What Ajinomoto (TSE:2802)'s ADC Technology Licensing Deal With Astellas Means For Shareholders

Reviewed by Sasha Jovanovic

- In late October 2025, Astellas Pharma announced it has signed a licensing agreement with Ajinomoto Co., Inc. to utilize Ajinomoto's AJICAP antibody-drug conjugate (ADC) technology in its contract development and manufacturing operations for biopharmaceuticals.

- This partnership underscores Ajinomoto's expanding capabilities in the biopharma sector, as it leverages its proprietary technology to support the development of innovative next-generation treatments for patients.

- We'll examine how this advanced ADC technology licensing could reinforce Ajinomoto's investment narrative and broader ambitions in biopharmaceutical innovation.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ajinomoto Investment Narrative Recap

To be a shareholder in Ajinomoto, you need to believe the company can successfully transition from its staple food roots to higher-margin growth areas like biopharmaceuticals and sustainable food technology. While the Astellas agreement highlights Ajinomoto's biopharma ambitions, the biggest near-term catalyst for the stock remains the recovery of demand and margin stability in core markets; this news does not materially shift that focus or offset persistent risks tied to raw material costs and demand elasticity.

The launch of GRe:en Drop Coffee, a limited-edition dairy-free latte with reduced CO2 emissions, stands out as Ajinomoto pursues environmentally friendly products. This announcement complements the company’s accelerator strategy in food tech and sustainability, which, while promising for long-term diversification, does not directly address the margin pressures felt across traditional business lines.

However, beneath these growth initiatives, investors should be aware that continued raw material cost inflation still threatens gross margins and could pressure...

Read the full narrative on Ajinomoto (it's free!)

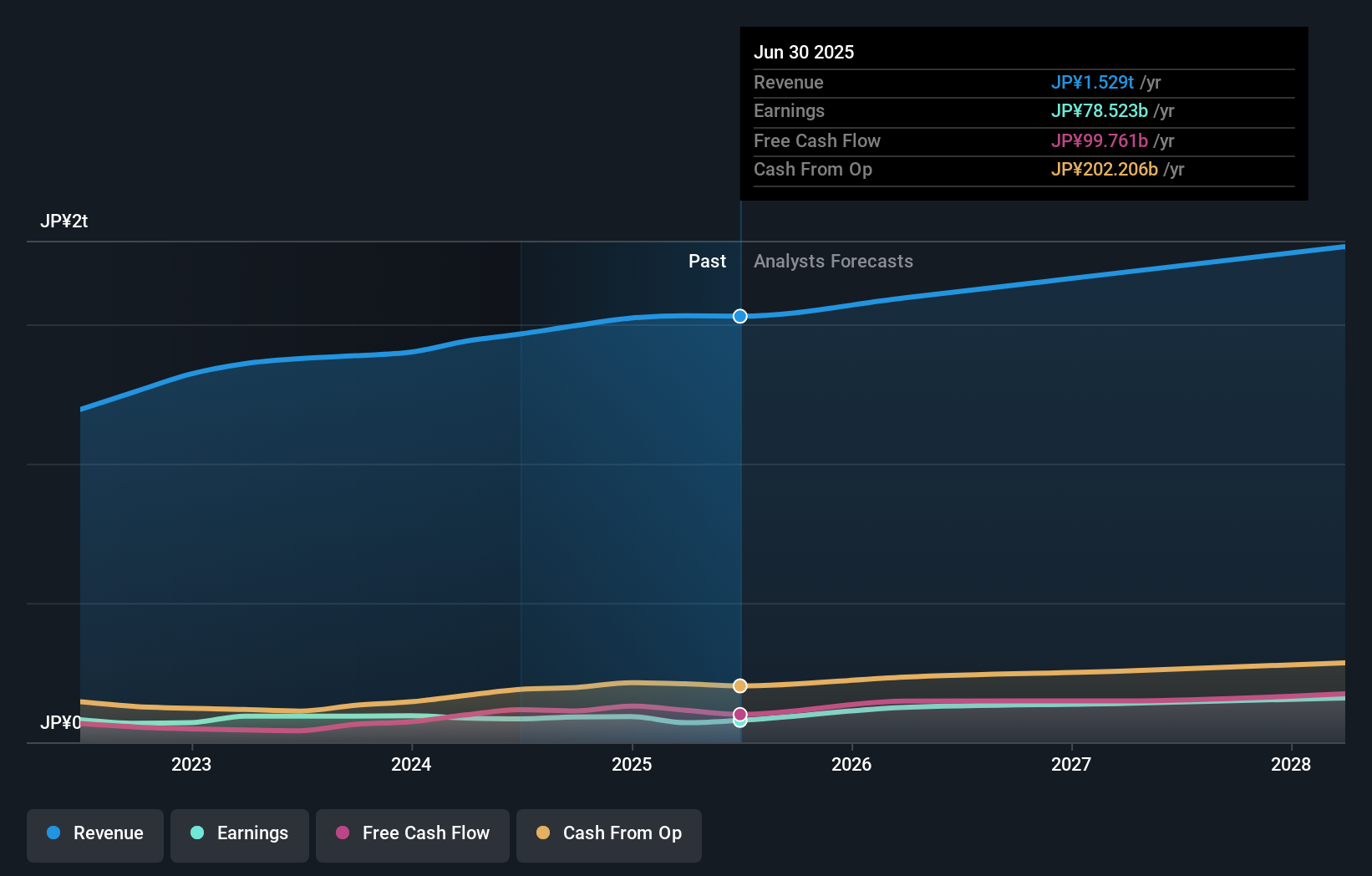

Ajinomoto's outlook anticipates ¥1,783.4 billion in revenue and ¥156.5 billion in earnings by 2028. This scenario is based on annual revenue growth of 5.3% and an increase in earnings of ¥78.0 billion from the current ¥78.5 billion level.

Uncover how Ajinomoto's forecasts yield a ¥4450 fair value, in line with its current price.

Exploring Other Perspectives

Community valuations for Ajinomoto span from ¥3,912 to ¥4,450, sourced from two Simply Wall St Community members. While some see upside, ongoing input cost pressure remains central to Ajinomoto’s outlook, explore several viewpoints to see what others anticipate for the business.

Explore 2 other fair value estimates on Ajinomoto - why the stock might be worth as much as ¥4450!

Build Your Own Ajinomoto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ajinomoto research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ajinomoto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ajinomoto's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2802

Ajinomoto

Engages in the seasonings and foods, frozen foods, and healthcare and other businesses in Japan and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives