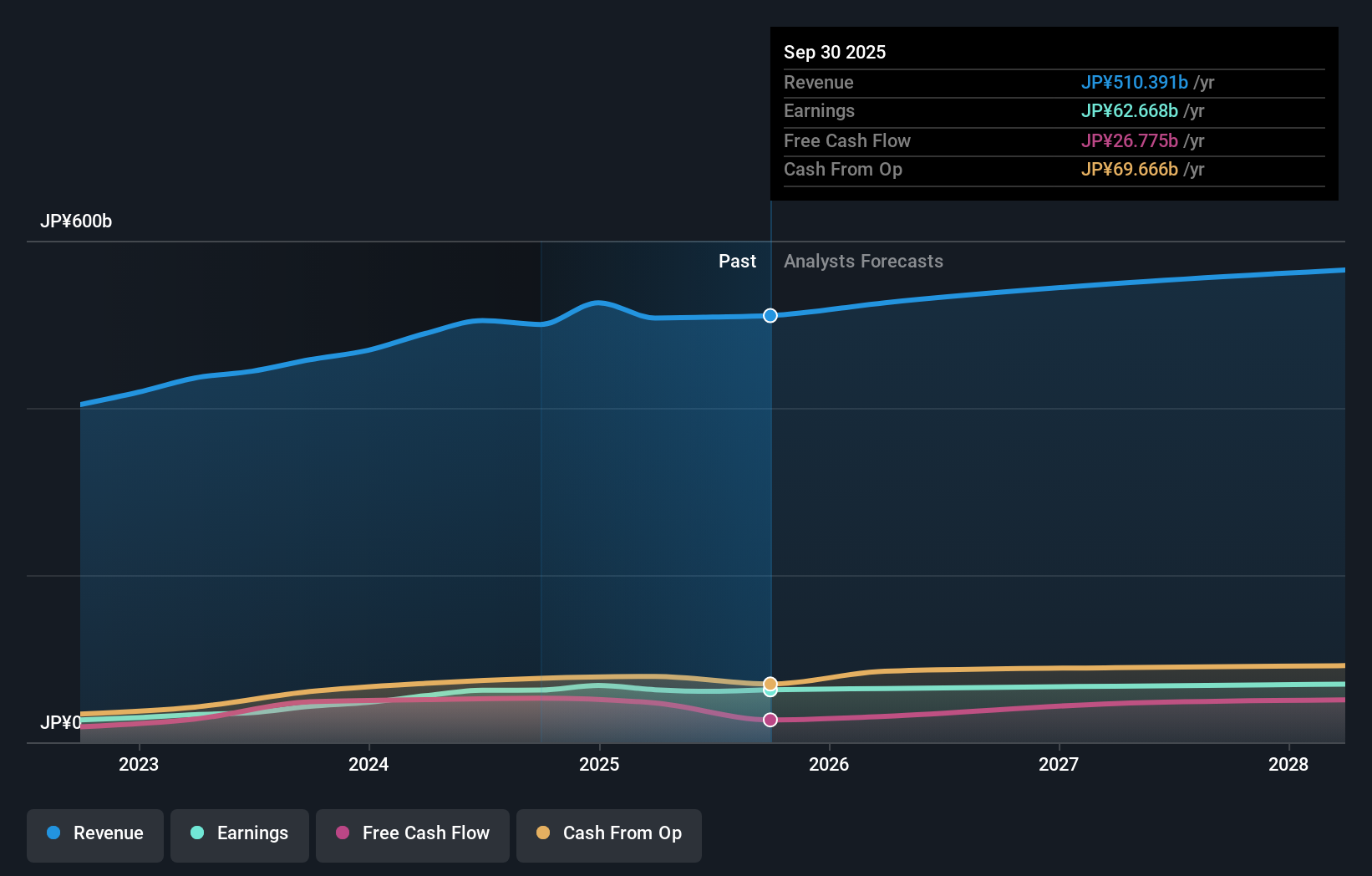

- Toyo Suisan Kaisha recently reported its consolidated financial results for the first half of FY2026, revealing a 1.1% year-on-year increase in net sales alongside minor declines in operating and ordinary profits.

- The company's upward revision to its full-year net sales forecast suggests management is maintaining a cautiously optimistic outlook despite softer profit margins so far this year.

- We’ll examine how the improved full-year sales outlook shapes Toyo Suisan Kaisha’s investment narrative moving forward.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Toyo Suisan Kaisha's Investment Narrative?

For investors, the core of the Toyo Suisan Kaisha story is built on its reputation for operational stability, steady sales growth, and focus on shareholder returns, qualities that often appeal to those seeking consistent, if unspectacular, growth. The recent increase in full-year net sales guidance signals that management is still confident about near-term demand, even with today's tight margins. While the headline 1.1% rise in first-half net sales is encouraging, modest declines in operating and ordinary profits keep profitably-inclined shareholders on watch, especially given broader sector expectations for faster earnings growth and margin improvement. The news of higher sales forecasts may help counterbalance some concerns about slowing profit momentum, shifting the attention of many investors toward how successfully Toyo Suisan can defend or lift margins in coming quarters. At the same time, ongoing governance debates and board independence remain issues some are likely to monitor closely, especially after recent activist pressure. The immediate impact of the latest news event appears incremental rather than transformative, but it does gently rebalance the conversation towards future sales growth potential and away from near-term profit softness.

But don’t overlook governance questions, they’re front and center for investors right now.

Exploring Other Perspectives

Explore another fair value estimate on Toyo Suisan Kaisha - why the stock might be worth just ¥14537!

Build Your Own Toyo Suisan Kaisha Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toyo Suisan Kaisha research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Toyo Suisan Kaisha research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toyo Suisan Kaisha's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Suisan Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2875

Toyo Suisan Kaisha

Produces and sells food products in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives