S&B Foods (TSE:2805) Net Margin Decline Reinforces Defensive Value Narrative

Reviewed by Simply Wall St

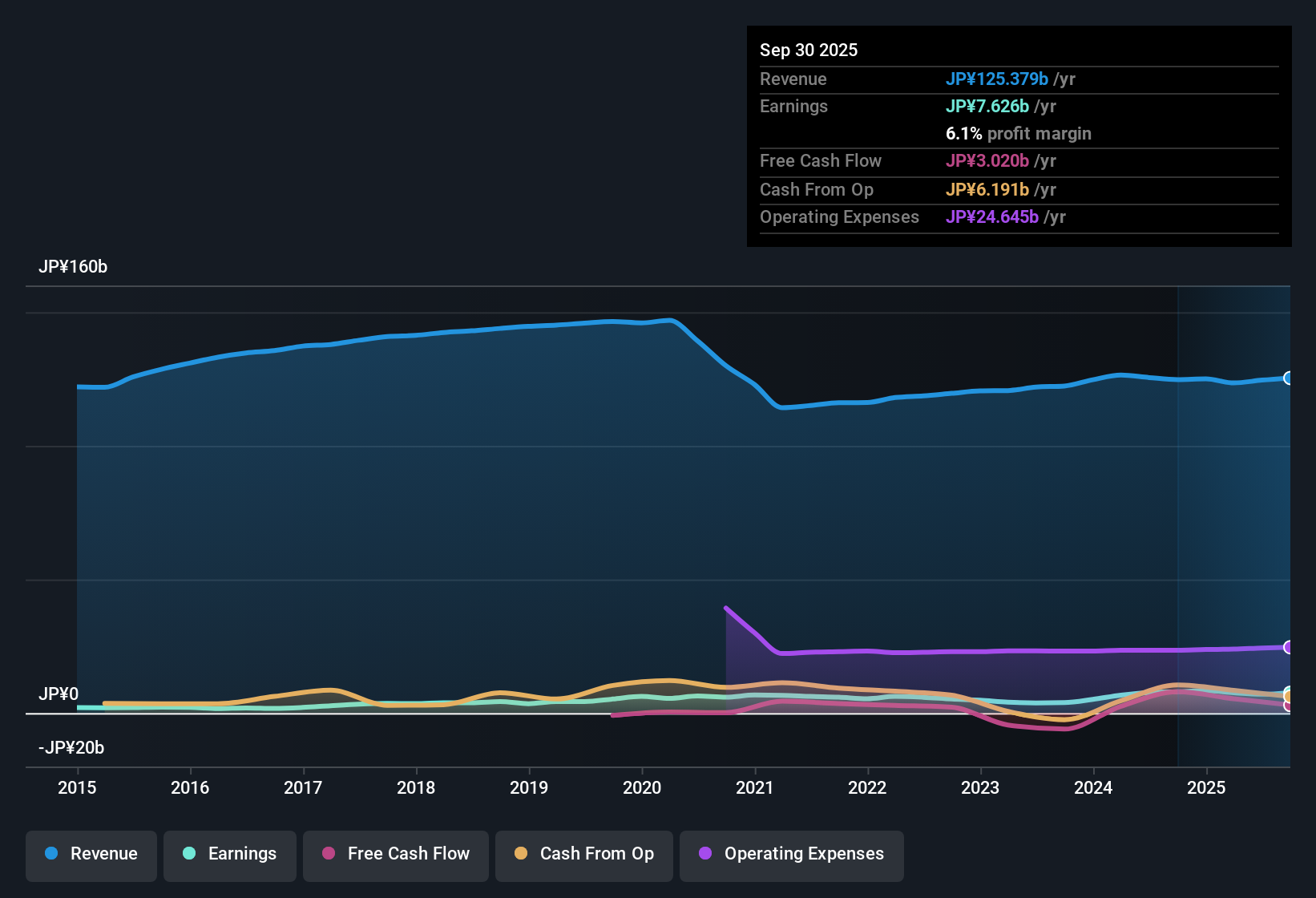

S&B Foods (TSE:2805) posted a net profit margin of 6.1% for the most recent period, slightly below last year's 6.4%. Over the past five years, the company has grown earnings at an average annual rate of 5.2%, although the latest year saw a decline. With a price-to-earnings ratio of 10.6x, lower than both the Japanese food industry average of 16.3x and the peer average, investors see value in S&B Foods, especially since its share price of ¥3,335 still sits below an estimated fair value of ¥5,304.55. The combination of stable margins, a track record of quality earnings, and no major identified risks positions the company as an attractive option in the current environment.

See our full analysis for S&B Foods.The next section compares these numbers to widely held narratives, revealing where this earnings story supports the consensus and where it might challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Stay Resilient Despite Minor Decline

- Net profit margin came in at 6.1% compared to 6.4% last year, reflecting only a minor dip in profitability for S&B Foods.

- What’s surprising is that, even with the slight margin shrinkage, investors focused on stability rather than acceleration in profitability.

- Five-year average earnings growth stood at 5.2% annually, so the latest year’s small decline does not materially alter the long-term trend.

- This steadiness strongly supports the narrative that S&B Foods’ established brand and stable domestic demand provide a defensive cushion, even when margins tighten.

Five-Year Earnings Growth Outpaces Peers on Value Metrics

- S&B Foods has delivered 5.2% average annual earnings growth over the past five years while currently trading at a Price-to-Earnings (P/E) ratio of 10.6x, which is discounted compared to the peer group at 11.8x and the industry at 16.3x.

- What investors should note is that S&B Foods’ quality earnings track record stands out even more when viewed against this lower P/E multiple.

- This valuation gap supports the case that the company offers “good value” and adds weight to the argument for considering Japanese food stocks as a defensive play, especially in volatile markets.

- The results also highlight how S&B’s reputation for quality earnings could justify a stronger premium in the future if growth momentum returns.

DCF Fair Value Far Exceeds Current Price

- With shares priced at ¥3,335 and estimated DCF fair value at ¥5,304.55, there is a notable 59% upside potential based on discounted cash flow analysis.

- The prevailing analysis highlights this significant valuation gap as reinforcing S&B Foods’ appeal versus both the sector’s and its peers’ average multiples.

- Valuation below DCF fair value, combined with a stable long-term growth rate, positions S&B Foods as an attractive option for investors prioritizing durable return prospects over speculative upside.

- No material company-specific risks have been flagged in recent filings, making the valuation case even more favorable for cautious buyers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on S&B Foods's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While S&B Foods has demonstrated resilient long-term earnings, the latest year’s slight decline highlights that growth momentum is not guaranteed going forward.

If you want to focus on steady performance through all cycles, check out stable growth stocks screener (2101 results) for companies consistently delivering robust and reliable earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2805

S&B Foods

Engages in the manufacture and sale of spice and herb, instant food, spicy seasoning, and other product primarily in Japan.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives