Ajinomoto (TSE:2802) Valuation in Focus After Gene Therapy Collaboration With Forge Biologics

Reviewed by Simply Wall St

Ajinomoto (TSE:2802) just announced a collaboration with Forge Biologics to create new culture media supplements that double the productivity of viral vector manufacturing for gene therapies. This move further aligns with Ajinomoto’s strategic focus on biopharmaceutical innovation and its 2030 Roadmap.

See our latest analysis for Ajinomoto.

Ajinomoto's big move into gene therapy is not happening in isolation. Investors have seen strong long-term gains, with a 246.6% total shareholder return over five years and 16.7% for the past year. Recent share price momentum has cooled after an early-year rally, with some near-term volatility following company announcements such as the completed buyback and strategic partnerships. Still, the company’s forward-thinking approach and recent innovations suggest growth potential remains a core part of the story.

If Ajinomoto’s innovation streak has you looking further afield, now’s a great moment to discover See the full list for free.

With shares up strongly over the long term but trading below analyst targets, investors now face a key question: is Ajinomoto still undervalued, or is the market already pricing in its ambitious growth outlook?

Most Popular Narrative: 18.2% Undervalued

With Ajinomoto closing at ¥3,638 and the most popular narrative estimating fair value at ¥4,450, there is a notable gap in expectations. This sets the scene for ambitious projections and surprising catalysts behind the upside potential.

Ongoing investment in R&D and human capital, particularly in Functional Materials and Bio-Pharma Services, is expected to yield differentiated, higher-value products (such as specialty amino acids, AI/PC/server-related materials), strengthening competitive moat and gradually improving net margins over the long term.

Curious why the valuation leap is so bold? The main drivers are daring bets on compounding earnings and expanding margins, all built into a high-growth financial blueprint. Want to see the actual numbers and bold targets powering this forecast? Check out the full narrative for the figures that could reshape Ajinomoto’s story.

Result: Fair Value of ¥4,450 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent input cost inflation and continued weakness in key markets could challenge Ajinomoto’s turnaround. This may make the growth narrative less certain.

Find out about the key risks to this Ajinomoto narrative.

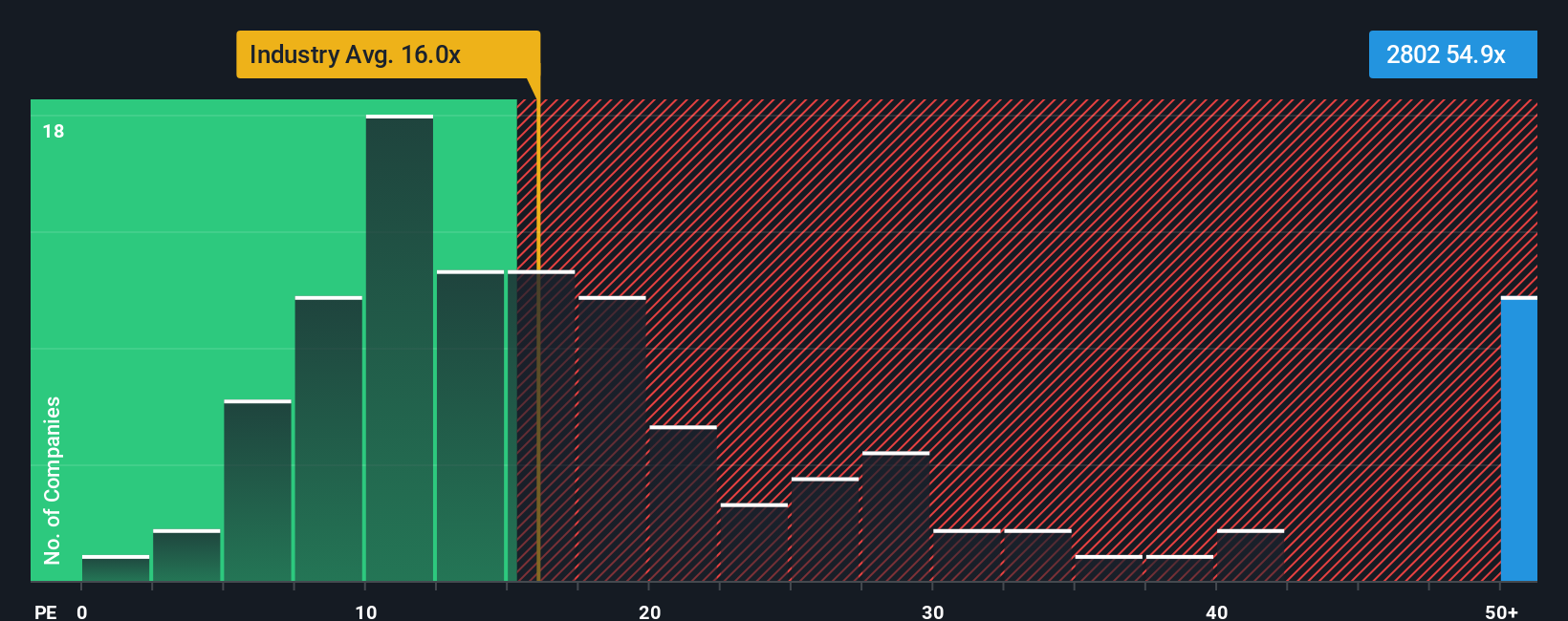

Another View: Comparing Market Ratios

While the narrative highlights Ajinomoto as undervalued, the market’s own price-to-earnings ratio tells a more cautious story. Ajinomoto’s current P/E stands at 49.5x, which is significantly higher than both the Japanese food industry average of 16x and the fair ratio of 33.6x. That gap could signal valuation risk rather than opportunity. Are investors too optimistic, or is the market overlooking something deeper?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ajinomoto Narrative

If you have a different take or want to dig into Ajinomoto’s numbers yourself, you can easily craft your own informed view in just a few minutes. Do it your way

A great starting point for your Ajinomoto research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t settle for one great idea when you could be lining up several. Broaden your portfolio with standout themes available right now on Simply Wall Street’s screener platform. Each one spotlights compelling market trends you won’t want to miss.

- Tap into growth by uncovering these 918 undervalued stocks based on cash flows where potential upside meets strong fundamentals ahead of the masses.

- Accelerate your portfolio’s innovation exposure as you target these 25 AI penny stocks that are pioneering the next wave of intelligent automation and disruption.

- Maximize income potential by locking in these 17 dividend stocks with yields > 3% boasting robust yields and reliable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2802

Ajinomoto

Engages in the seasonings and foods, frozen foods, and healthcare and other businesses in Japan and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives